Accounting: Accounting: Management: Assets: Depreciation & Depreciation Schedules

Purpose

This document covers the three different types of depreciation methods in Odoo 14 within the Accounting application: Straight Line, Declining, and Declining then Straight Line.

Important!

Regardless of the depreciation method chosen, Odoo Accounting handles depreciation entries by creating them in draft mode and posting them automatically. The server checks each day to see if an entry must be posted, though it can take up to 24 hours before seeing a change of state from Draft to Posted.

Process

To get started, navigate to the Accounting App.

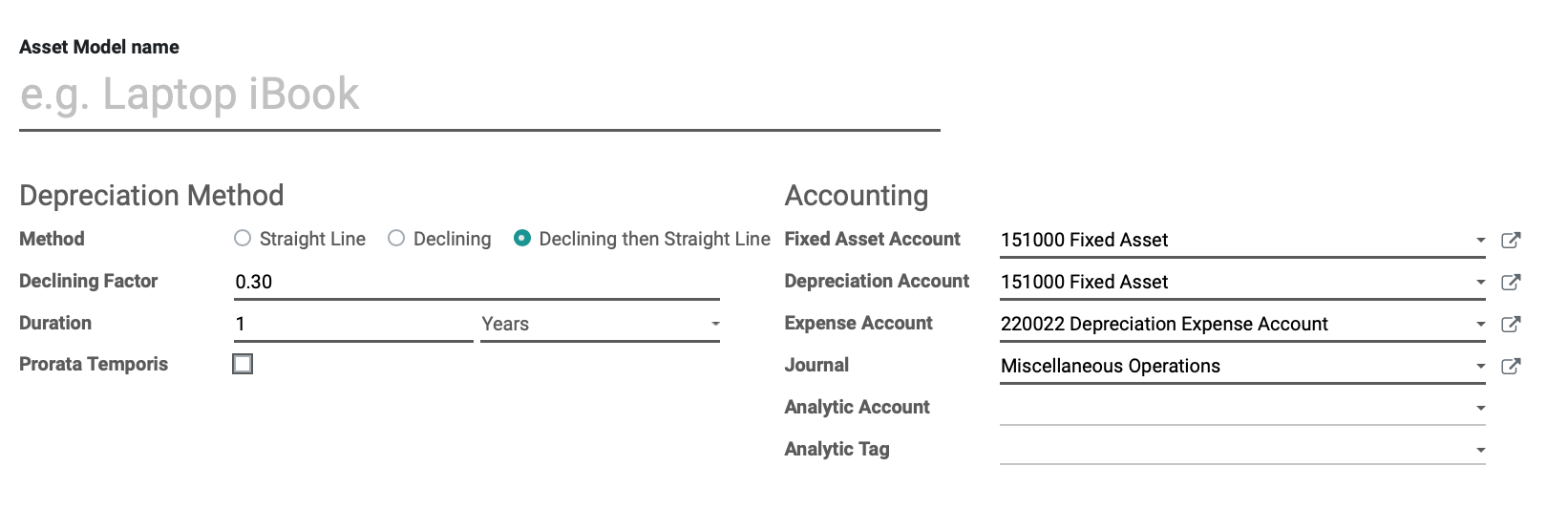

Creating Asset Models

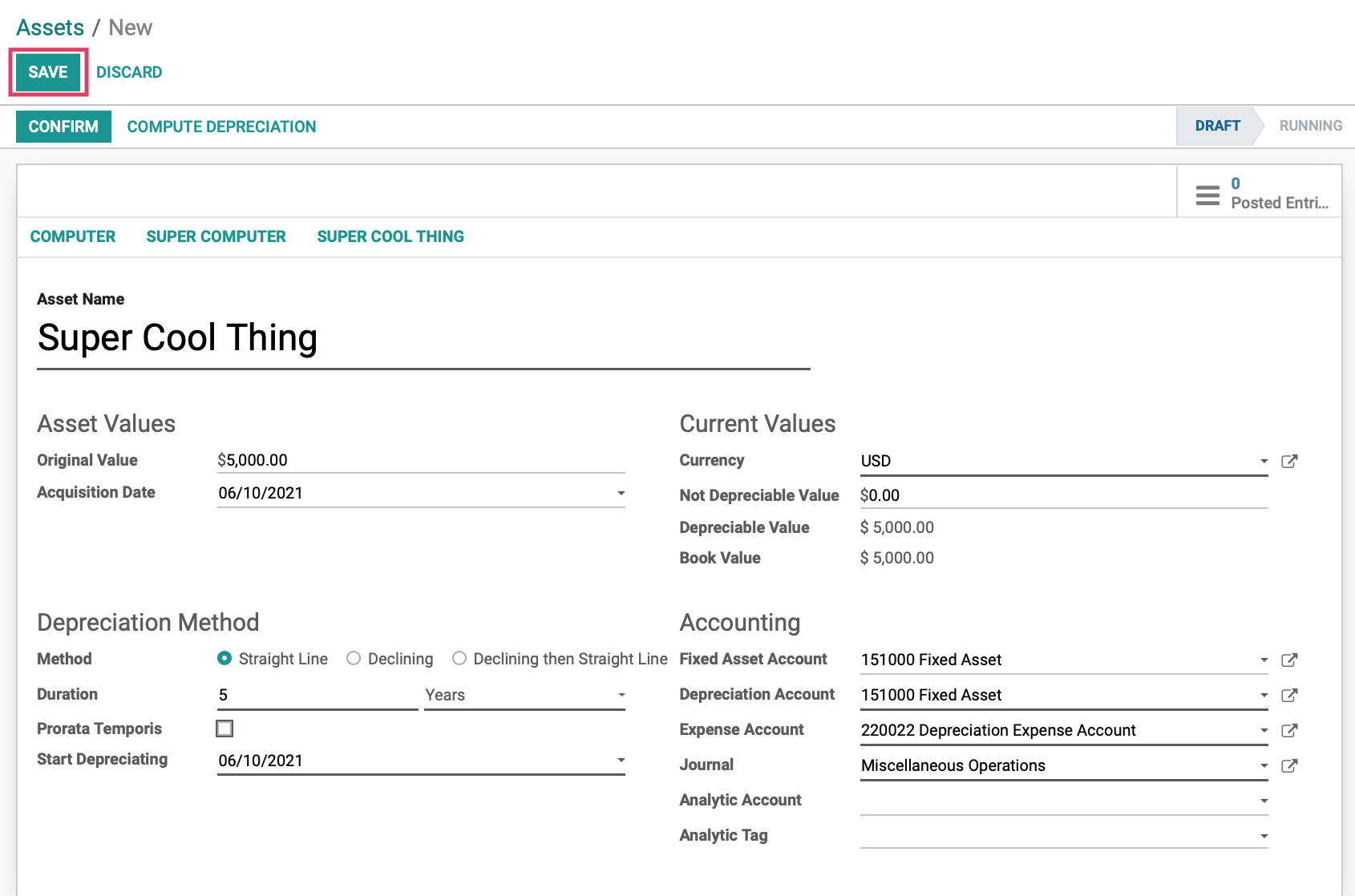

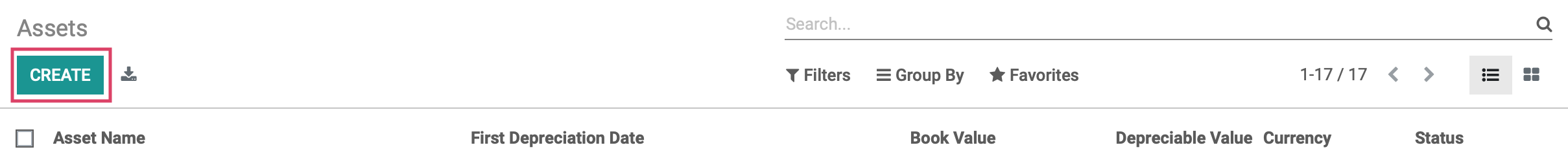

Click on accounting > Management > Asset, then click on CREATE.

Asset Model Name: Give the asset model a name to represent the type of asset being depreciated (e.g. Computer, Delivery Truck).

Asset Values

Original Value: Price paid for the asset.

Acquisition Date: Date of purchase or acquisition of asset.

Depreciation Method

Method

Straight Line: This is the most common method and the easiest to calculate. With this method, the initial residual value is divided equally by number of planned entries.

Declining: This method multiplies the last residual value by a chosen declining factor.

Declining then Straight Line: This method is a combination of Straight Line and Declining. It follows the Declining method until the Straight Line method gives a higher amount, then it switches to Straight Line values. This allows you to claim higher amounts earlier in the life of the asset.

Duration: This figure is set by the IRS, so you'll need to refer to their documentation and enter the correct duration.

Prorata Temporis: When selected, the first depreciation entry will be made when the asset is purchased.

Start Depreciating: Date to start depreciation reporting.

Current Values

Currency: Currency set on company template.

Non Depreciable Value: If a portion of this asset will not lose value over time, enter its value here.

Depreciable Value: This is a calculated field that displays the difference of the Original Value less the Non Depreciable Value. The depreciation schedule will be calculated from this figure.

Book Value: This is a calculated field that displays the value of the asset at the current date. This is calculated by subtracting posted depreciations from the Depreciable Value.

Accounting

Fixed Asset Account: The account used to record the purchase of the asset at its original price.

Depreciation Account: The account used in the depreciation entries, to decrease the asset values.

Expense Account: The account used in the periodical entries, to record a part of the asset expense.

Journal: The Journal that will record the asset entries, usually the 'Miscellaneous Operations' journal.

Analytic Account: An optional field, applying an Analytic Account provides additional reporting.

Analytic Tag: An optional field to add relevant keywords used for reporting and organization.

We will first look at the Straight Line Method. When finished, click SAVE.

