- Accounting Modules

- Account Payment Electronic

- Boxes

- Forte Payment Acquirer

- Helpdesk Modules

- Hibou Commissions

- Hibou Fedex Shipping

- HR Employee Activity

- HR Holidays Accrual

- HR Holidays Partial

- HR Payroll Input Report

- Human Resources (HR) Modules

- Inventory Modules

- Maintenance Modules

- Manufacturing Modules

- Payment Analytic

- Payroll Batch Work Entry Error SKIP

- Payroll Input Name Report

- Payroll Modules

- Point of Sale Modules

- PrintBox

- Project Modules

- Purchase by Sale History MRP

- Purchase Modules

- Sale Section Subtotal

- Sales Modules

- ShipBox

- Stock Delivery Planner

- Tools + Settings Modules

- US ZIP Code to City/State

- Web Auto Paginate

- Website Modules

Hibou Odoo Suite: Payroll Modules: USA - 401k Payroll

Purpose

This documentation covers the installation, configuration, and functionality of Hibou's USA - 401K Payroll module for Odoo. This module adds fields to the Employee Contract for the amount or percentage to withhold for retirement savings. It also adds rules to withhold and have a company match.

Getting Started

The first step is to install the module. To do so, navigate to the Apps application.

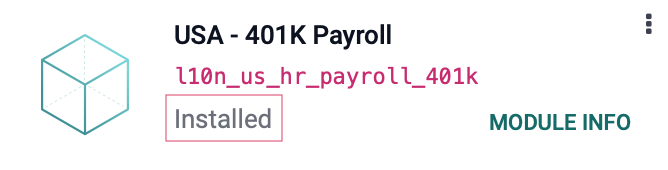

Once there, remove the 'Apps' filter, then search for 'USA - 401K Payroll'. When you're ready, click install. As pictured, below, ours has already been installed.

Good to Know!

The USA - 401K Payroll module requires the Hibou USA - Payroll module. However, if you do not already have this module installed, Odoo will install it for you during this module's installation.

Process

To see the new fields added, navigate to the Employee app.

