Accounting: Accounting: Management: Deferred Expenses

Purpose

This document covers how Odoo 14 manages deferred expenses via custom models in the Accounting application.

Process

To get started, navigate to the Accounting app.

Configuring a Deferred Expense Account

Important!

Automating Deferred Expenses?

In the sections below, we'll go over Deferred Expense Models, which provision for the automation of deferred expense journal entries. If you plan to use the automated method, you'll need to create a separate account for each Deferred Expense Model due to the unique configuration of each.

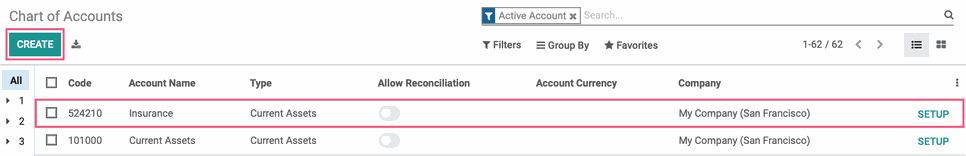

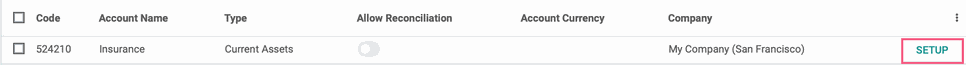

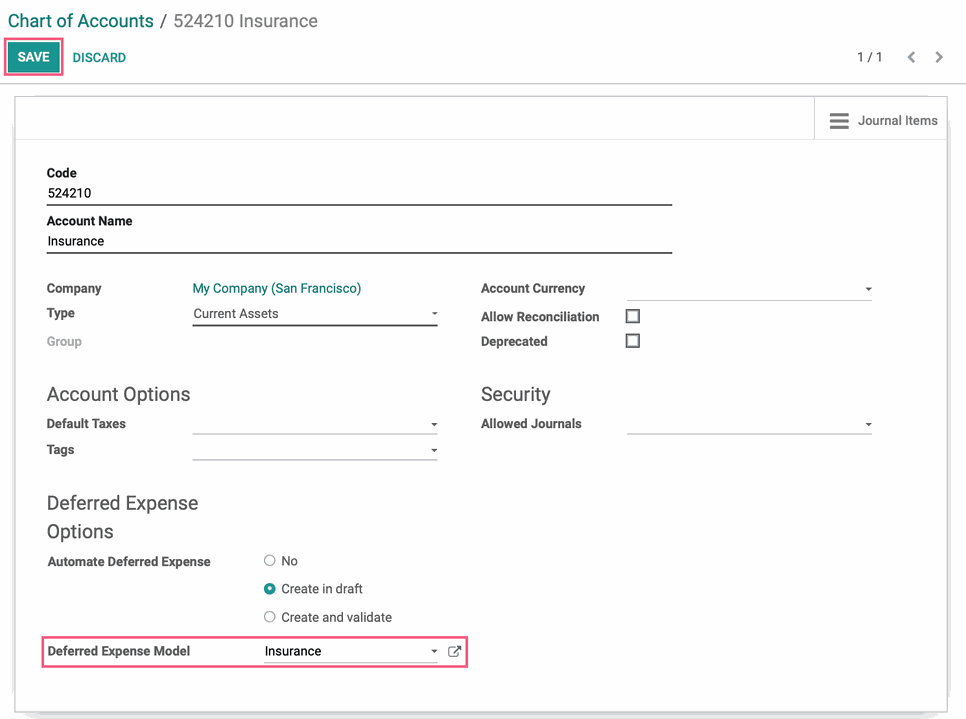

Go to Configuration > Accounting > Chart of Accounts. Click create to open a new line. Enter the Code, Account Name, and Account Type (Current Assets). When you're done, click save.

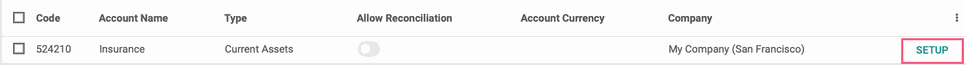

Once saved, click Setup on the new account line.

