Payroll: Payroll Configuration

Purpose

The purpose of this documentation is to outline the use case and processes associated with setting up and maintaining the Payroll application in Odoo 16.

Configuration includes:

Settings: Set up payroll localizations and Accounting functionalities.

Structure Types: View Salary Structure Types, which contain the payroll structures.

Structures: View Salary Structures, the localized constructions that contain Salary Rules.

Rules: View Rules, the lines that appear on payslips and indicate an input or output.

Rule Parameters: View the input parameters for any Rule.

Other Input Types: Create a new input type that will appear on the payslip.

Good to Know!

The payroll information outlined in this document uses modules in the Hibou Odoo Suite. Hibou created and maintains the US Federal and State localizations for payroll in the United States. The data you will see below is drawn from that module.

We recommend that you install Hibou’s USA - Payroll with Accounting module, which links Rules to Accounts based on the US Accounting Localization.

Structure Types, Structures, and Rules are all pre-loaded in Hibou's module. We recommend not altering them in any way, and instead reaching out to us if you require additional rules, structures, or modifications.

Process

To get started, navigate to the Payroll application.

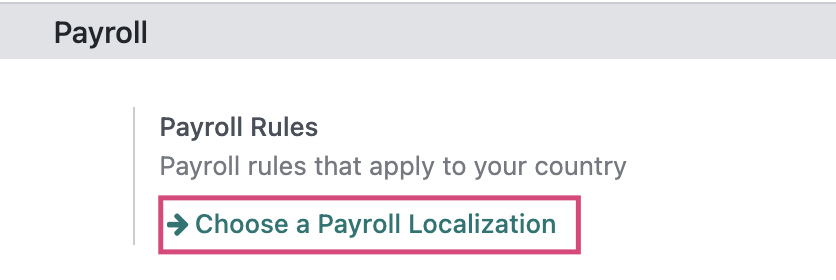

Under Payroll, click on Choose a Payroll Localization.

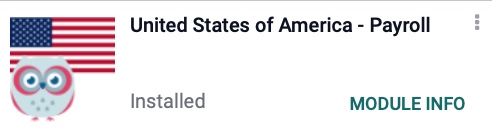

On the next screen, locate the Hibou United States of America - Payroll with Accounting module. If the module hasn't been installed, click ACTIVATE.

When the installation is complete, you'll be taken back to Odoo's main menu screen. From there, navigate back to the Payroll application.

Good to Know!

Odoo does not come pre-loaded with salary rules or conditions. Without them, you cannot run payroll in any country.

In order to run payroll, you must install a localization, like Hibou's USA Payroll - With Accounting module. This module is pre-loaded with Basic Salary, Commissions, Badges, Gross, all federal taxes (Social Security, FUTA, and medicare) and Net Salary.

We do not recommend modifying rules unless you are familiar with this process. If you require additional or modified salary rules, please contact us.

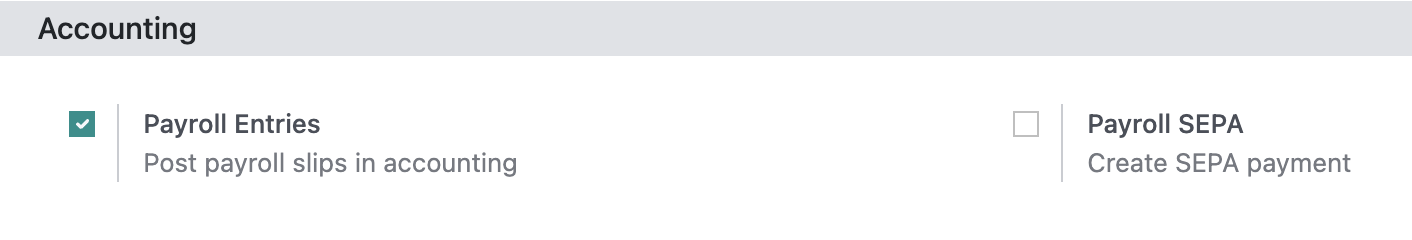

Accounting

Again, go to CONFIGURATION > SETTINGS and find the Accounting section. You'll see the following options:

Payroll Entries: By enabling this option, payroll slip amounts will be posted in the Accounting app.

