Accounting: Accounting: Journals: Customer Payments

Purpose

This document will walk you through how payment journal entries are created and how to set the accounts that those payment journal entries will impact. We will show examples of both sending payment to a vendor and receiving payment from a customer as well as how to create payments manually.

Process

To get started, navigate to the Accounting application.

Journals and Accounts

The accounts that will be impacted by registering payments will always be taken from the journal's default debit/default credit accounts and the partner's AR/AP accounts listed on their contact.

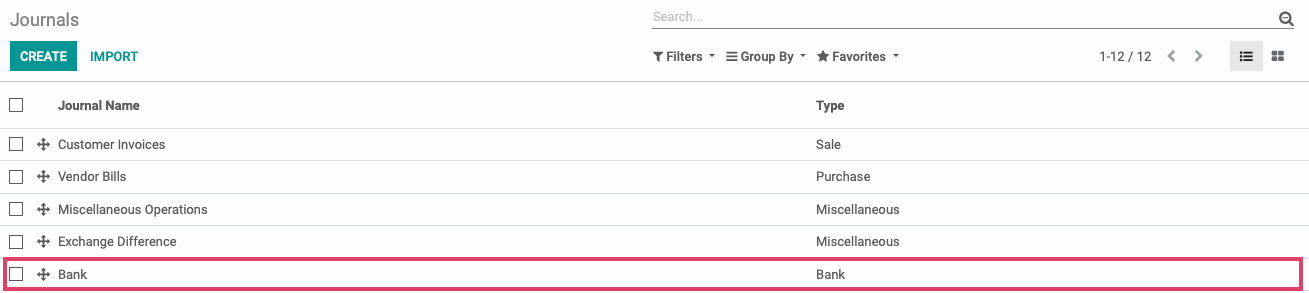

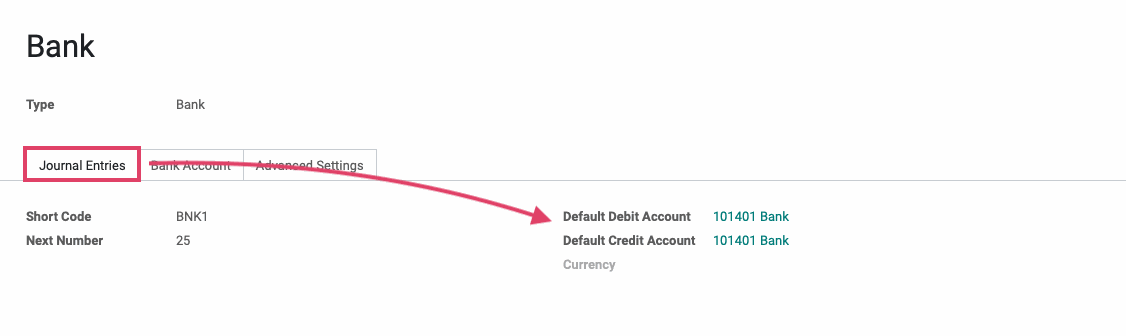

We will look at the journal's accounts first. Navigate to the journal that you want to post your payment to by going to Configuration > Journals.

In this example, we will post a payment to our Bank journal.

Like all journal entries, the account used on a transaction will depend on whether a payment is being sent or received. When sending payments, the default credit account on the journal will be used. For receiving payments, the default debit account on the journal will be used.