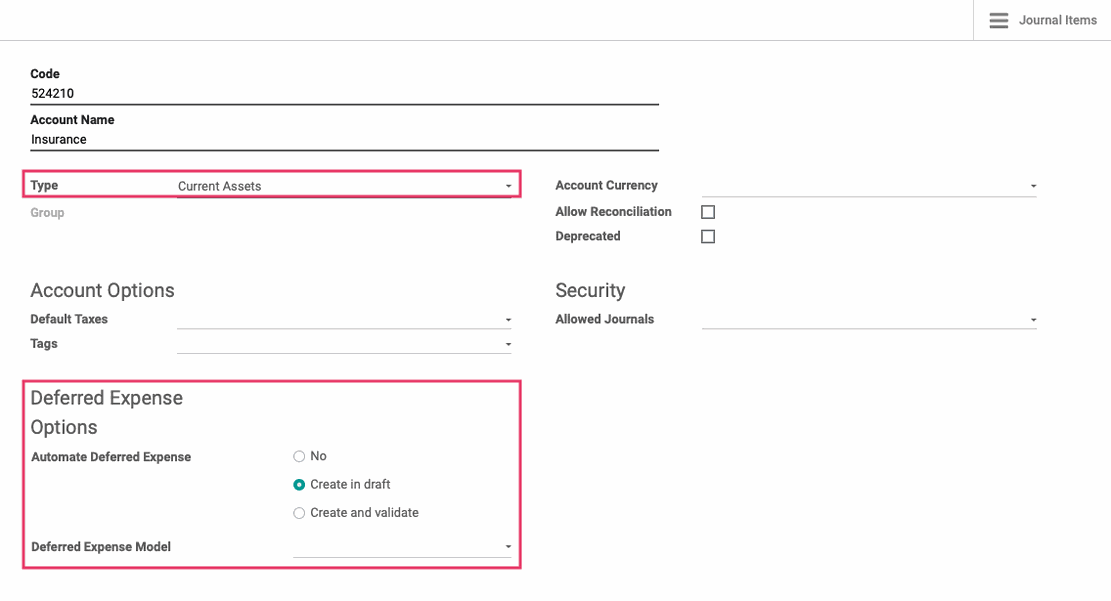

From within the record, click Edit.

There are two sections to focus on in this account.

Type: Because this is deferred expense, the account should be set to Current Assets.

Automated Deferred Expense: This is what will automate the process for us. If you'd like to review the entries before they post, select 'Create in draft'. If you'd like Odoo to do this for you, select 'Create and validate'.

Deferred Expense Model: In order to automate this process, we need to give the account a model to use. If you haven't created that model yet, no worries, we'll come back to this!

When you're ready, click Save.

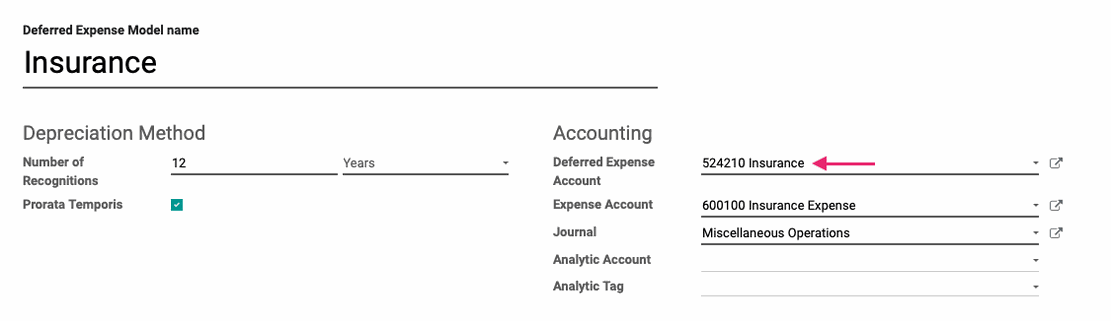

Creating a Deferred Expense Model

These configurations are the means by which Odoo automates deferred expenses.

To create a Deferred Expense Model, go to CONFIGURATION > MANAGEMENT > DEFERRED Expense MODELS. Once there, click CREATE. This brings up the following form.

Deferred Expense Model name: Enter a name for this configuration.

Depreciation Method

Number of Recognitions: Select the unit and number of units (e.g. months, years)

Prorata Temporis: Indicates that the first depreciation entry for this asset must be done from the asset date (purchase date) instead of the first January / Start date of fiscal year.

Accounting

Expense Account: Select the Expense Account to which this expense will be recorded.

Deferred Expense Account: Select the Deferred Expense Account to which this income will be recorded. For our example, we'll select the account we just created.

Journal: Select the journal to which these transactions will be recorded.

Analytic Account: If applicable, select the Analytic Account wo which these transactions will be recorded.