Straight Line Method

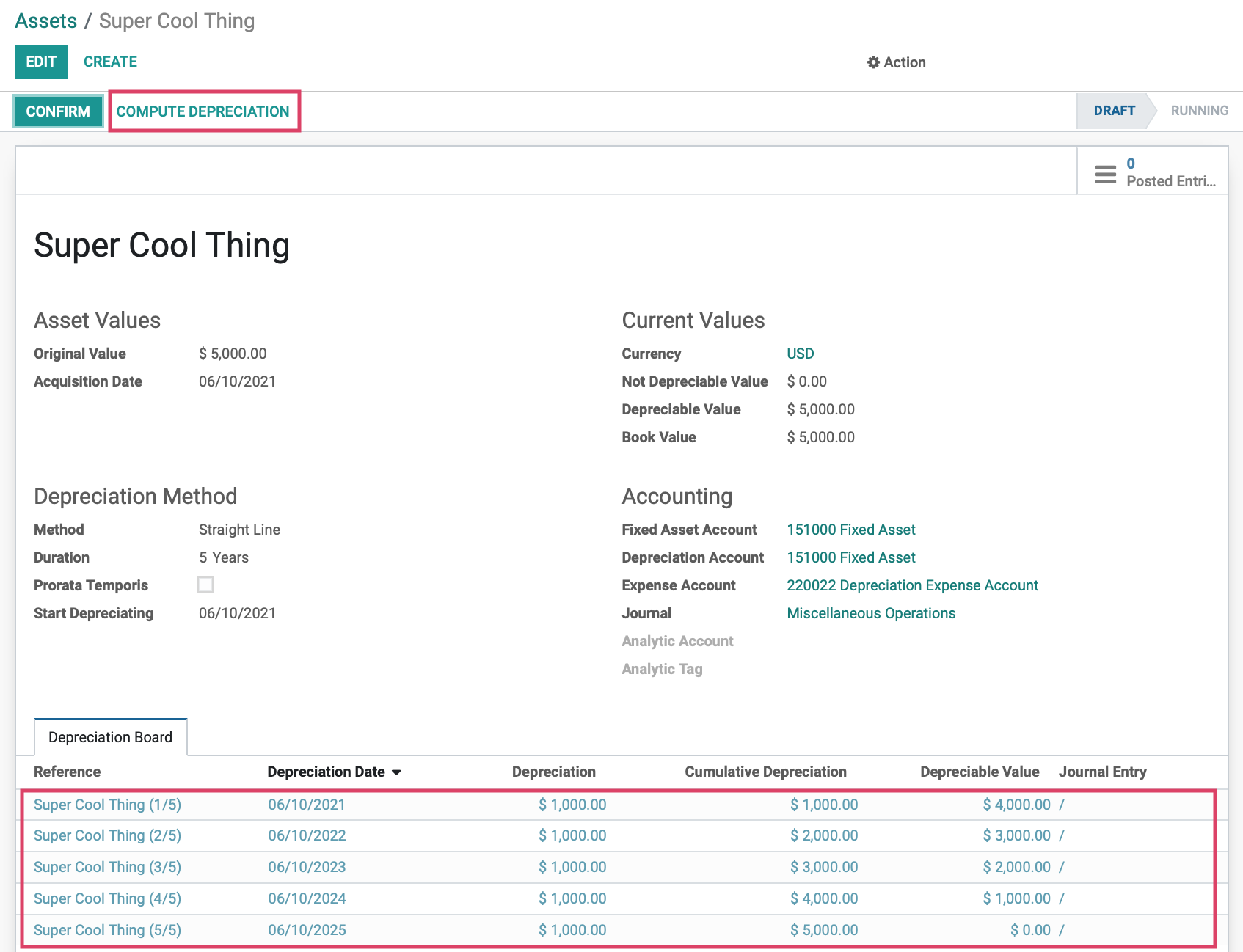

As mentioned near the beginning of this document, the Straight Line method takes the initial residual value of the asset, in this case $5000, and divides it equally among a predetermined number of planned entries, 5 years which is set on the Duration field. Click COMPUTE DEPRECIATION and a Depreciation Board will appear at the bottom of the page.

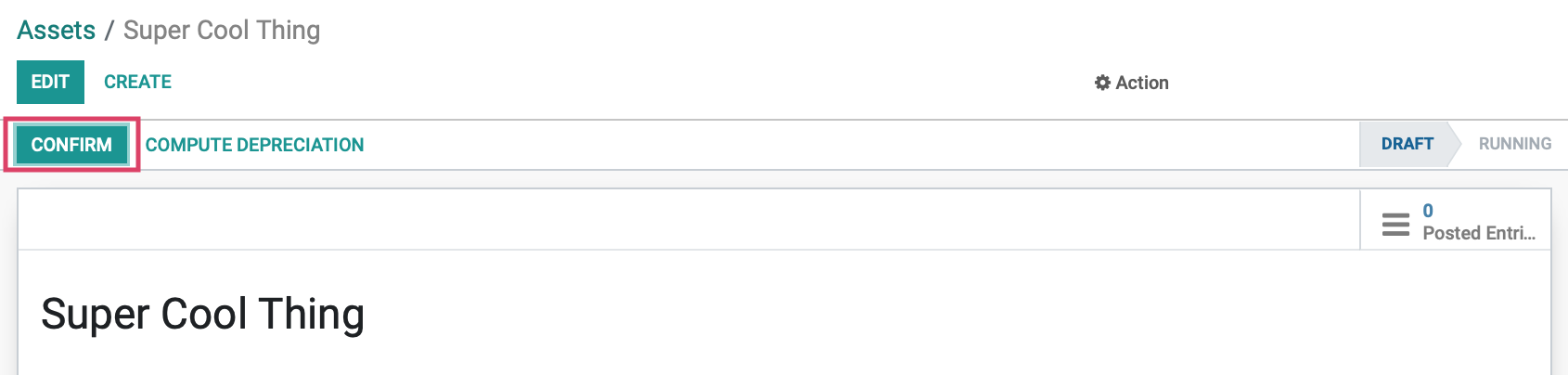

Here, we can see the Prorata Entry showing the value at the time of acquisition, followed by one entry for each of the five years we had set on our duration, with a final entry being the remaining value on the asset. If everything looks correct, click CONFIRM .