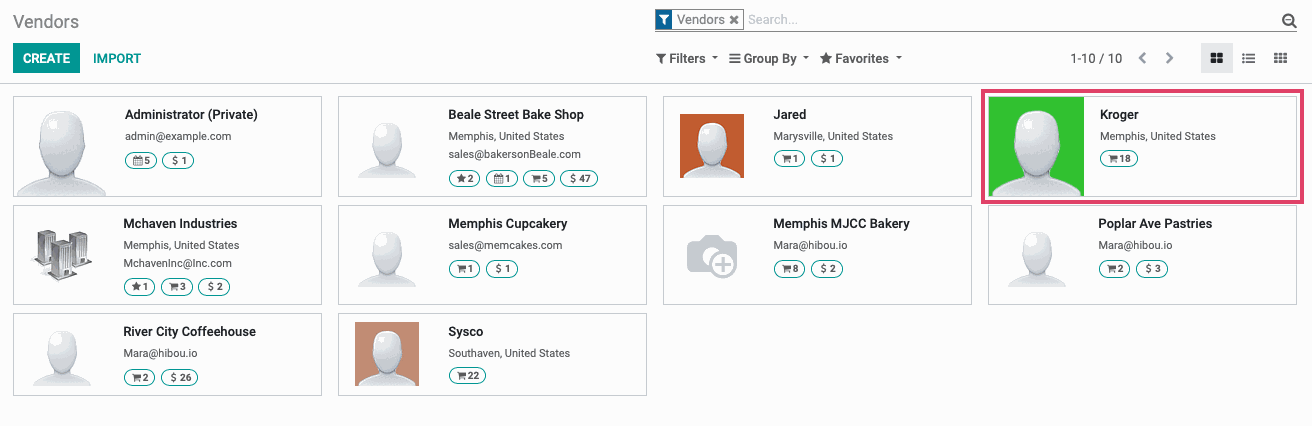

The other half of the journal entry will be determined by the accounts listed on the partner's AR/AP found on their contact. To access your vendors, navigate to Vendors > Vendors. To access your customers, navigate to Customers > customers.

Choose the partner that you want to associate with your payment. In this example, we are looking at a vendor.

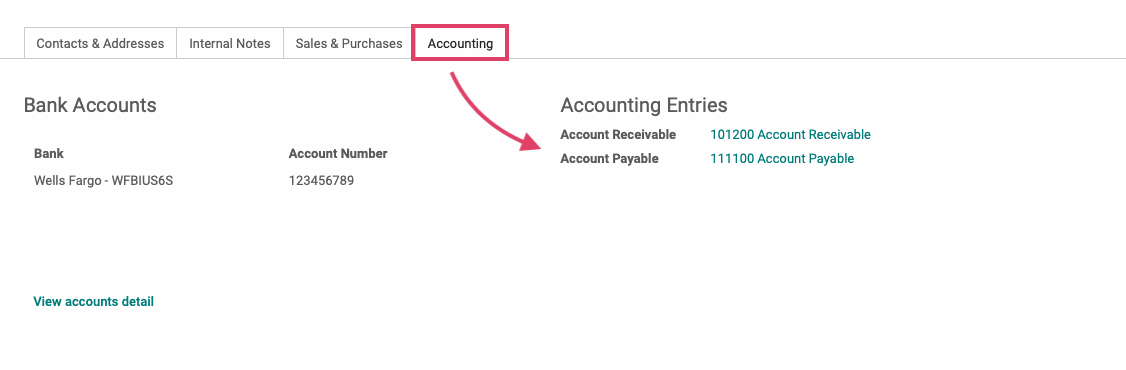

Navigate to the accounting tab for the partner. The accounts listed as their Account Receivable and Account Payable will be used for payments associated with this partner.

Customer type payments use the partner's Account Receivable.

Vendor type payments use the partner's Account Payable.

When you are receiving money, the AR/AP account will be credited. When sending money, the AR/AP account is debited.

Create a Payment

To create payments, you have two locations. One is to post payments to/from vendors which can be found by navigating to Vendors > Payments and clicking create.

The other location is for posting payments to/from customers and can be found by navigating to Customers > Payments and clicking create.