Analytic Tag: If applicable, indicate the tag(s) to be added to transactions that use this model.

When you're ready, click Save.

Now that we've created that model, let's go back to CONFIGURATION > ACCOUNTING > CHART OF ACCOUNTS and click Setup on the account we created in the first step.

Under the Deferred Expense Options section, set the Deferred Expense Model to the model we just created, then click Save.

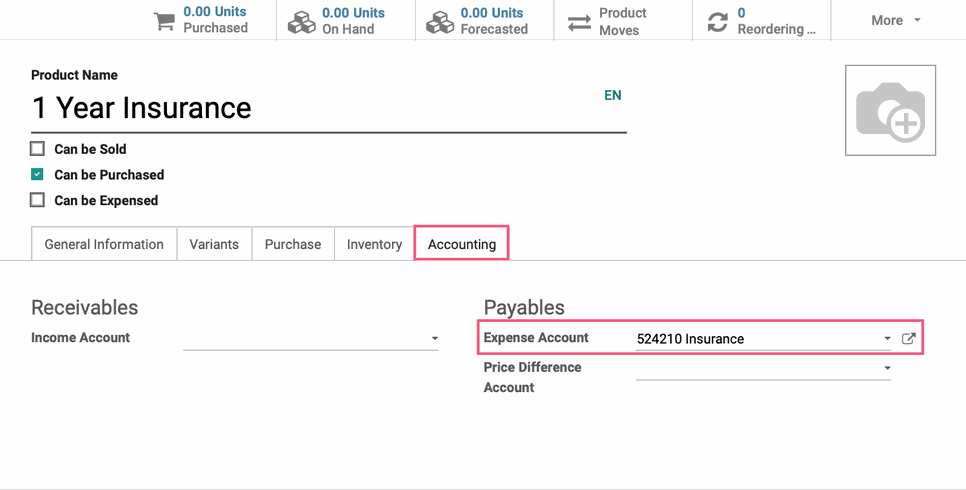

Configuring a Product for Deferred Expense

Go to Vendors > Products and either create or select an existing product to configure, referring to the following example.

We have a product called "1 Year Insurance" where we send the vendor a one time payment for a one year insurance plan. We want to disperse the expense over the course of 12 months to properly reflect what we're sending out each month.

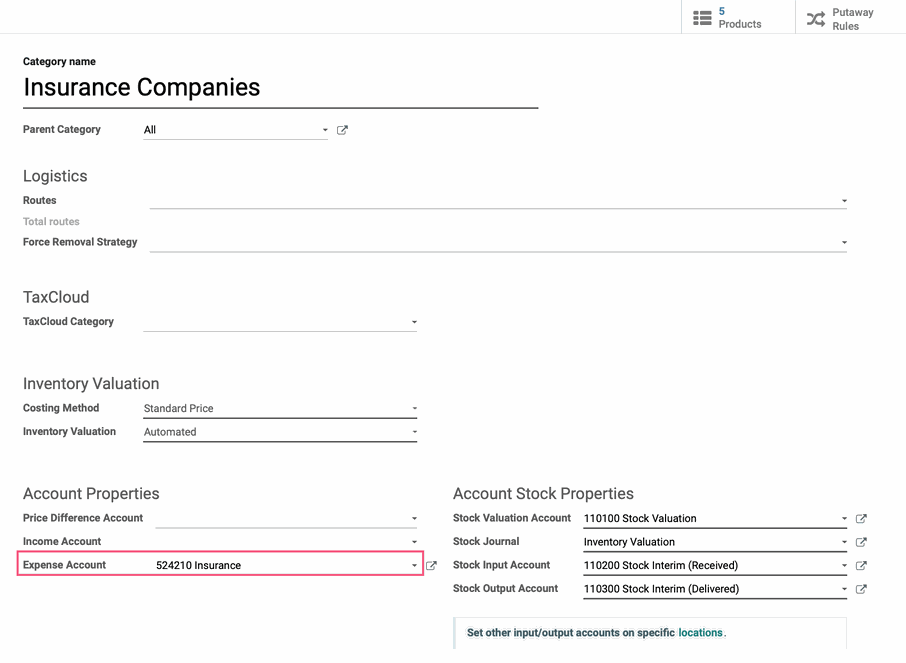

This product looks like any other service product, with one important distinction. We're going to edit this product, then head over to the Accounting tab. Under the Payables section, set the Expense Account to match the deferred expense account on your Deferred Expense Model. Make sure that the Control Policy for this product is set to On ordered quantities under the Purchase tab.

