USA State Payroll Rates + Resources: State of Washington: New Hire Reporting

Purpose

This documentation outlines the processes and requirements associated with doing your new hire reporting in the state of Washington.

New Hire Reporting

Washington employers must report new hires to the Washington State Department of Social and Health Services.

Washington state law RCW 26.23.040 requires employers to report all new and rehired (not worked for you for at least 60 consecutive days) employees regardless of age, gender, or the number of hours worked within 20 days of hire.

You will need the following information for each new hire:

Employer

Company Name

Company Address

Federal Employer Identification Number (FEIN)

Employee

Employee Name

Employee Address

Employee Social Security Number

Employee Date of Birth

Employee Date of Hire (the date on which the employee first performed services for pay, or returned to perform services for pay)

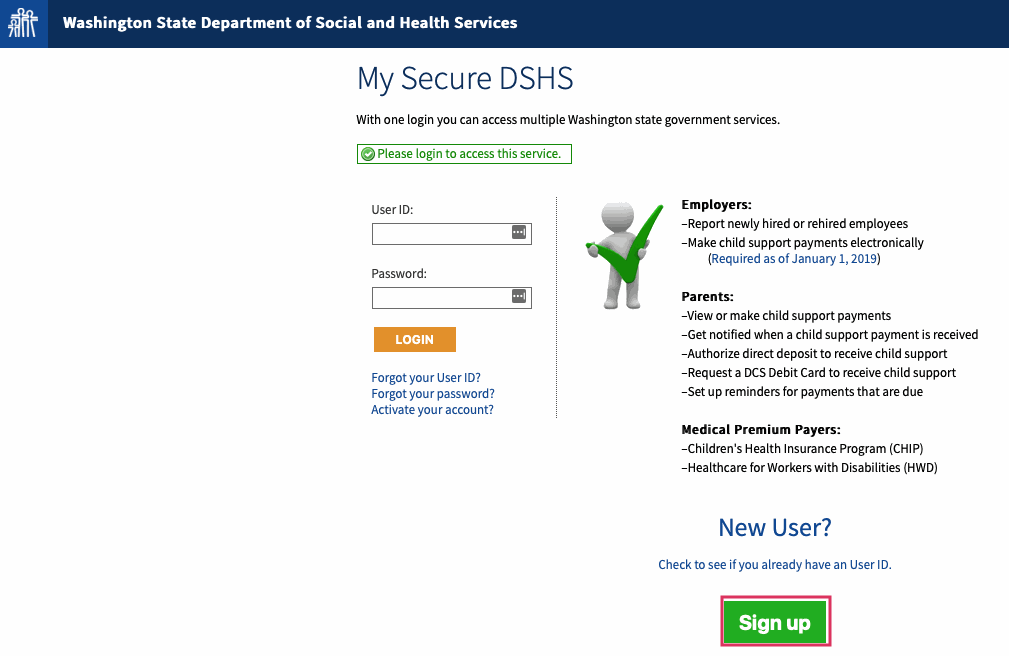

You can report new hires in several ways. The Washington State Department of Social and Health Services prefers you report online through My Secure DSHS. To establish an account from this page, click Sign up.

You also have the option to report your new hire by calling the Washington State Department of Social and Health Services at (800) 562-0479.

You can also complete and submit the State of Washington New Hire Reporting form, a W-4 form, a computer print out or list to:

New Hire Program

PO Box 9023

Olympia, WA 98507-9023

Fax: (800) 782-0624

For more information, please visit the New Hire Reporting page of the Washington State Department of Social and Health Services, or contact the department at (800) 562-0479.