Setting Employee Contribution Rates

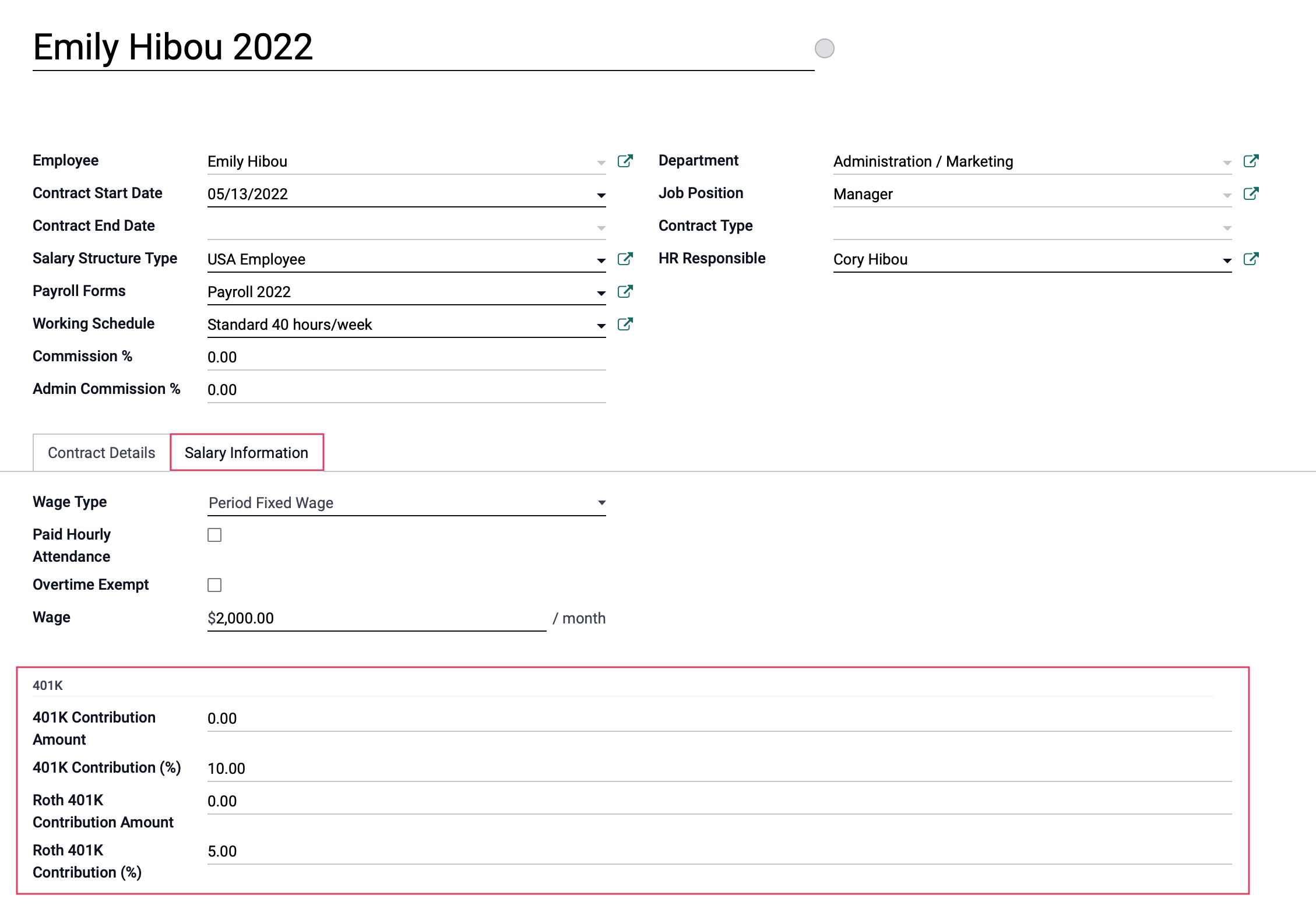

Once there, go to Employees > All Contracts. You can select and edit on a running contract, or click Create to add a new contract.

On the contract form, under the Salary Information tab, complete all applicable fields:

401K Contribution Amount: A pre-tax, flat-rate contribution.

401k Contribution (%): A pre-tax contribution percentage.

Roth 401K Contribution Amount: A post-tax, flat-rate contribution.

Roth 401K Contribution (%): A post-tax contribution percentage.

When you're ready, click Save.

Employer Match Percentage

To set the employer's match percentage, first navigate to the Payroll app.

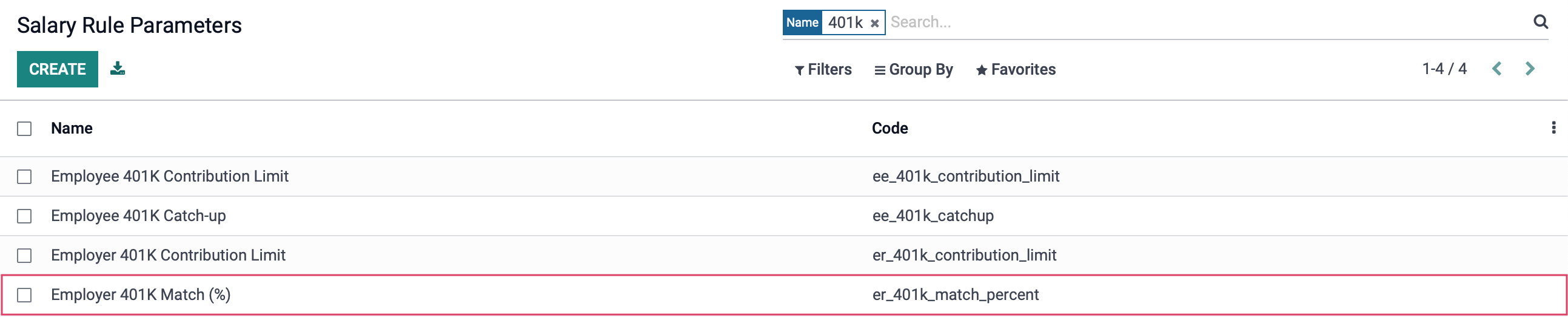

Once there, go to Configuration > Salary > Rule Parameters and search for '401k' in the search bar. In the results, select the entry for 'Employer 401K Match (%)'.