When you're ready, click Save.

Good to Know!

Multiple Deferred Expense Products?

If you have several products that should create deferred expense, consider creating a dedicated category for those products. Doing so allows you to set the category itself to deferred expense, so all products within it will inherit that setting.

Watch it Work!

Let's sell this product and watch how it works based on the configuration, above.

Navigate to the Purchase app.

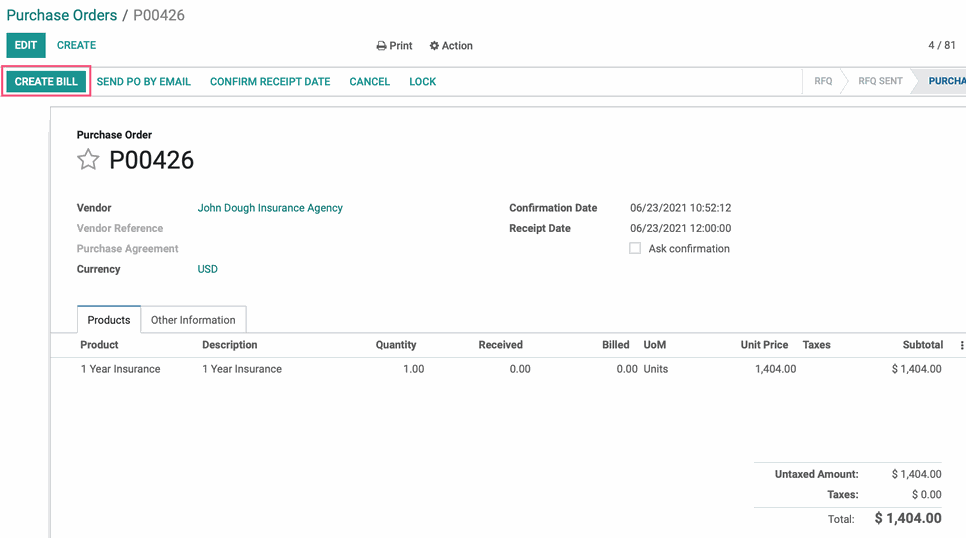

Once there, we'll go to ORDERS > ORDERS and click CREATE. We'll select a Vendor and add the '1 Year of Insurance' product under the ORDER LINES tab. We'll then confirm the order.

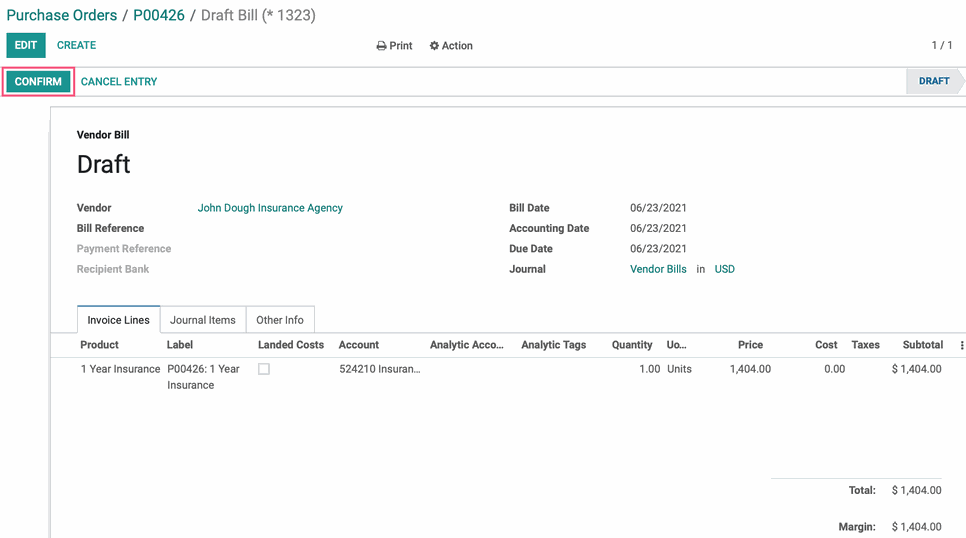

On the confirmed invoice, click Create bill and finally, Confirm the draft bill.

Now, let's jump back to the Accounting app.