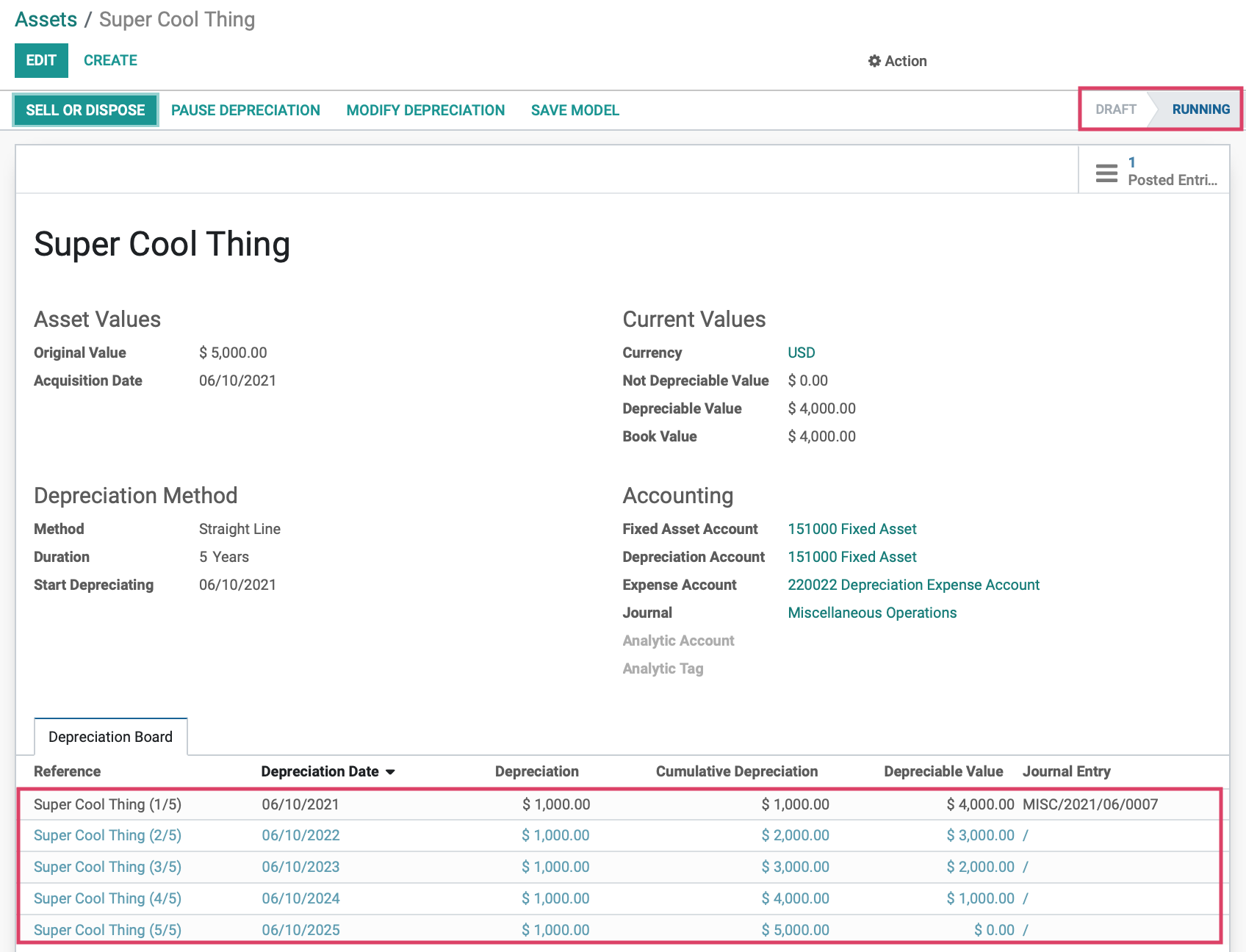

This will move the Asset from a Draft to a Running state and make the first journal entry.