Payroll SEPA: SEPA is a payment method for the European Union. Leave this unchecked if you only run payroll in the U.S.

Once you've enabled Payroll Entries, click SAVE.

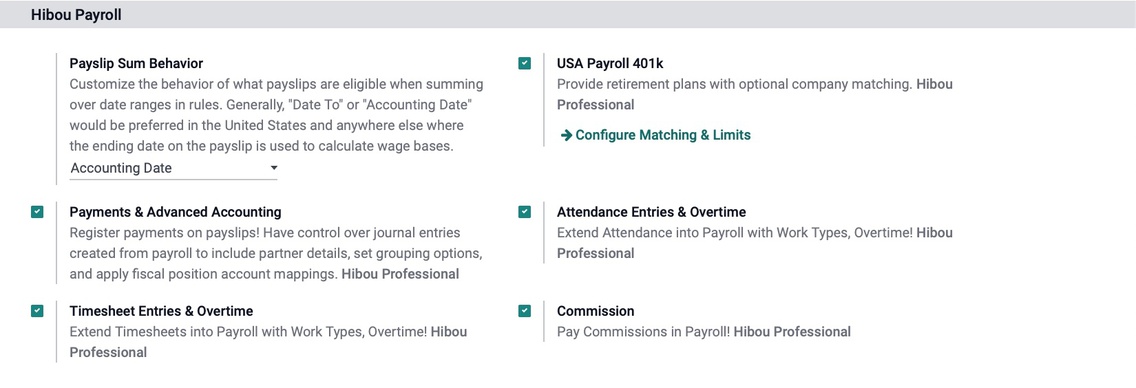

Hibou Payroll

If you've installed any of the Hibou Payroll modules, you'll see this configuration section added to Odoo's Payroll settings. By enabling these options, you'll be installing related modules. Note that these are Hibou Professional modules and will incur a small monthly fee for usage.

Payslip Sum Behavior: Customize the behavior of which payslips are eligible when summing over date ranges in rules. Generally, "Date To" or "Accounting Date" would be preferred in the United States and anywhere else where the ending date on the payslip is used to calculate wage bases.

Payments & Advanced Accounting: This Hibou Professional module allows you to register payments on payslips. Have control over journal entries created from payroll to include partner details, set grouping options, and apply fiscal position account mappings.

Timesheet Entries & Overtime: This Hibou Professional module allows you to extend Timesheets into Payroll with Work Types and Overtime.

USA Payroll 401k: This Hibou Professional module allows you to provide retirement plans with optional company matching.

Attendance Entries & Overtime: This Hibou Professional module allows you to extend Attendance into Payroll with Work Types, Overtime!

Commission: This Hibou Professional module allows you to pay commissions in Payroll. This option will only be added when you install the Hibou Commissions module. To learn how to configure commissions, please review our

Documentation.

Enable the modules you'd like to utilize, then click SAVE.

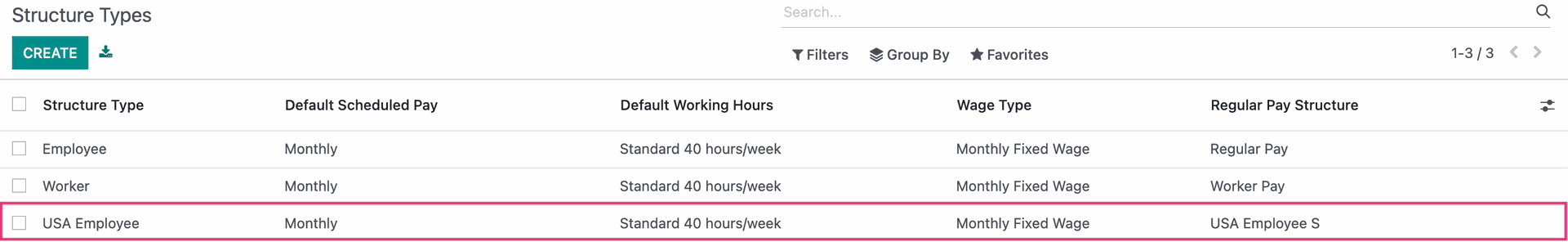

Salary Structure Types

Go to CONFIGURATION > Salary > STRUCTURE TYPES.