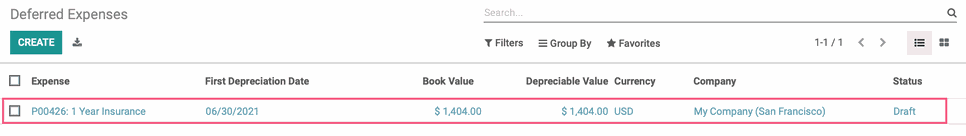

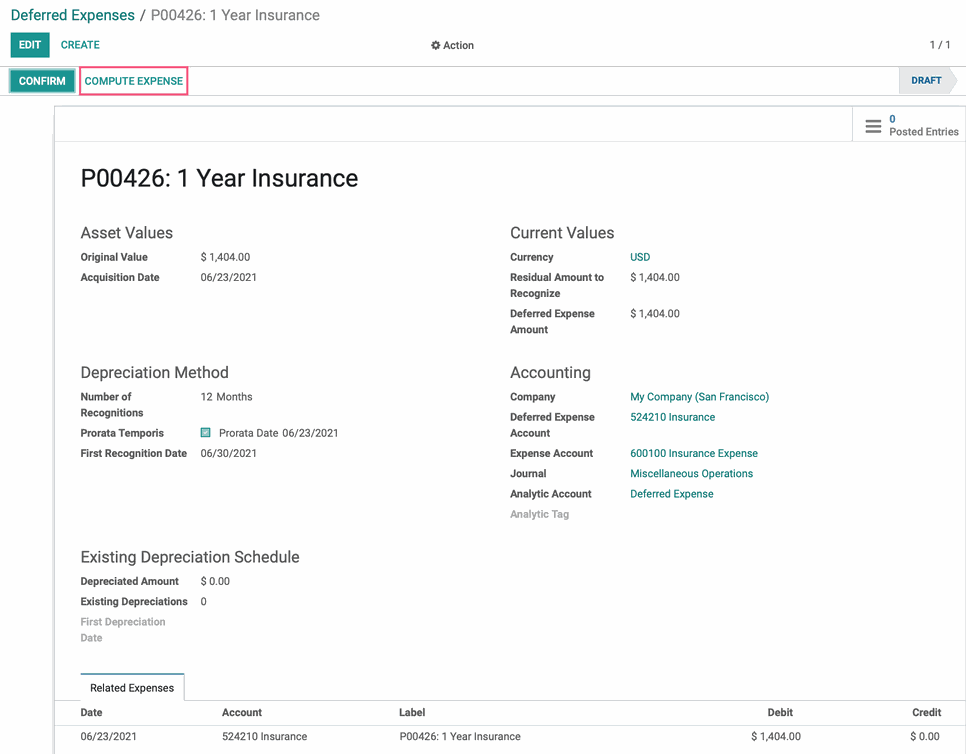

Once there, we'll go to Accounting > Management > Deferred expenses. Here we'll see our brand new entry in draft status, based on the configuration above. Let's open it up!

From within this record, we can see the configuration of the deferred expense model has been applied. To see the planned journal entries, we'll click Compute expense.