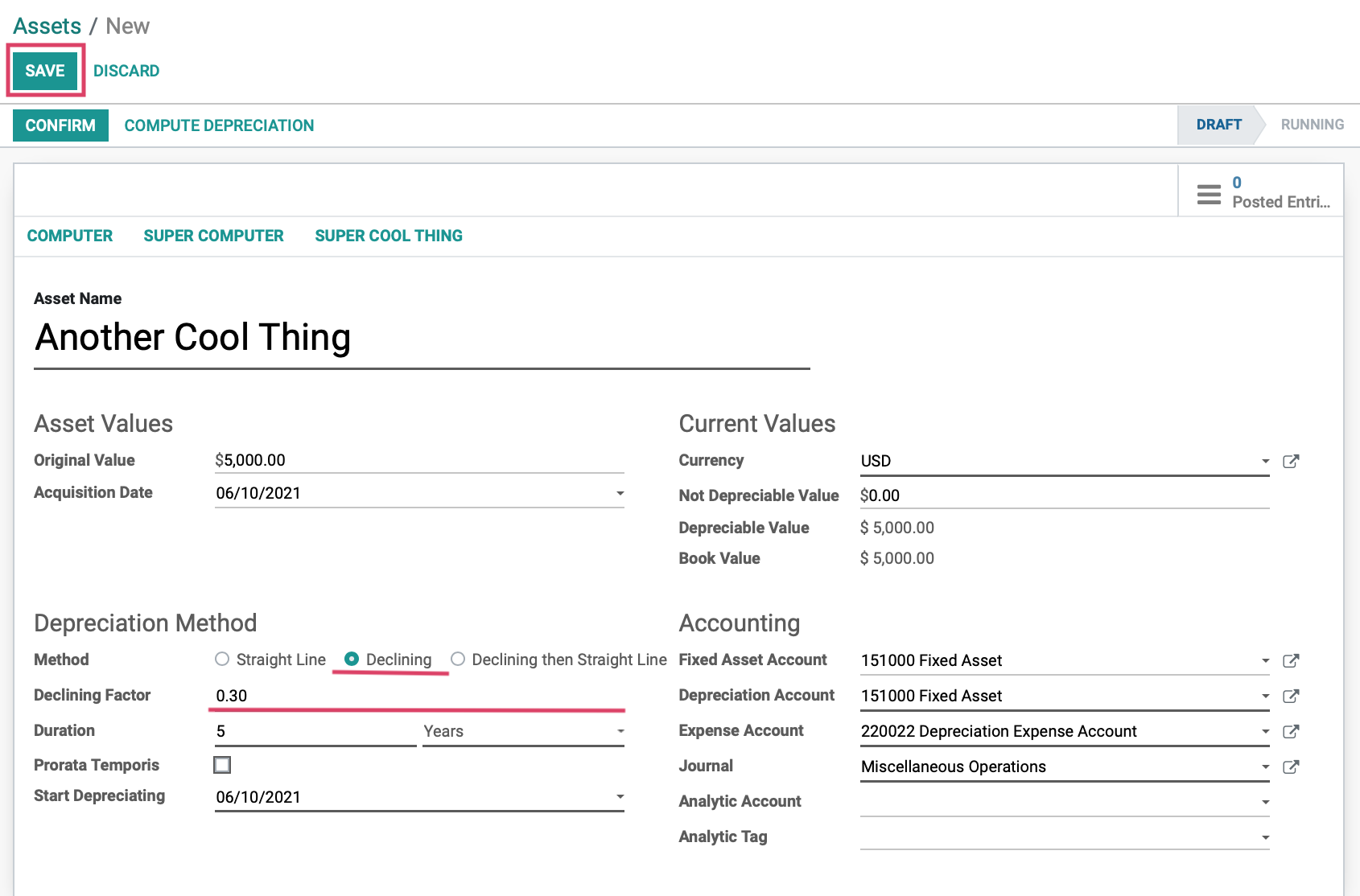

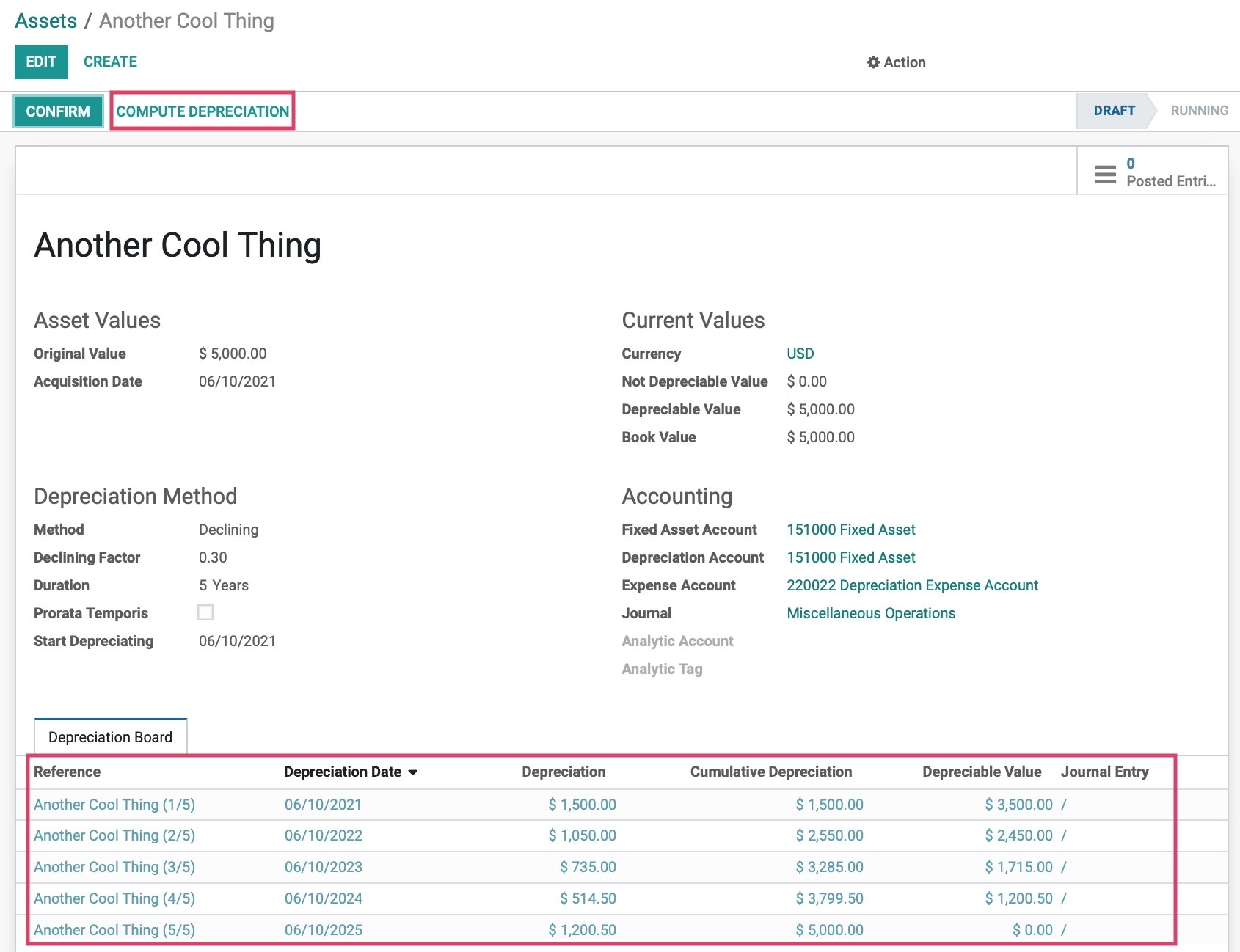

Declining Method

The declining method multiplies the last residual value by a determined declining factor. Let's use the breadcrumbs to go back to Assets and CREATE another new asset. This time, if we choose the declining method, and set a declining factor of .30, the first entry should be $1500, or $5000 (current value of asset) multiplied by .30. Click SAVE when you are done with your configuration.

Click COMPUTE DEPRECIATION. We now see the first depreciation value of $1500 as expected. The second entry is again, our remaining residual value ($5000-$1500) of $3500, times our declining factor of .30, for a value of $1050. The third entry will be the new residual value ($3500-$1050) of $2450, times our factor of .30, for a value of $735. This equation repeats itself until the depreciable value has reached $0, or the end of the duration has been reached.

In our example, you'll see that the last entry is greater than those before it. This is because the Duration wasn't long enough to bring the assets down to $0 with the configured declining factor. When this happens, Odoo will claim the balance of the depreciation in the last entry.

