- Stock Delivery Planner

- ShipBox

- PrintBox

- Boxes

- US ZIP Code to City/State

- Point of Sale Modules

- Purchase by Sale History MRP

- Payroll Batch Work Entry Error SKIP

- Web Auto Paginate

- Website Modules

- Hibou Fedex Shipping

- Hibou Commissions

- Sale Section Subtotal

- Forte Payment Acquirer

- Helpdesk Modules

- Account Payment Electronic

- Tools + Settings Modules

- Sales Modules

- Inventory Modules

- Accounting Modules

- Manufacturing Modules

- Purchase Modules

- Project Modules

- Payment Analytic

- Payroll Modules

- Human Resources (HR) Modules

- HR Holidays Partial

- Payroll Input Name Report

- HR Payroll Input Report

- HR Holidays Accrual

- Maintenance Modules

- HR Employee Activity

Hibou Odoo Suite: Accounting Modules: US WA State SalesTax API

Repository Versions:

Modules:

AGPL-3

Purpose

The purpose of this documentation is to outline the use case and processes associated with Hibou's US WA State SalesTax API module. This module integrates the WA State SalesTax API for use with fiscal positions.

Getting Started

First thing's first, we want to install the module! Navigate to the Apps application and search 'US WA State SalesTax API'. When ready, hit the install button.

Good to Know!

The US WA State SalesTax API depends on the Invoicing module. However, if you do not already have this module installed Odoo will install it for you during this module's installation.

Processes

To get started, navigate to the Accounting application.

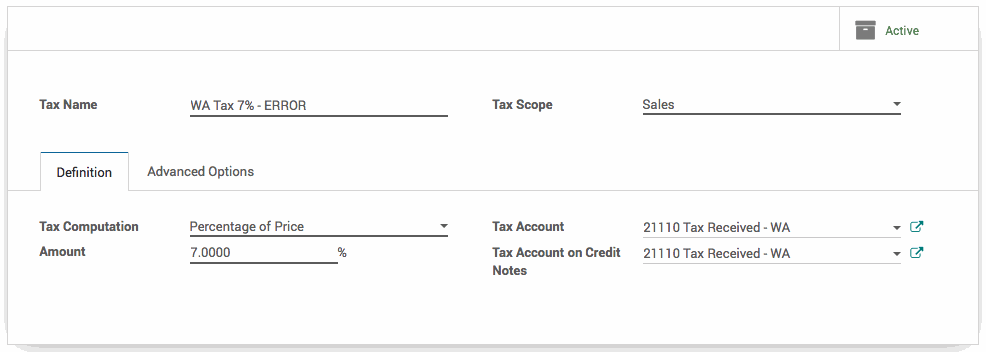

Creating a Backup Tax

Creating a Fiscal Position

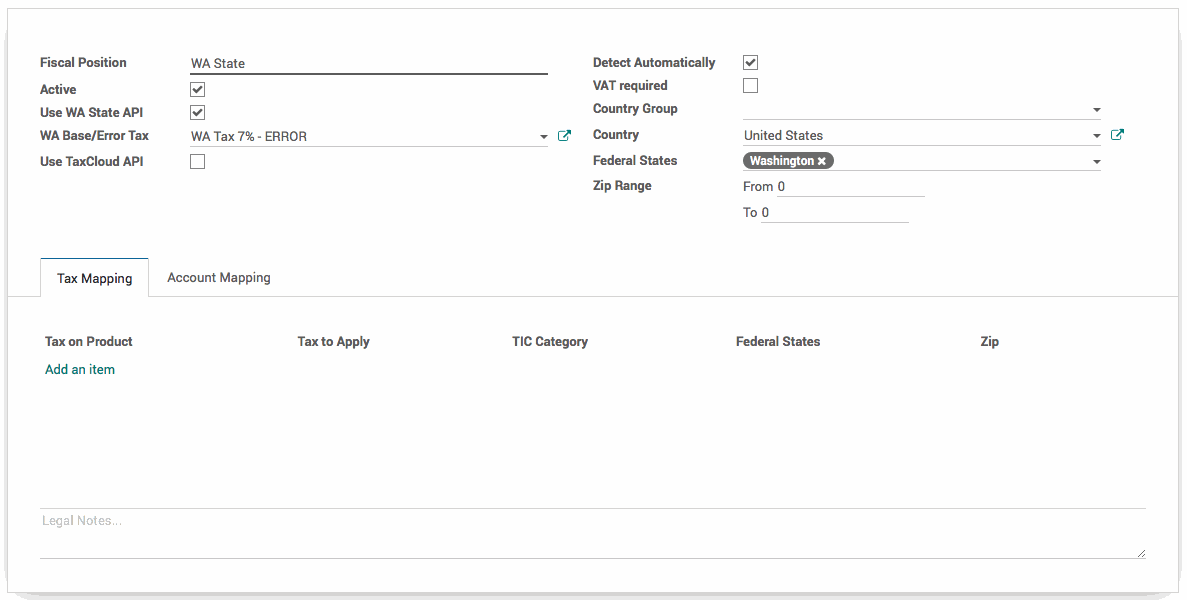

In the Accounting application select Configuration followed by Fiscal Positions. Here you will find a list view of all fiscal positions. Make a new one by hitting the Create button. Name the fiscal position. Check the checkbox next to Use WA State API. Once checked, a new dropdown for WA Base/Error Tax will appear. Select the previously created tax from the dropdown menu.

Check the checkbox for detect automatically. In the Country dropdown selected United States. In the Federal States dropdown select Washington.

Important!

Customers must have complete address information for the WA Tax to be used properly.

Technical

This modules adds two new fields to the Fiscal Position model:

`is_us_wa` Boolean field to flag use of WA State API

`wa_base_tax_id` Many2one field for the WA Base/Error Tax

These two fields are used for the WA State API. Additionally, it includes a new class WATaxRequest used for making API requests to gather WA tax rates.

Additionally, two new fields are added to the `account.tax` model:

`wa_location_code` Integer field for the WA Location Code

`wa_location_zips` Char field for the WA Location Zips