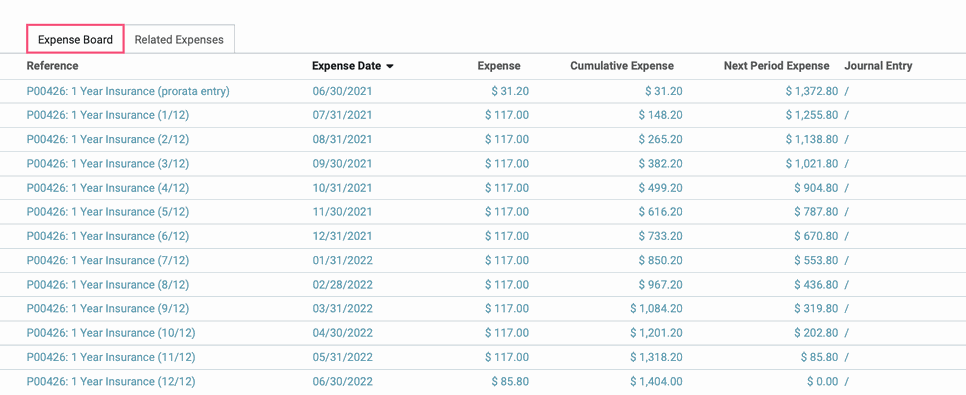

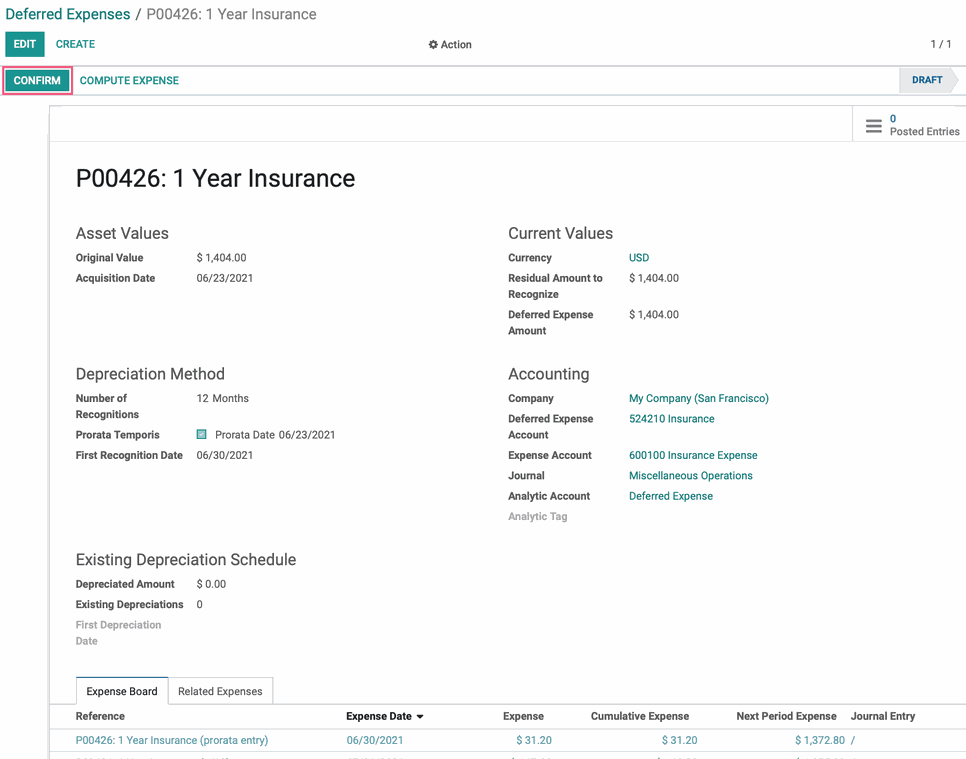

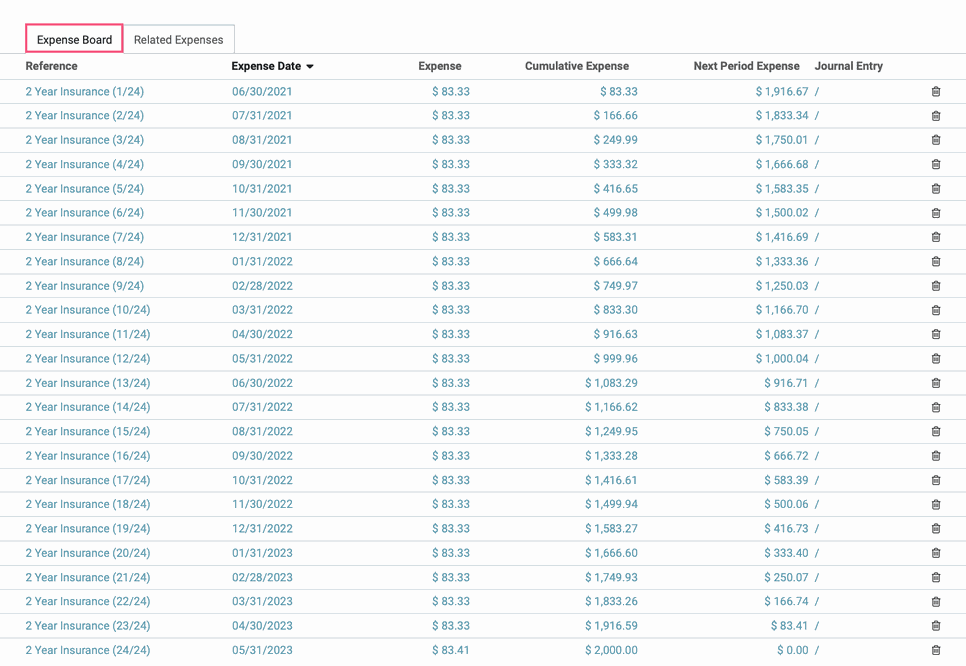

You'll now see a new expense Board tab with all of those planned entries.