Structure Types give you basic information about the wage structure. If you need assistance downloading additional structure types, please contact us.

The Hibou United States of America - Payroll with Accounting module is preconfigured with basic Structure Types for US Payroll. This is represented by the USA Employee entry.

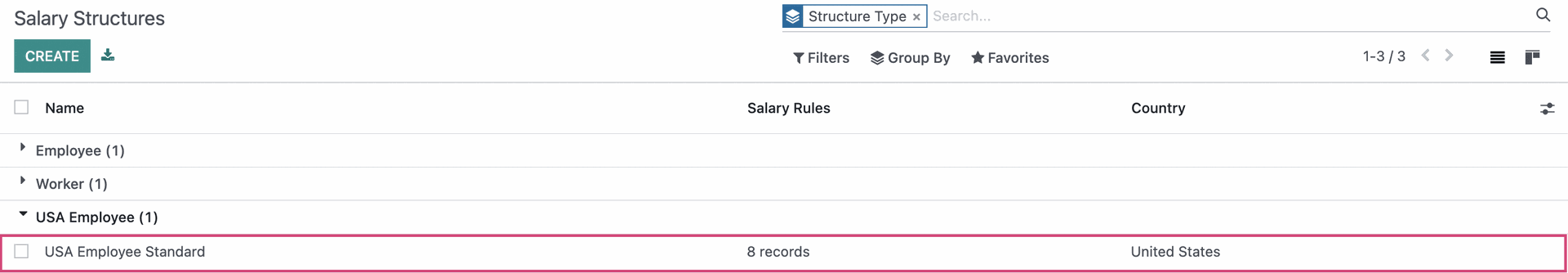

Salary Structures

Go to CONFIGURATION > Salary > STRUCTURES.

Salary Structures are used to determine an employee's compensation. You will typically require one or more salary structures for your employees depending on where they live and work.

Please contact us if you need more salary structures.

The Hibou United States of America - Payroll with Accounting module is preconfigured with basic Salary Structures for US Payroll. This is represented by the USA Employee Standard entry.

Important!

Don't Duplicate a Salary Structure

Duplicating salary structures can cause conflicts in your payroll configuration and workflow. Instead, create a fresh record. For example, you might see an error like this:

Wrong python condition defined for salary rule EE: US Federal Income Tax Withholding (EE_US_941_FIT).