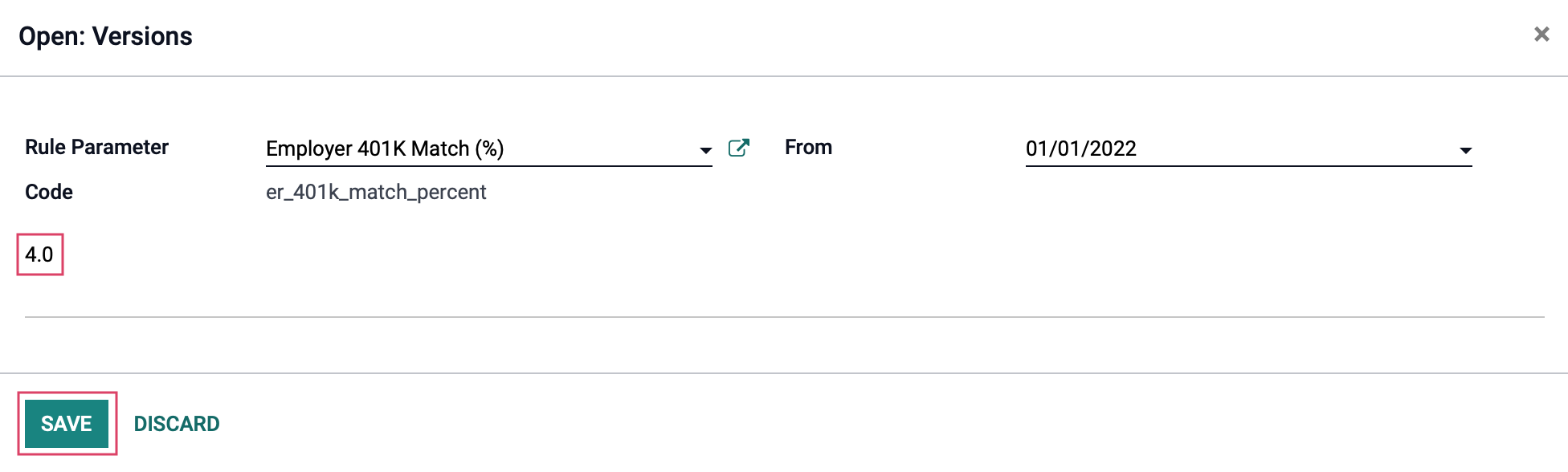

Click Edit, then enter the match percentage in Parameter Value and ensure the Date From field is correct and will include the dates you'll be creating these contributions for (4.0 = 4.0%). When you click an existing line, a new modal window will display where you'll enter the match rate, then click Save.

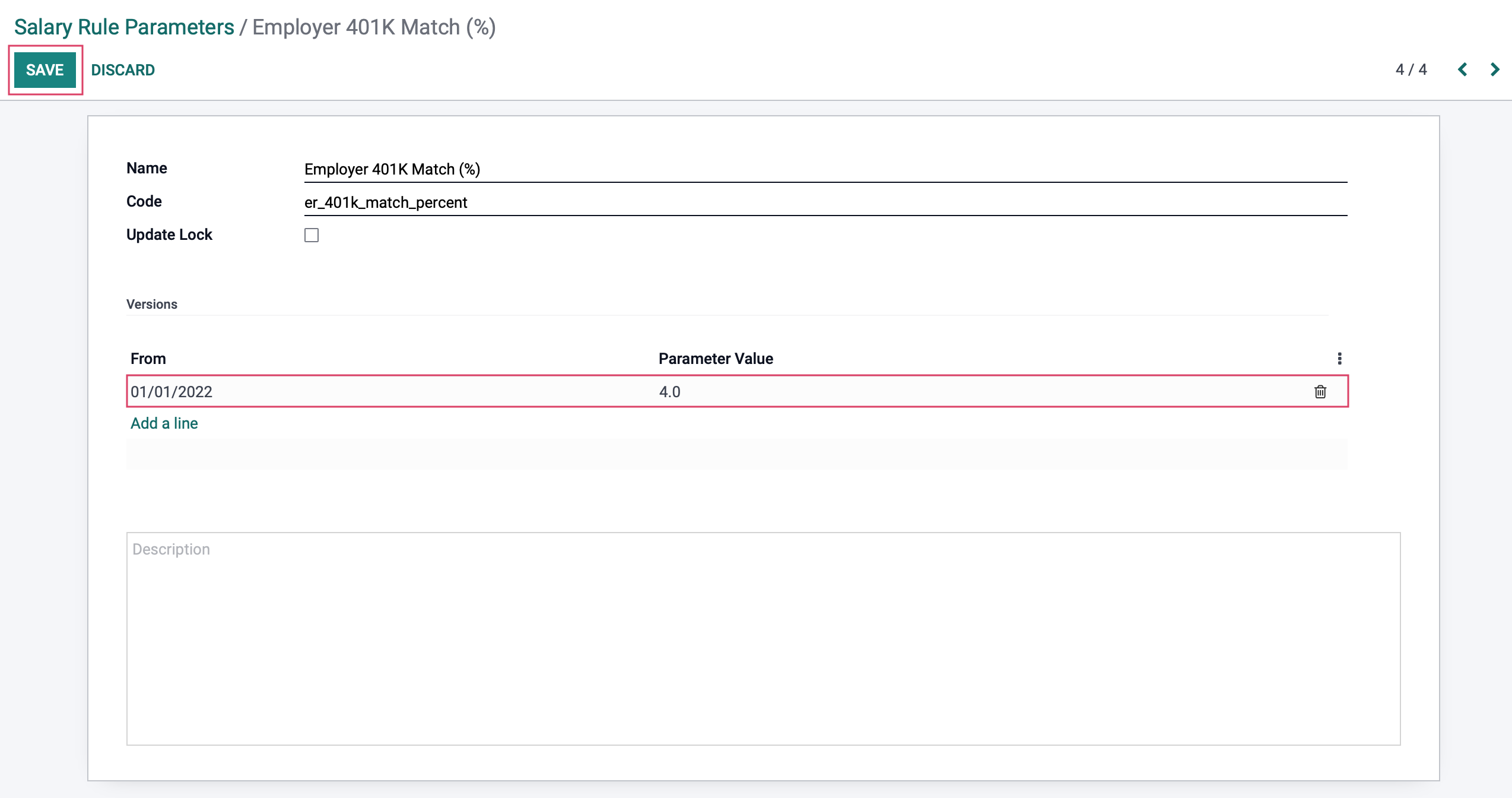

On the Salary Rule Parameters form, click Save.

With this configuration, we can now see all configured 401k employee contributions and employee matching under the Salary Computation tab of this employee's payslip.