If everything looks good, you can go ahead and click confirm. Odoo will now start posting journal entries according to the Expense Board.

Create a Manual Deferred Expense

If you're not at the point of needing to automate Deferred Expenses, that's no problem! You can easily create an entry manually.

We are about to renew our insurance plan and our vendor, Jane Dough Insurance Agency, has offered us a one time deal. We have already created the purchase order and after creating and confirming our bill, let's go ahead and create a manual Deferred Expense!

To do so, start in the Accounting app.

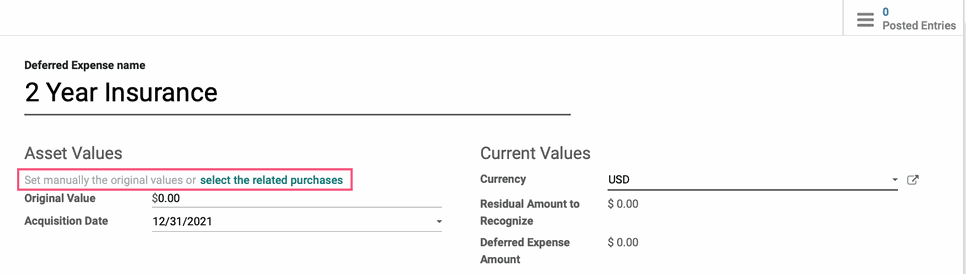

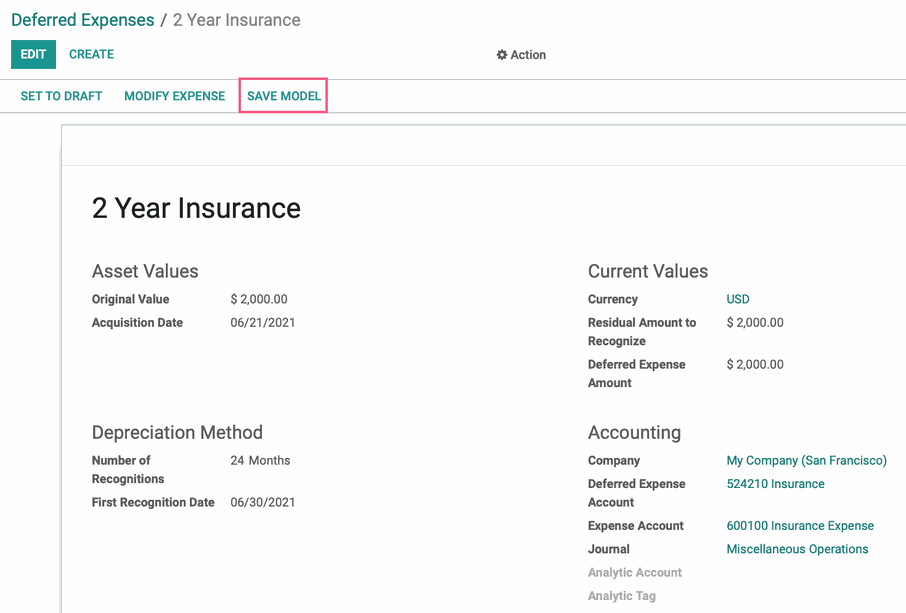

Once there, we'll go to ACCOUNTING > MANAGEMENT > DEFERRED expenses and click Create to bring up the empty form.

Deferred Expense name: Enter a name for this record.

Asset Values: Click select the related purchases.