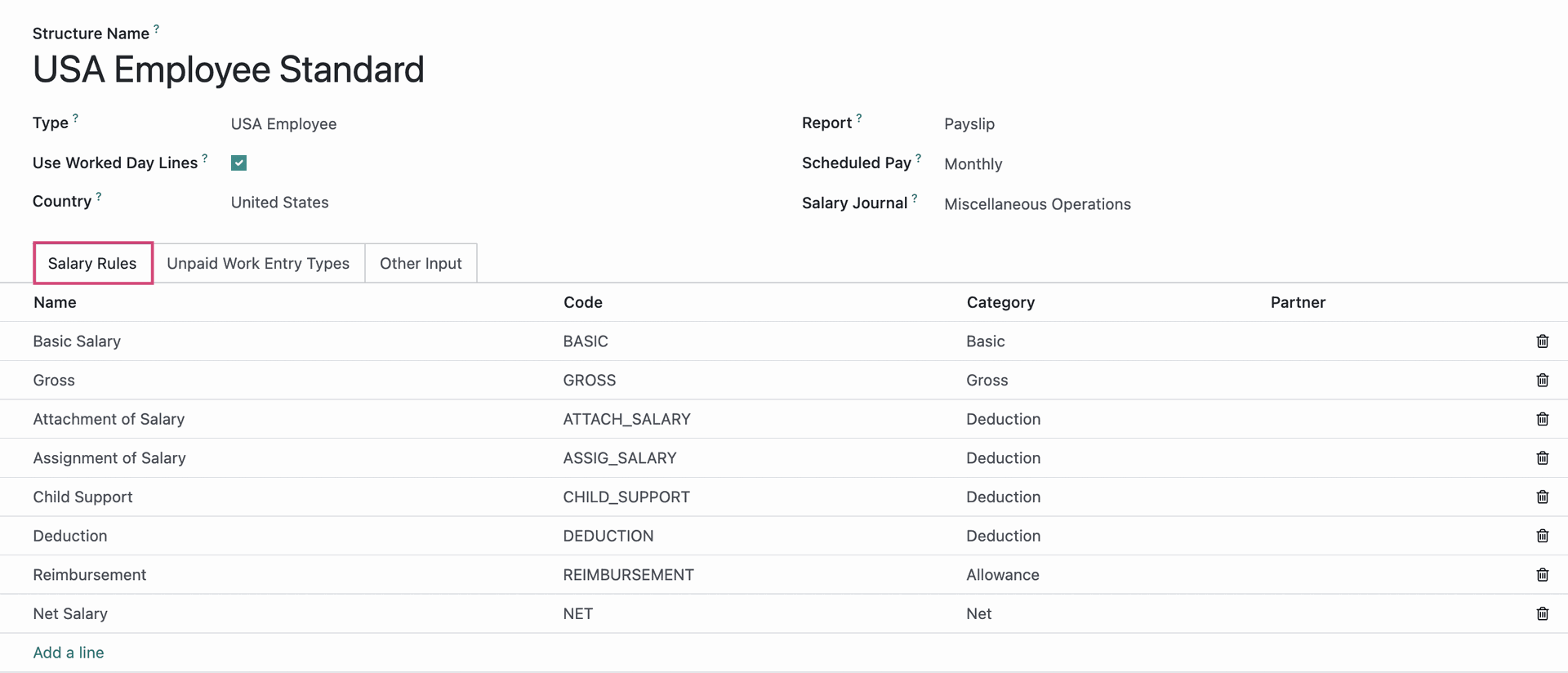

Review USA Employee Standard Salary Structure

Click to open the USA Employee Standard Salary Structure to see how Hibou has preconfigured the template.

Under the Salary Rules tab is where requirements for each state you run payroll for will be configured, including state unemployment, tax withholdings, and other applicable rules.

The Hibou United States of America - Payroll with Accounting module is preconfigured with basic Salary Rules for US Payroll. These are represented by over 100 entries except Basic Salary, Gross, and Net Salary, which are the basic Odoo entries.

Salary Rules

Salary Rules are conditions that apply to a Salary Structure, such as computation of amount, designation of general ledger accounts for the Accounting app, Python code, and more.