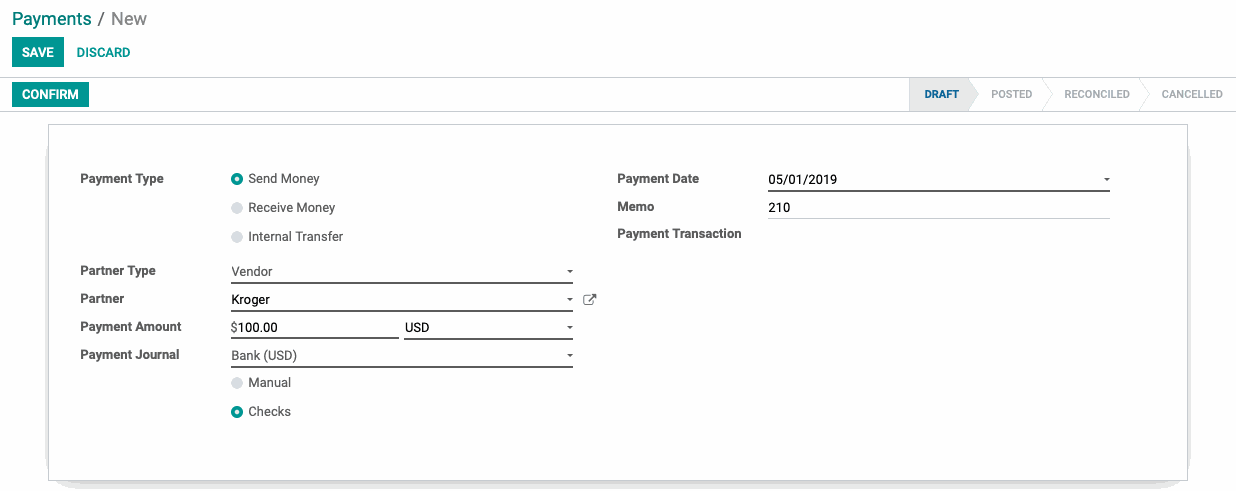

You will be presented with the following fields to fill in regardless of if it's for a vendor or a customer:

Payment Type:

Send Money: This designates the funds as outbound.

Receive Money: This designates the funds as inbound.

Internal Transfer: This designates the funds as being moved from one internal account to another.

Partner Type: Set it to either customer or vendor.

Partner: Select the partner that the payment is for.

Payment Amount: Input the payment amount.

Payment Journal: Select the Journal that the payment will be posted to.

Payment Date: Select the date that the payment should be recorded on.

Manual: This means that the payment was sent or received by a method outside of Odoo like a credit card payment or PayPal receipt.

Check: This means that a check was used to make or receive this payment and can be recorded within Odoo. If you use check printing within Odoo, you can have Odoo print the check for this payment.

Memo: Input a reference for the payment, we recommend using the invoice or vendor bill number associated with this payment or the check number being used to make the payment.