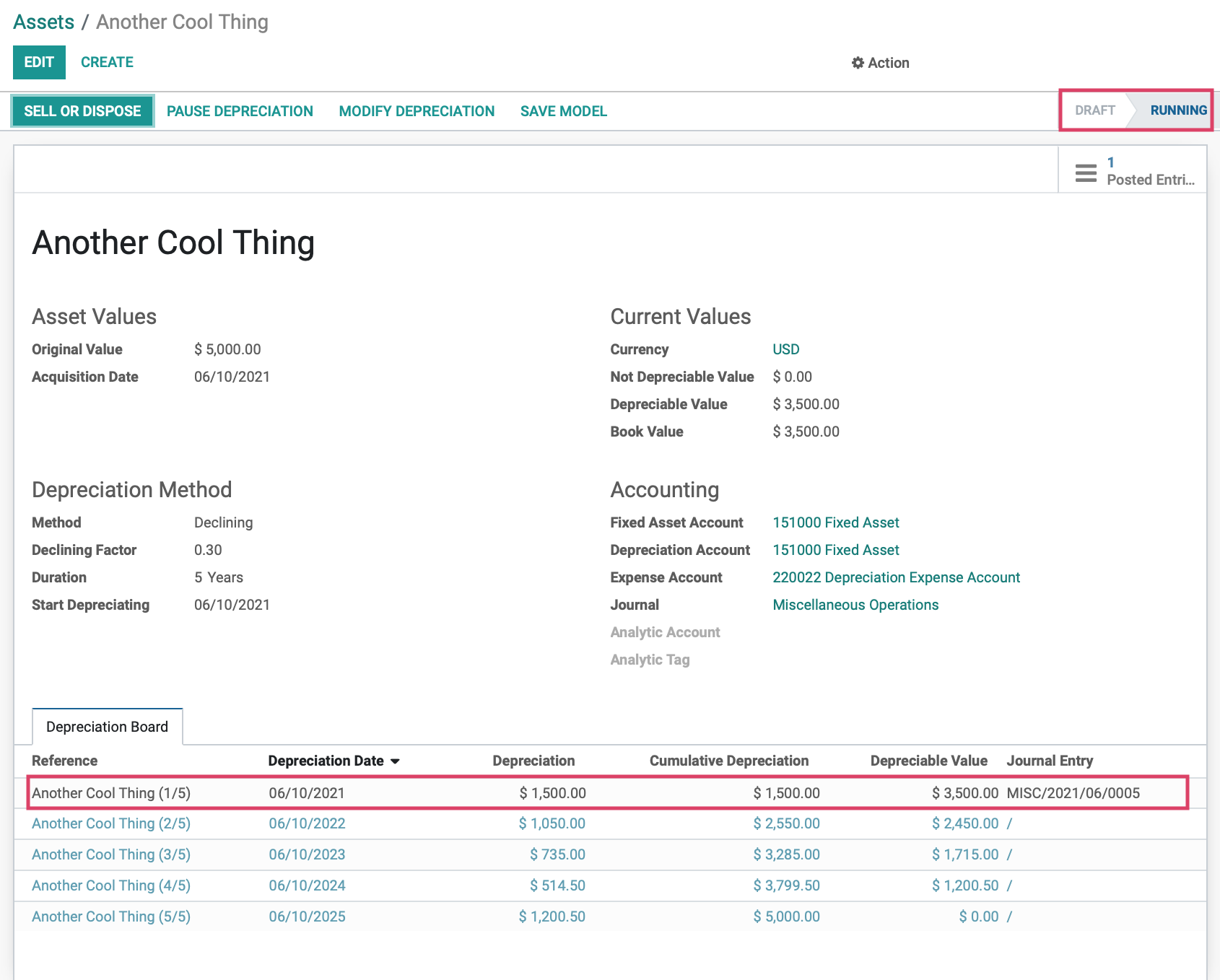

If everything looks correct, click CONFIRM to move from a draft to a running state, and make or schedule your first journal entry.