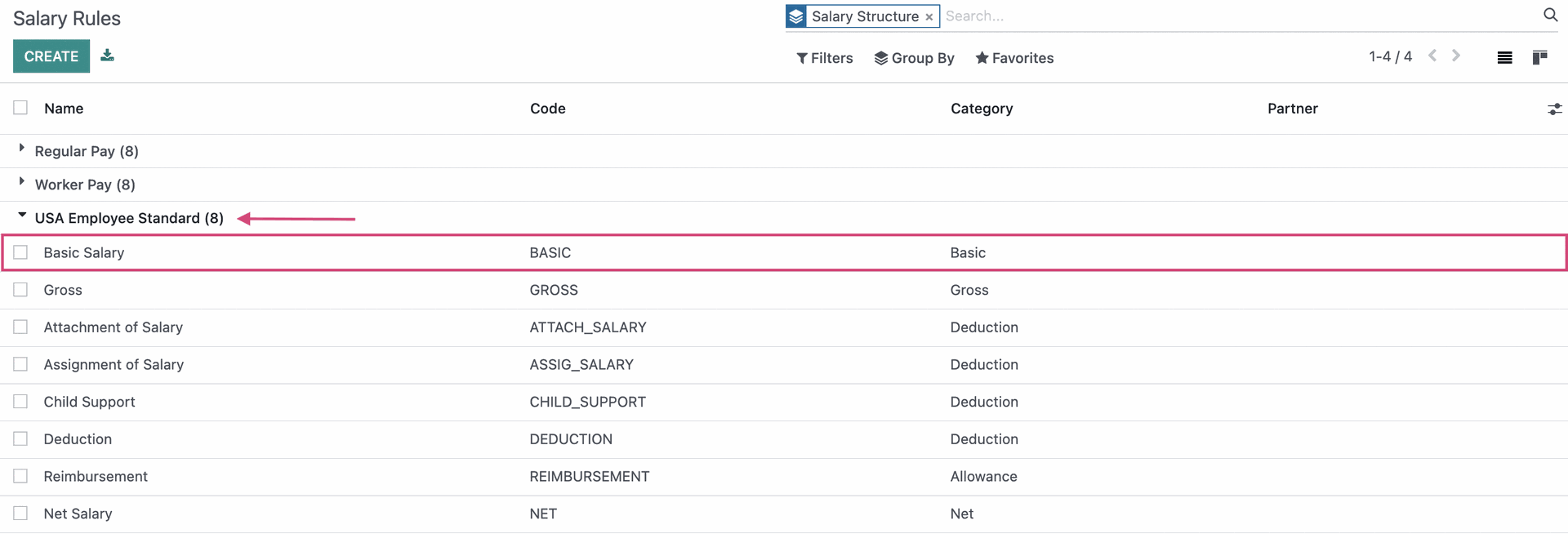

To access all Salary Rules, go to CONFIGURATION > Salary > RULES. Here you'll see those rules listed out under their structure headings. Expand the USA Employee Standard section.