Journal Entry Sent Payment

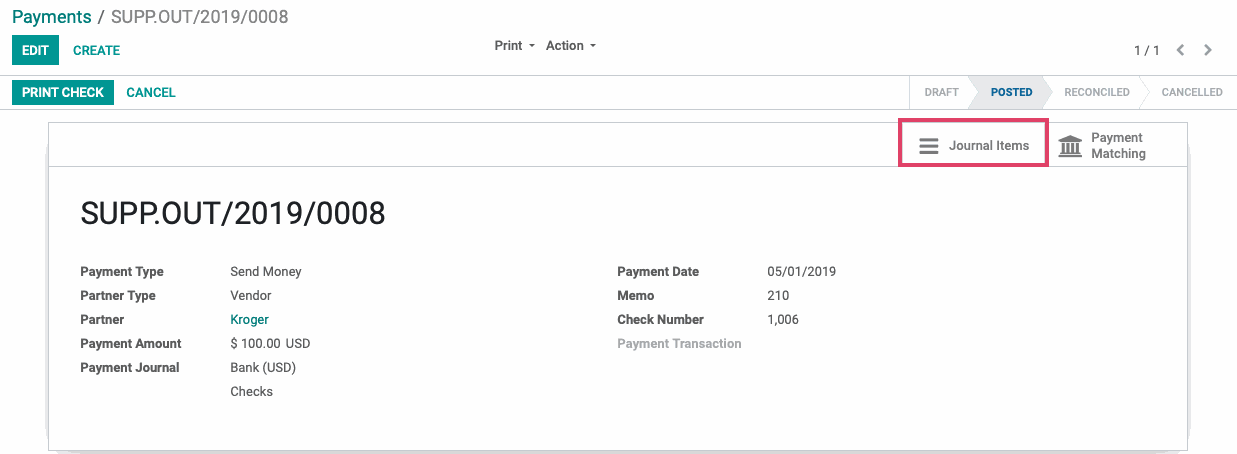

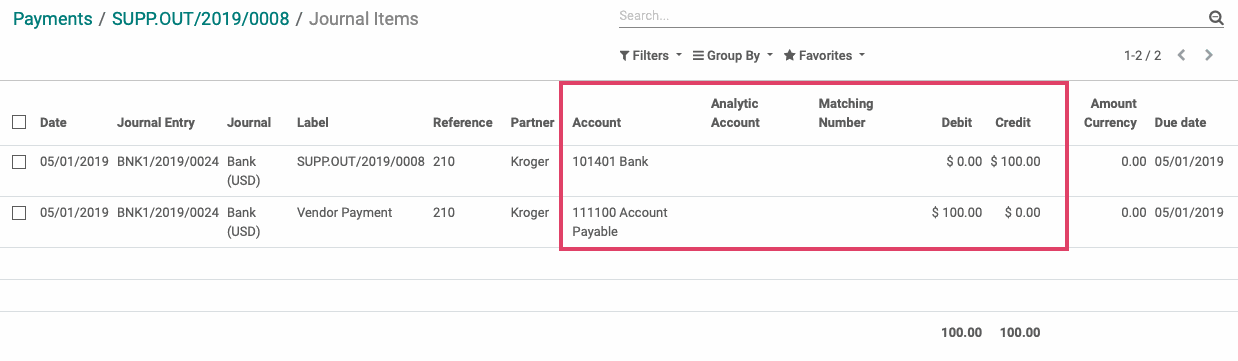

Once your payment is confirmed, we can review the journal entry that was created by clicking on the Journal Items smart button that will appear at the top right of the confirmed payment.

This is an example of a payment we sent to a vendor. We can see that we credited $100.00 from the account that was listed as the Credit account on our Bank journal and we debited the account that was listed as the default debit account on the partner's accounting tab.

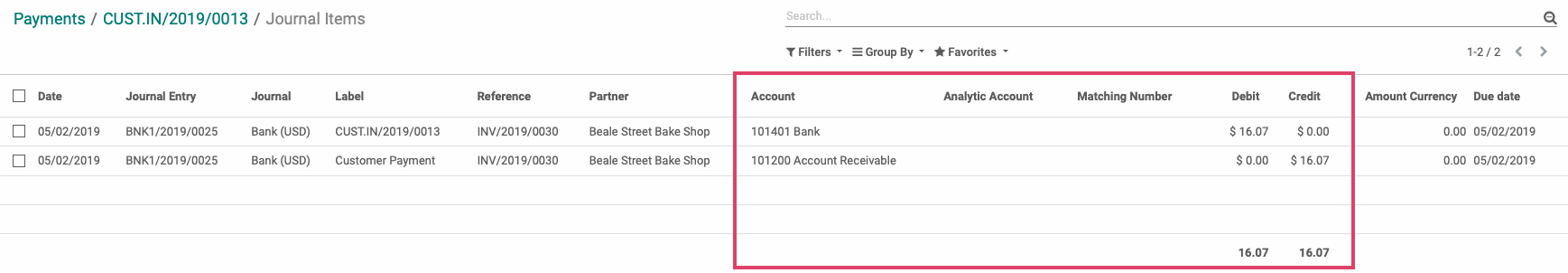

Journal Entry Received Payment

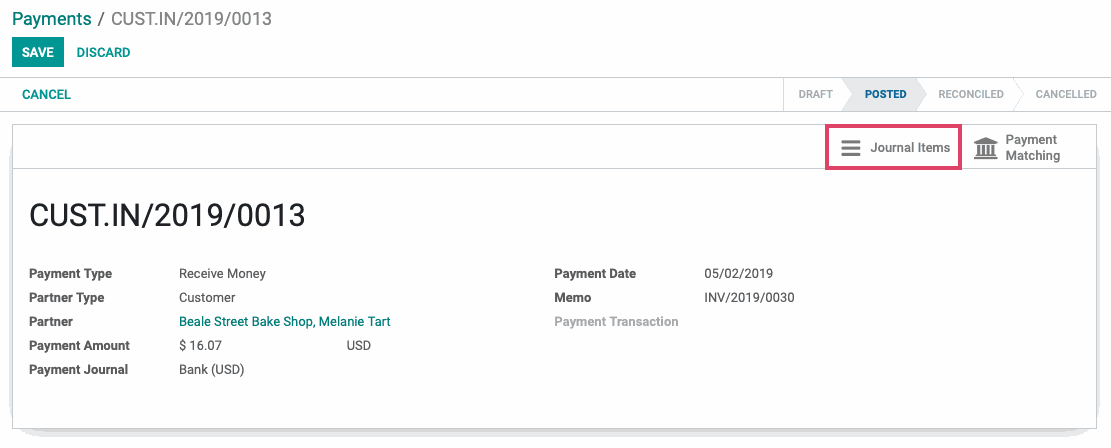

Once your payment is confirmed, we can review the journal entry that was created by clicking on the Journal Items smart button that will appear at the top right of the confirmed payment.

This is an example of a payment we received from a customer. We can see that we credited $16.07 from the account that was listed as the Account Receivable on the partner's AR/AP and we debited the account that was listed as the default debit account on the Bank Journal.