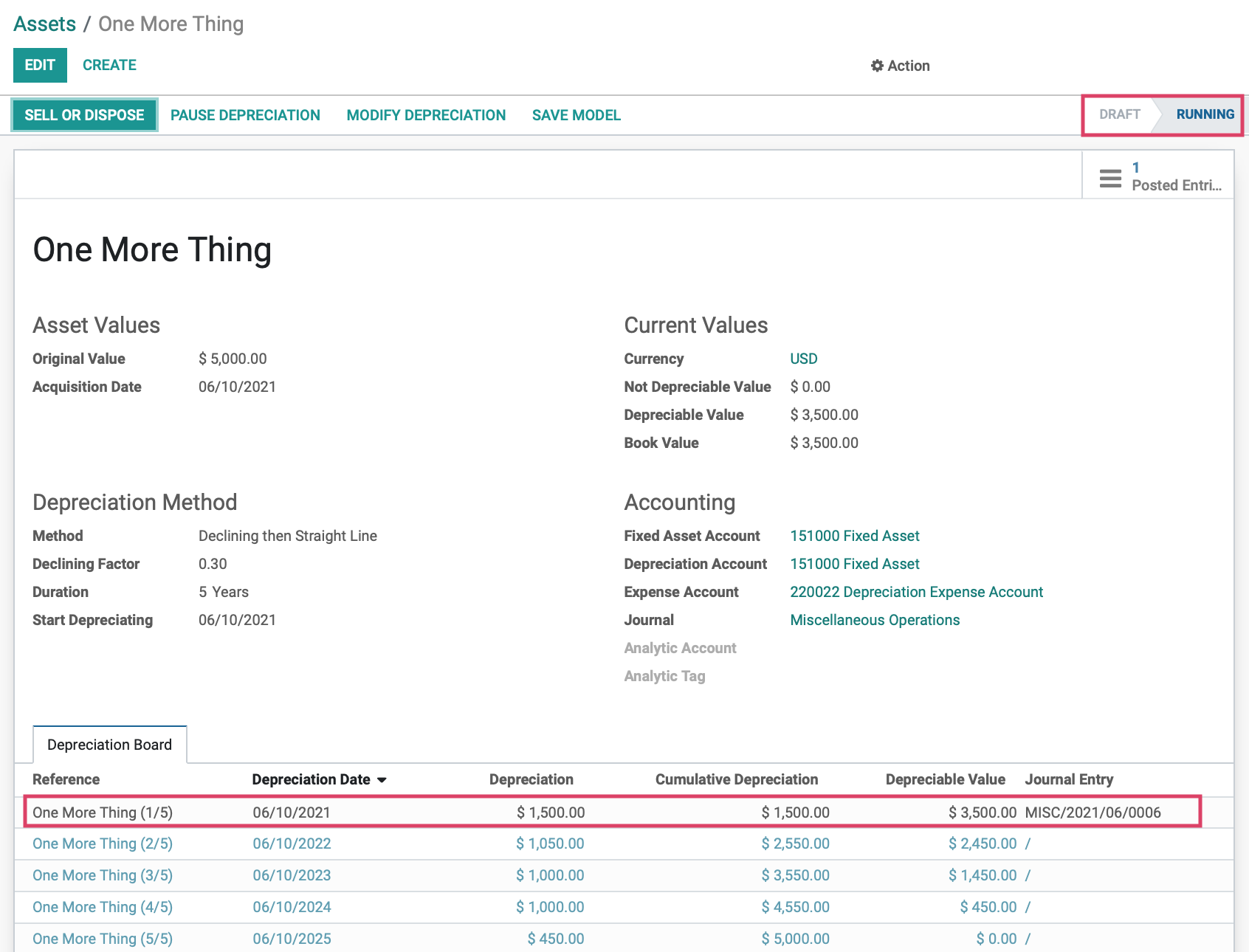

Declining then Straight Line Method

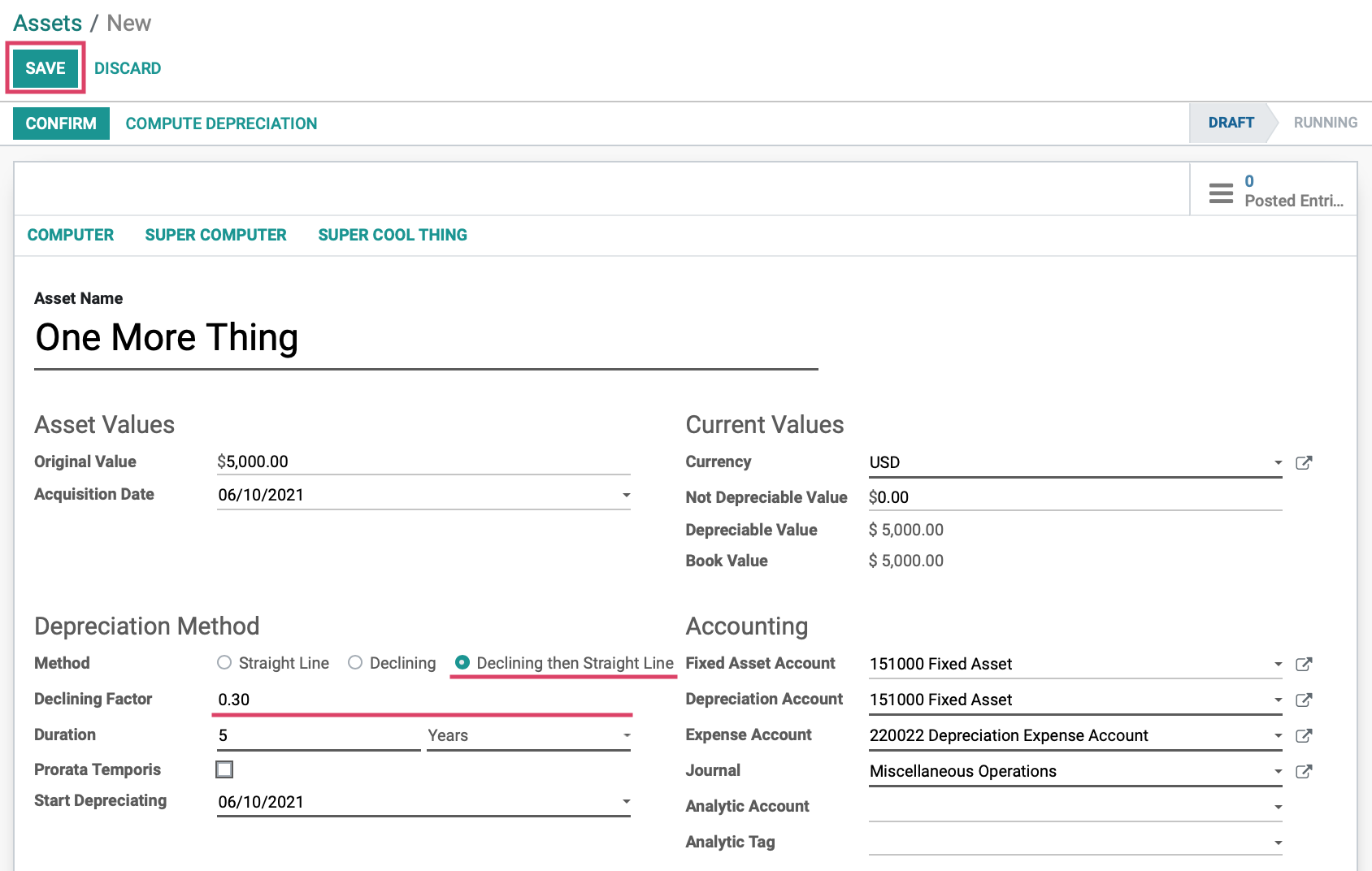

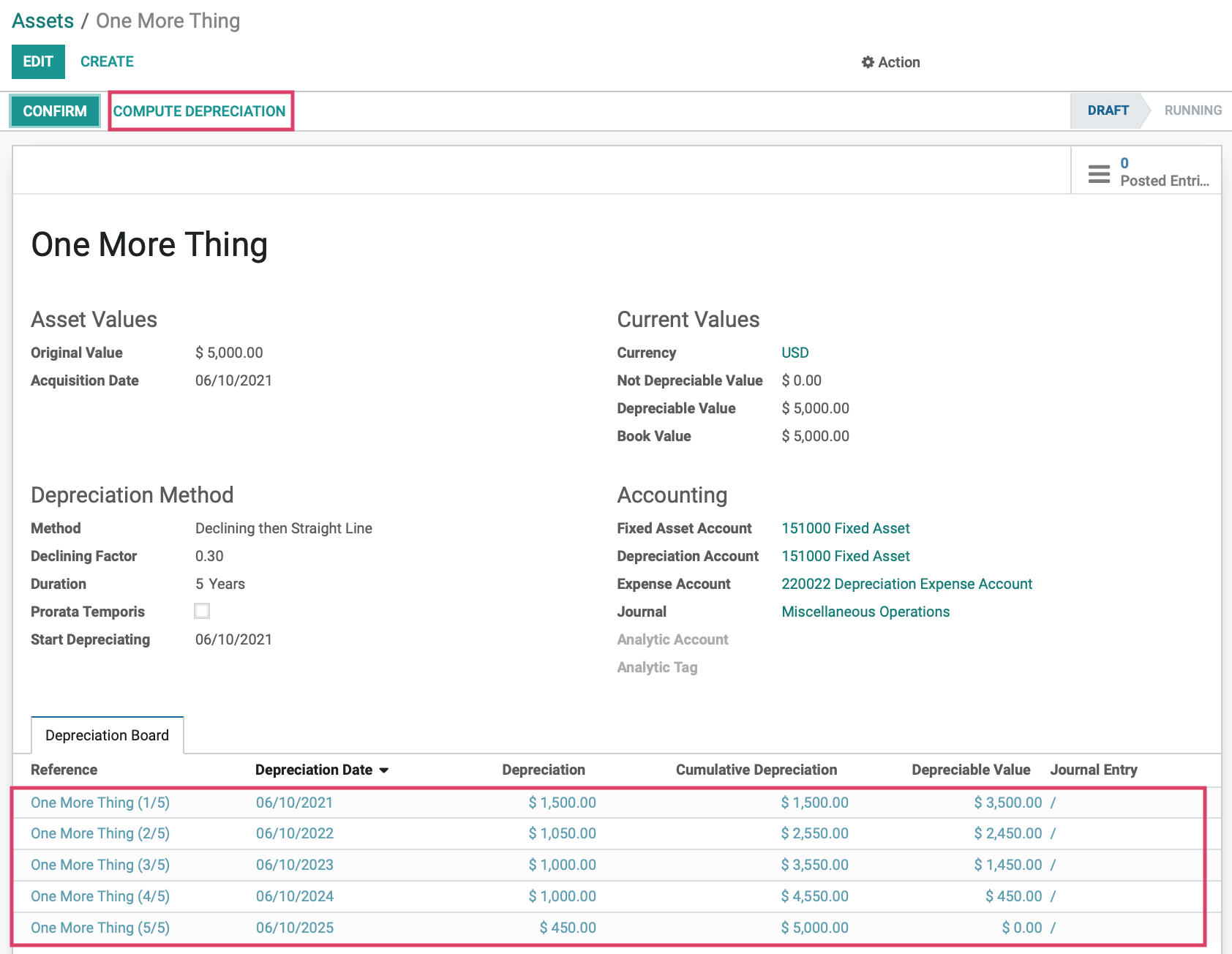

The last method uses the declining method until the residual value is higher with the straight-line method, and then switches to the straight-line method for the remainder of the entries. Again, use the breadcrumbs to go back to Assets and click on CREATE. Once you have selected the 'Declining then Straight Line' method, click SAVE.