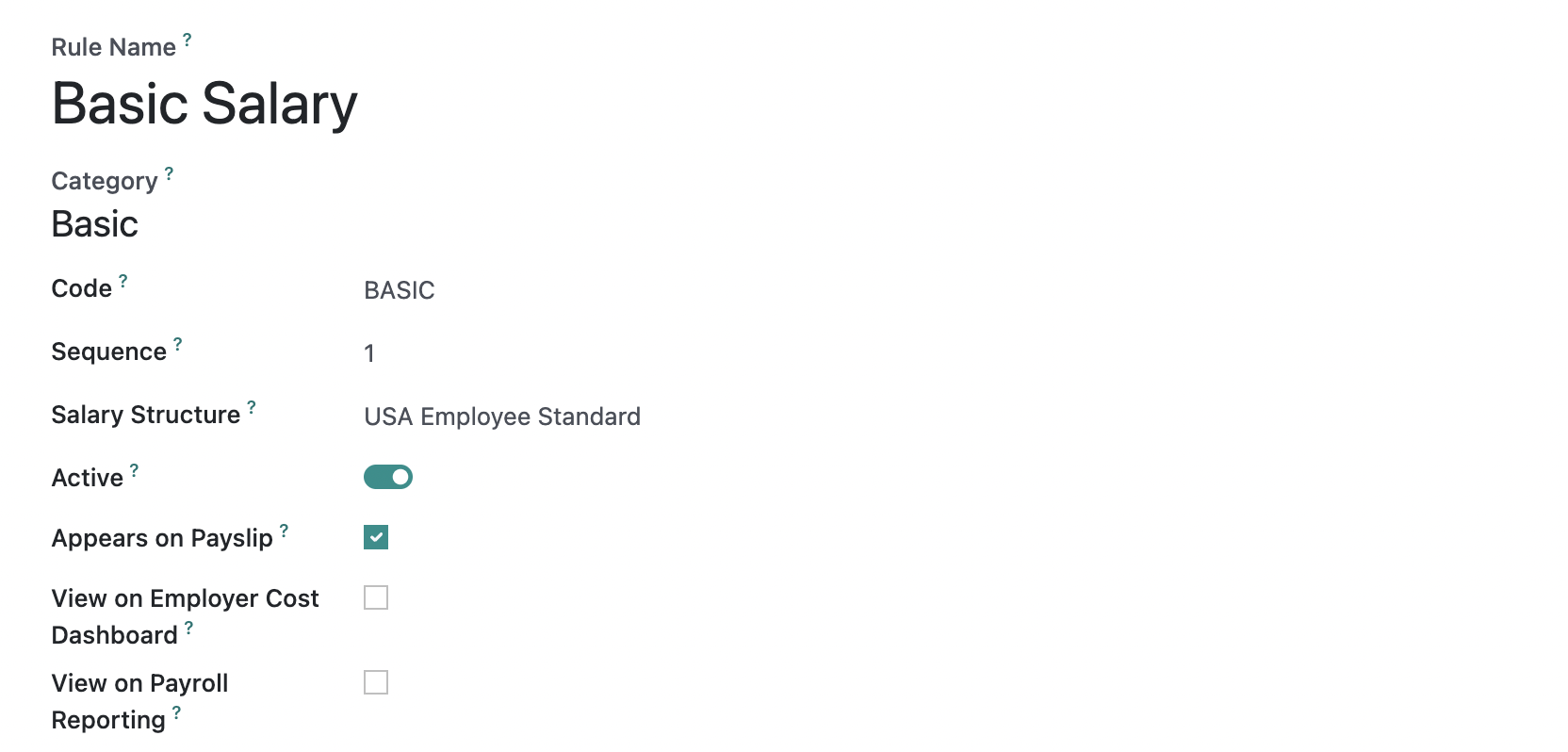

To see a rule configuration, click into Basic Salary.

Within the salary rule, you can see all of the field options:

Rule Name: A unique but identifiable name for the rule.

Category: Select the appropriate category.

Code: Can be used as a reference in the computation of other rules. In that case, it is case sensitive.

Salary Structure: Indicates which structure this salary rule falls under.

Appears on Payslip: Description used to display salary rule on payslip.

Sequence: Use to arrange a calculation sequence. For example, a 401K contribution should have a lower sequence number than Gross Wages, while Taxes would have a higher sequence number than Gross Wages.

Active: Disabling this field will allow you to hide the salary rule without deleting it.

