- Stock Delivery Planner

- HR Holidays Accrual

- HR Payroll Input Report

- HR Employee Activity

- HR Holidays Partial

- Human Resources (HR) Modules

- Boxes

- Payroll Modules

- ShipBox

- Sales Modules

- Sale Section Subtotal

- PrintBox

- Hibou Fedex Shipping

- Inventory Modules

- Maintenance Modules

- Accounting Modules

- Helpdesk Modules

- Forte Payment Acquirer

- Account Payment Electronic

- US ZIP Code to City/State

- Purchase by Sale History MRP

- Payroll Batch Work Entry Error SKIP

- Web Auto Paginate

- Payment Analytic

- Payroll Input Name Report

- Purchase Modules

- Project Modules

- Website Modules

- Tools + Settings Modules

- Point of Sale Modules

- Manufacturing Modules

- Hibou Commissions

Hibou Odoo Suite: Payroll Modules: US Payroll

Repository Versions:

Modules:

OPL-1

Important!

Hibou Payroll + Odoo Compatibility

Due to the changes made in Odoo Accounting at version 13, Hibou's Payroll module is only compatible with Enterprise after version 13. It is still compatible with pre-13 versions of Community.

Purpose

This documentation outlines the use case and processes associated with Hibou's USA - Payroll module for Odoo 12.

The USA - Payroll module contains Salary Structures, Salary Rules, Payroll Rates, and Contribution Registers for all fifty U.S. states. You will need these to run payroll in the U.S. Without a localization like the USA - Payroll module, you cannot run Payroll, as Odoo does not have any pre-loaded salary rules or conditions.

We'll provide an overview of the following areas of the module:

Salary Structures

Salary Rules

Payroll Rates

Contribution Registers

Contract Configuration

Process

To get started, navigate to the Apps application.

Once there, remove the 'Apps' filter in the search bar, then, search for 'USA - Payroll". When you're ready, click Install.

Once the installation is complete, you will be ported to your Odoo home screen.

Good to Know!

If you do not have the Payroll Accounting module installed, we recommend installing it when you install the USA - Payroll module. To do this, navigate to the Apps application, remove the Apps filter and search for Payroll Accounting.

Then, click install. Once the installation is complete, you will be ported to your database homepage.