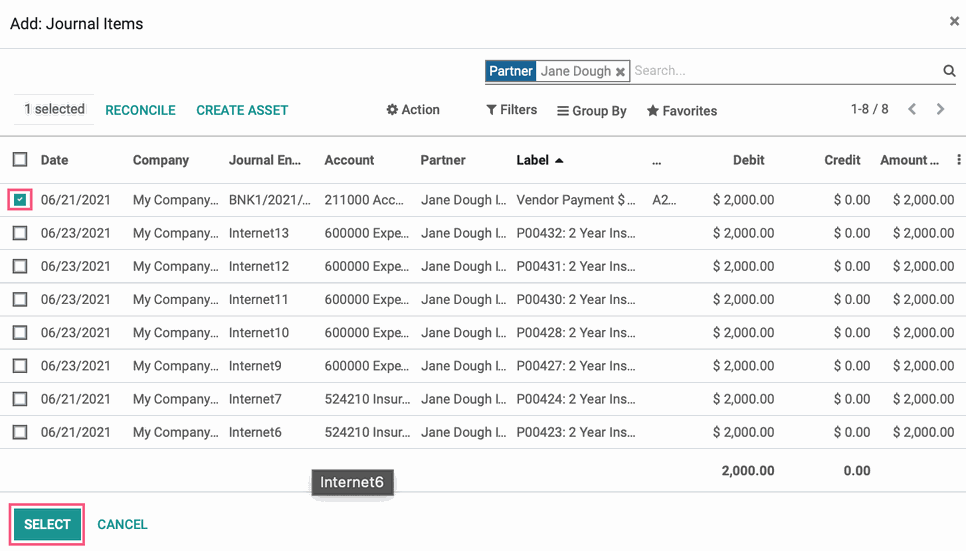

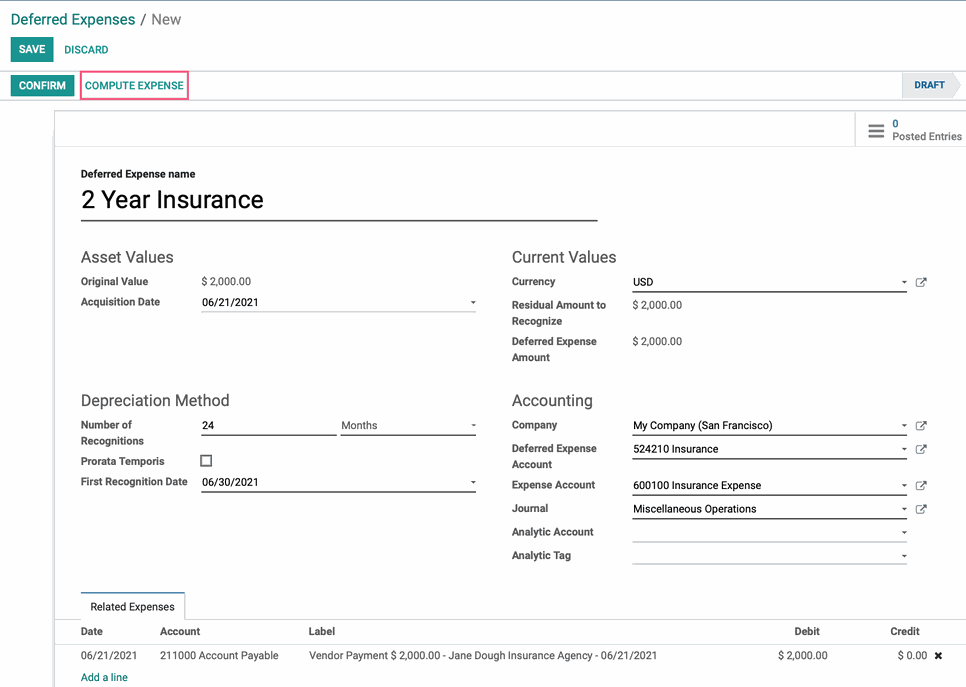

This brings up a list of journal items. Here, locate and select the entry for the purchase, and click Select. In doing so, several fields on the page will populate for you.

Original Value: This is a calculated field that pulls directly from the record(s) you selected in the previous step.

Acquisition Date: The date of revenue acquisition.

Depreciation Method

Number of Recognitions: Select the unit and number of units (e.g. months, years).

Prorata Temporis: Indicates that the first depreciation entry for this asset must be done from the asset date (purchase date) instead of the first January / Start date of fiscal year.

First Recognition Date: Select the date for the first journal entry to be made.

Current Values

Currency: This will default to the invoice currency.

Residual Amount to Recognize: This is a calculated field that displays the amount left to defer.

Deferred Expense Amount: This is a calculated field that displays the amount deferred up until the current date.

Accounting

Expense Account: Select the account to recognize the revenue.

Deferred Expense Account: Select the account to recognize the deferred expense.

Journal: Select the journal to record entries for this deferred expense entry.

Analytic Account + Analytic Tag: If you're using analytic accounting, select the account and tag(s) for these journal entries.

Under the Related expenses tab, you'll see the Sale Order you selected in the first step. When you're ready, click Compute expense.

You'll now see a new Expense BOARD tab with all of those planned entries.

Good to Know!

Create a Deferred Expense Model from a Manual Entry

If you've created a manual deferred expense entry that you think will be useful in the future, go ahead and click Save Model to save this configuration for future use!

At that point you can follow the instructions for Creating a Deferred Expense Model.