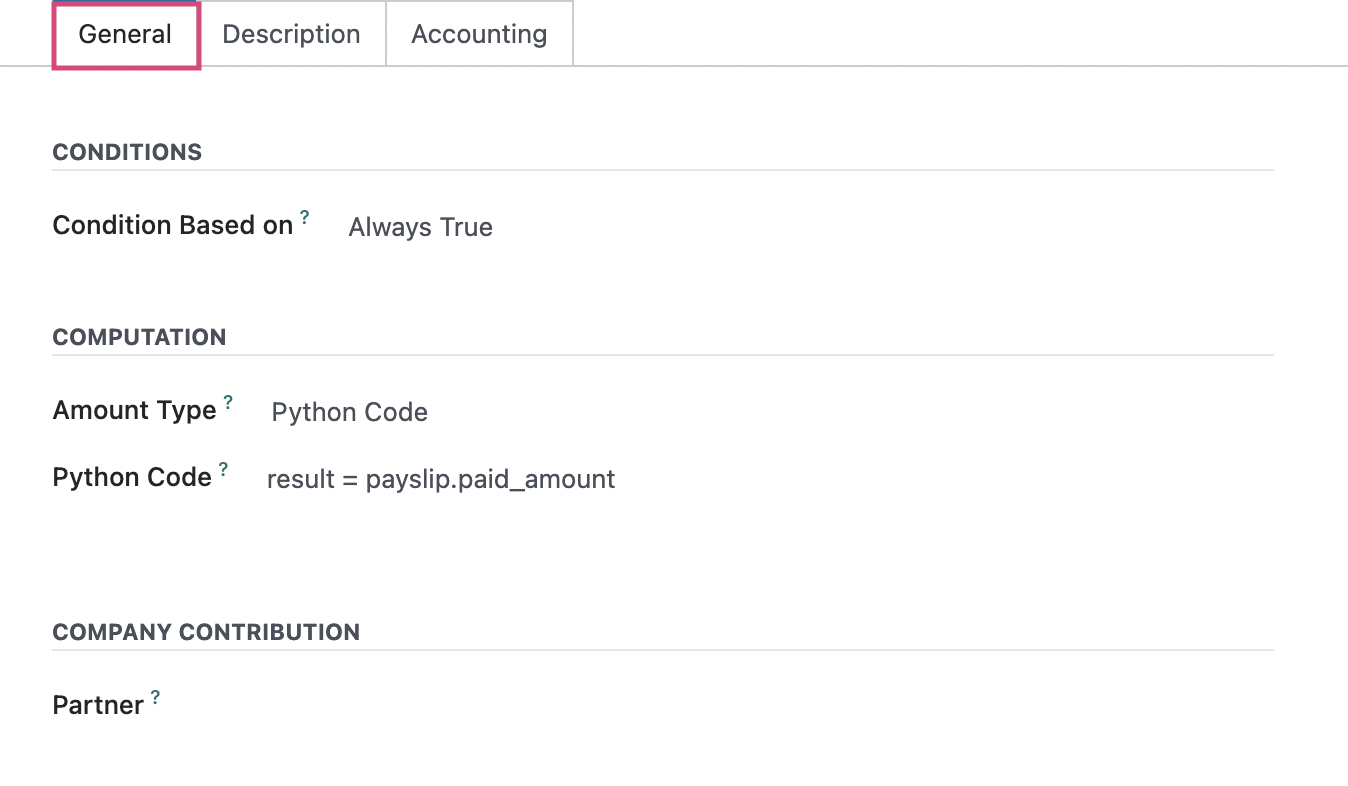

On the General tab:

Conditions

Condition Based on: Condition on which the rule is based (Always True, Range, or Python Expression). If you choose Range or Python Expression, other fields will become available for setting the conditions. Hibou creates these for its pre-loaded rules and provides them in the module.

Computation

Amount Type: Computation for the rule amount. The choice selected will affect what fields you see.

Percentage (%):

Percentage Based On: Input the variable the result will be affected by.

Quantity: Used in computation for percentage and fixed amount.

Percentage (%): Input field for the percentage

Fixed Amount:

Quantity: Used in computation for percentage and fixed amount.

Fixed Amount: Input field for amount.

Python Code:

Python Code: Input Python code for the salary rule calculation

Company Contribution

Partner: Indicates to whom we send the money being withheld. Hibou pre-programs the appropriate partners at state and federal levels in the module.

Important!

If you create a new tax or deduction and enter a fixed amount or percentage (%), ensure it is entered as a negative amount.

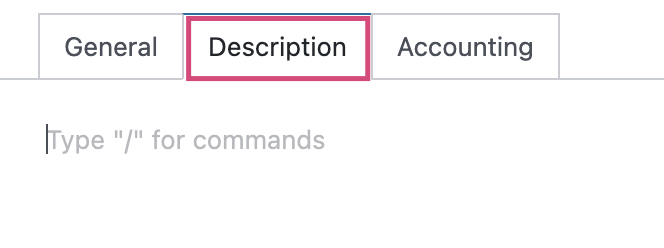

On the Description tab, use the freeform field to write a more detailed description of the rule.

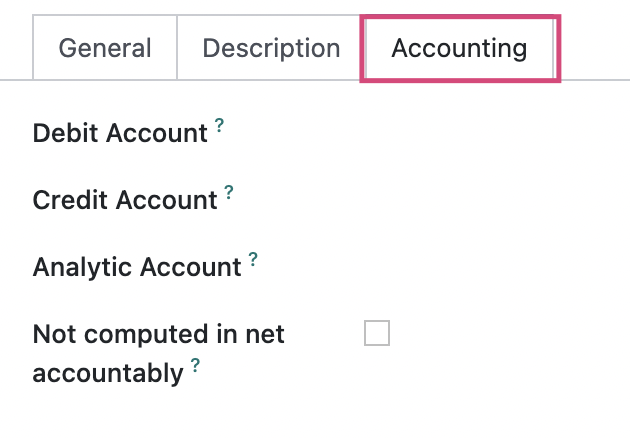

On the Accounting tab, refer to the Good to Know section below for guidance in completing these fields:

Debit Account: Select the appropriate account.

Credit Account: Select the appropriate account.

Analytic Account: If applicable, select Analytic Account.

Not computed in net accountability: Allows you to explicitly display the value of this rule in the accounting, rather than including it in the "Net Salary" rule.

To leave this screen, click DISCARD.

Good to Know!

Proper Uses of Debit and Credit Accounts

Basic Salary: Debit salary expense

Basic Bonus: Debit salary expense

Net Salary: Credit accounts payable or a payables account specifically for employee payables (example: Employee Net Payable).