Payroll

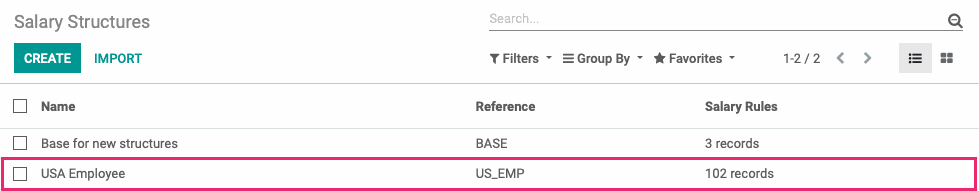

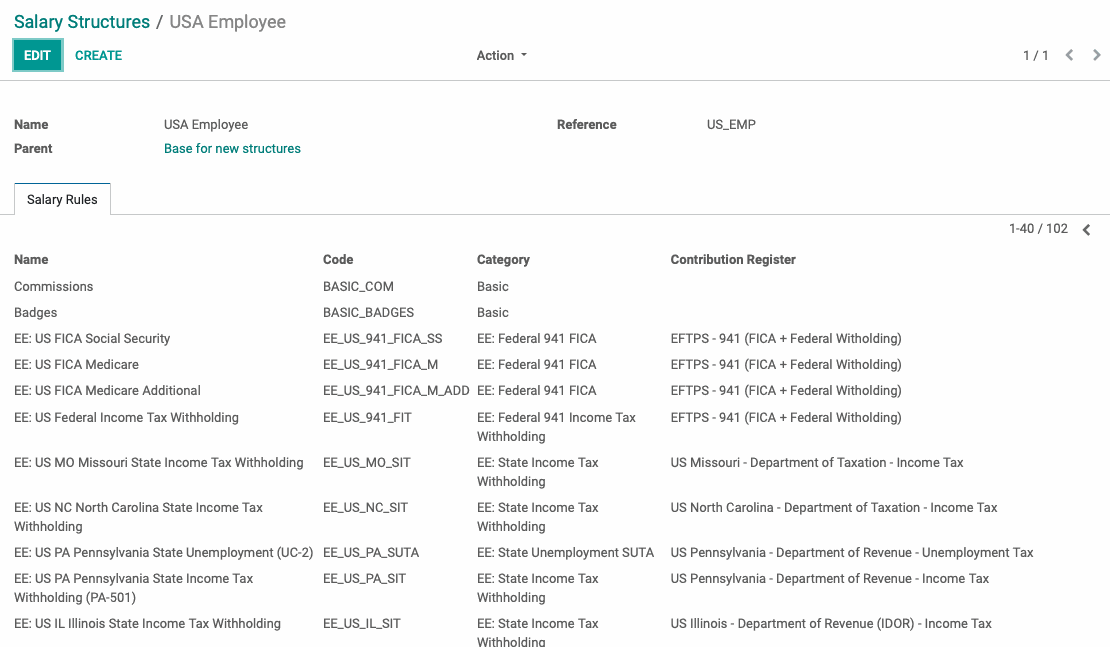

Salary Structure

Navigate to the Payroll application.

Once there, click Configuration > Salary Structures.

Salary Structures are required to create payslips in the U.S. You will typically require one or more salary structures for your employees depending on where they live and work. For more information on Salary Structures, refer to our How to Set-Up Payroll documentation.

From the list, click the USA Employee salary structure. This entry is preconfigured by the USA - Payroll module.

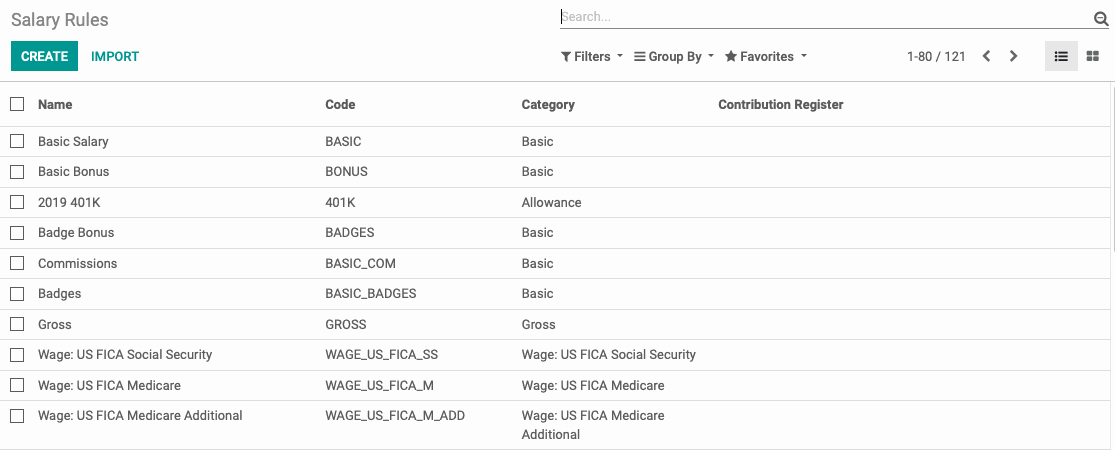

Salary Rules

On the next page, you will see a list of the Salary Rules for this structure.

Salary Rules are conditions that apply to a Salary Structure, such as computation of amount, designation of general ledger accounts for the Accounting app, Python code, and more. For more information on Salary Rules, refer to our How to Set-Up Payroll documentation.

The USA - Payroll module is preconfigured with the Salary Rules shown below.

It is possible to create and modify Salary Rules by clicking Configuration > Salary Rules. However, we do not recommend doing so unless you are familiar with this process. If you require additional or modified Salary Rules, please contact us.

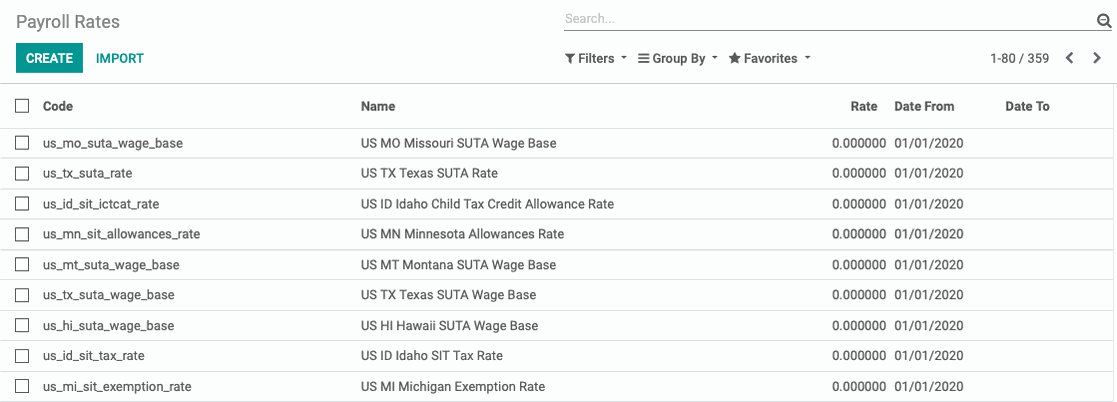

Payroll Rates

Next, click Configuration > Payroll Rates.