Click COMPUTE DEPRECIATION to see the Depreciation Board and all future Journal Entries for the asset. We now see the first depreciation value of $1500 as expected. The second entry is, again, our remaining residual value ($5000-$1500) of $3500, times our declining factor of .30, for a value of $1050. The third entry would be the new residual value ($3500-$1050) of $2450, times our factor of .30, for a value of $735, which is lower than the $1000 that we would have if we were using the Straight Line method, so the journal entry automatically jumps to the higher value, allowing you to retain a higher value over the asset than if you continued to use the declining factor. Click SAVE when ready.

We now see our asset has moved from a draft to a running state, and our first journal entry is made according to our Start Depreciating date.

Action Buttons

One thing not yet covered are the action buttons near the top of each confirmed asset, regardless of depreciation type.

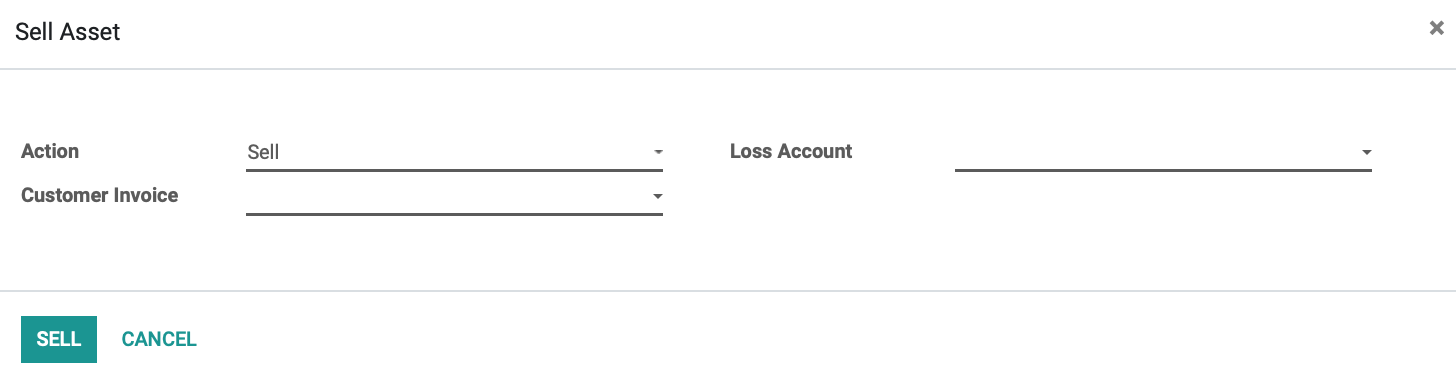

Sell or Dispose allows you to stop a depreciation at anytime, giving you the following screen:

Action: Choose to either Sell or Dispose of the asset.

Customer Invoice: Reference to invoice if sold.

Loss Account: Account set to capture loss amounts.

PAUSE DEPRECIATION will let you halt journal entries at a specified date until resumed.

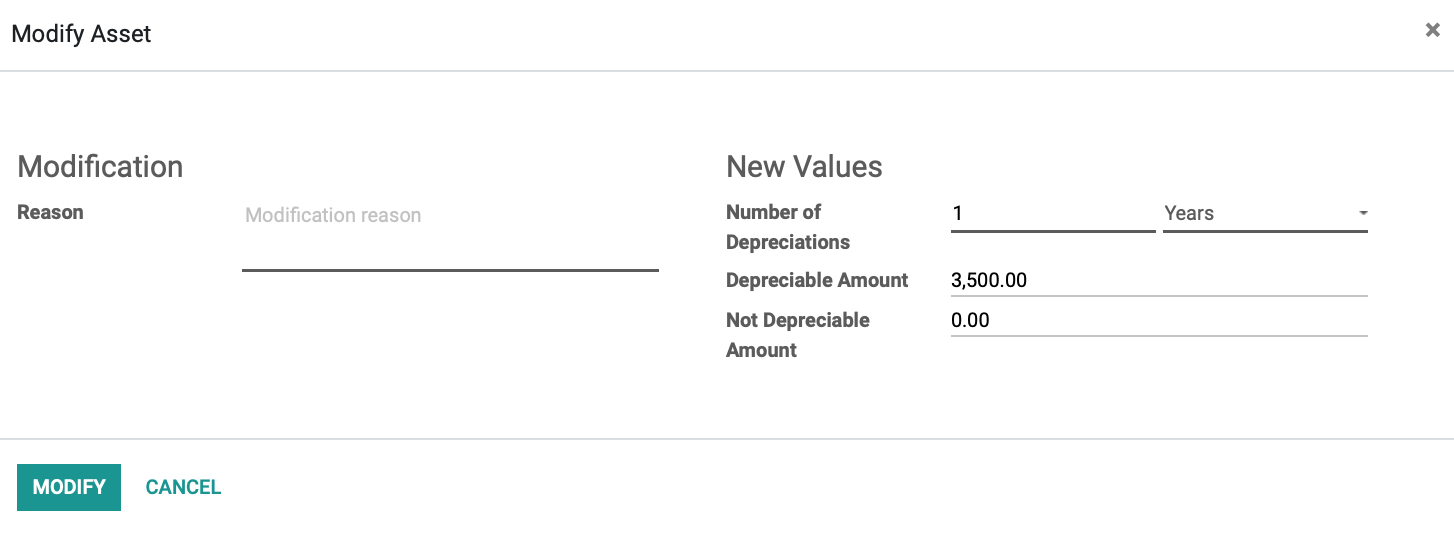

RESUME DEPRECIATION andMODIFY DEPRECIATION both bring up the same modal and allow you to made changes, as needed:

And finally, SAVE MODEL allows you to save the asset for future use.