EE: US FICA or Federal Income Tax W/H: Debit accounts payable (since the amounts are negative number on the payslips , by selecting the debit account, the number will be posted as a credit in accounts payable).

ER: US FICA, state unemployment or Federal Income Tax W/H: Debit accounts payable and credit a salary expense, such as Salary FUTA Expense, Salary FICA Expense or Salary SUTA Expense. Both fields are filled out as it is paid by the company.

Gross, Wage: US FICA, FUTA, or state unemployment: No accounts selected

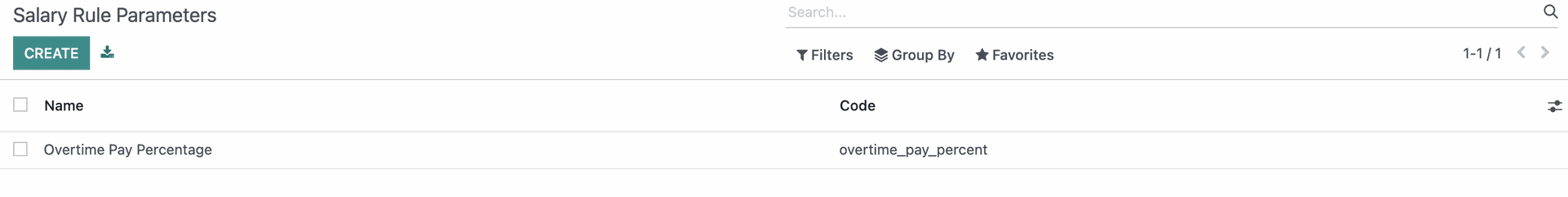

Rule Parameters

Go to CONFIGURATION > Salary > RULE PARAMETERS.

On this page, all federal (FUTA, FICA (Social Security & Medicare)) and state (unemployment) deductions are set-up and maintained. We do not recommend that you alter these parameters.

On a new Odoo installation, there will be no rule parameters listed. The Hibou United States of America - Payroll with Accounting module is preconfigured with over 200 basic Rule Parameters for US Payroll.

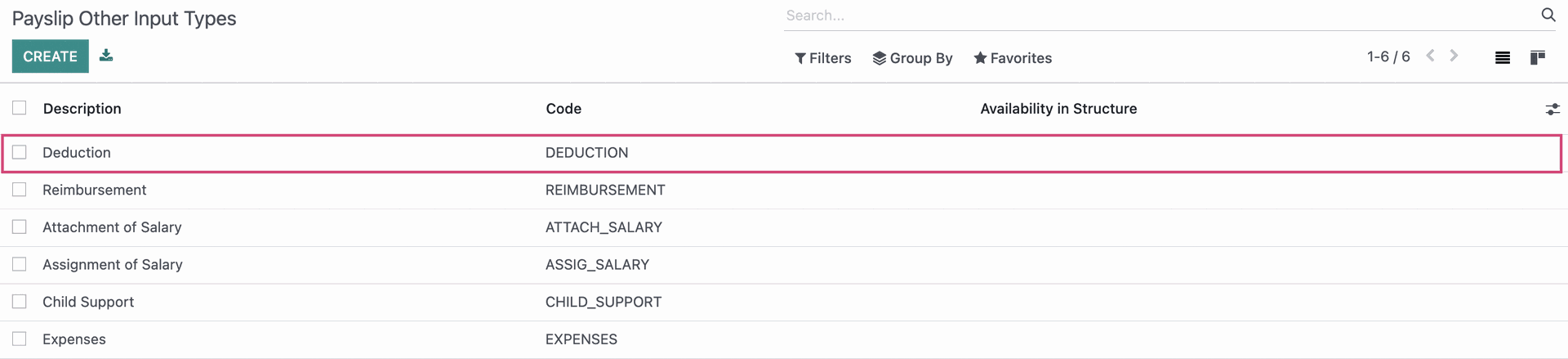

Other Input Types

Go to CONFIGURATION > Salary > OTHER INPUT TYPES.

On this page, you can set up additional Input Types that can appear on a payslip. Let's view an existing other input type.

Description: Enter a brief description of the Input Type.

Availability in Structure: Indicate to which structure you want to assign the input type.

Code: Give the input type a unique code.