Payroll Rates calculate the withholdings for a Payroll Rule. It is possible to create new Payroll Rate; however, we do not recommend doing so unless you are familiar with this process. If you require additional or modified Payroll Rates, please contact us.

The USA - Payroll module is preconfigured with these Payroll Rates.

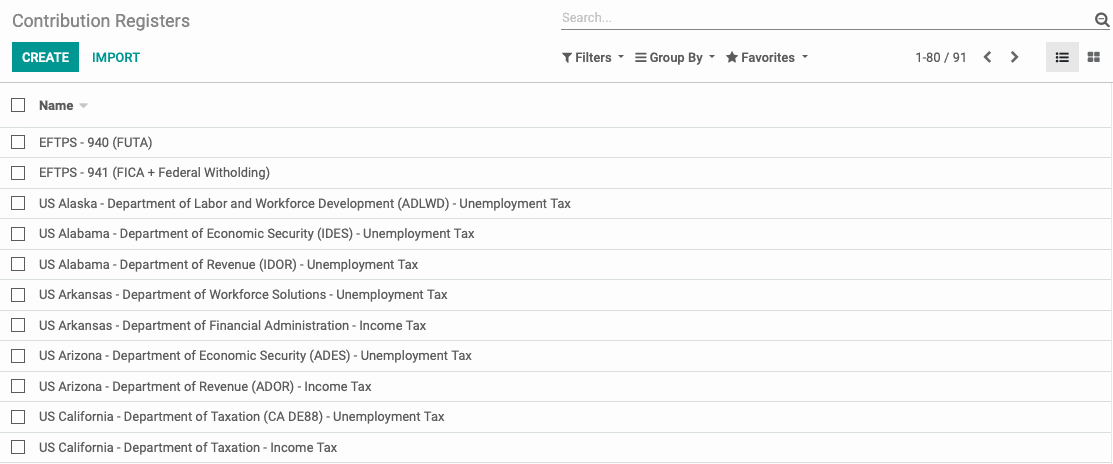

Contribution Registers

To see Contribution Registers, click Configuration > Contribution Registers.

Contribution Registers track contributions, such as unemployment, on each paycheck. It is possible to create new Contribution Registers; however, we do not recommend doing so unless you are familiar with this process. If you require additional or modified Payroll Rates, please contact us.

The USA - Payroll module is preconfigured with these Contribution Registers.

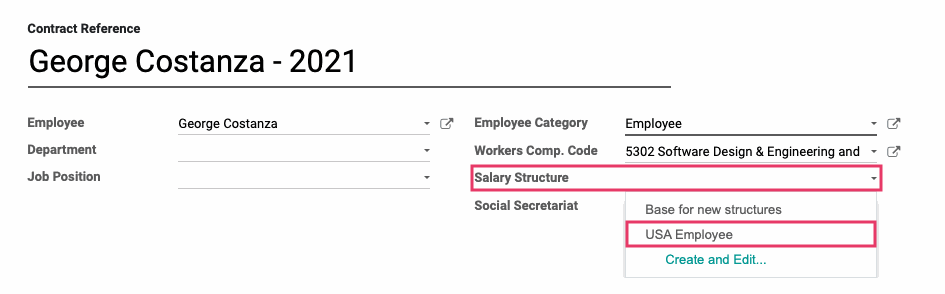

Configuring an Employee Contract

Now that you have configured US Payroll, you will need to modify your employee contracts to reflect those changes. To do this, navigate to the Employees Application.

Once there, go to Contracts. Then, select the contract you wish to modify.

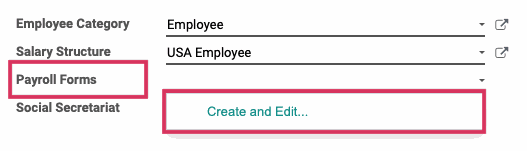

On the contract, you will be able to change the Salary Structure to USA Employee.

Payroll Forms: Once you have selected USA Employee in the Salary Structure field, the Payroll Forms field will appear beneath. Click Create and Edit... to add a new record. Please refer to our Employee Contracts documentation for a full walkthrough of this section.

Good to Know!

When you install the USA - Payroll module, the Payroll Rates module is also installed.

Once done configuring the contract, click save.

To fully set up and run payroll for your organization, please see our How to Set Up Payroll and How to Run Payroll documentation.