USA State Payroll Rates + Resources: State of Utah: Unemployment Insurance Reporting & Payments

Purpose

The purpose of this documentation is to outline the processes and requirements associated with submitting unemployment insurance reports and submitting unemployment insurance payments in the state of Utah.

Unemployment Insurance Reporting & Payments

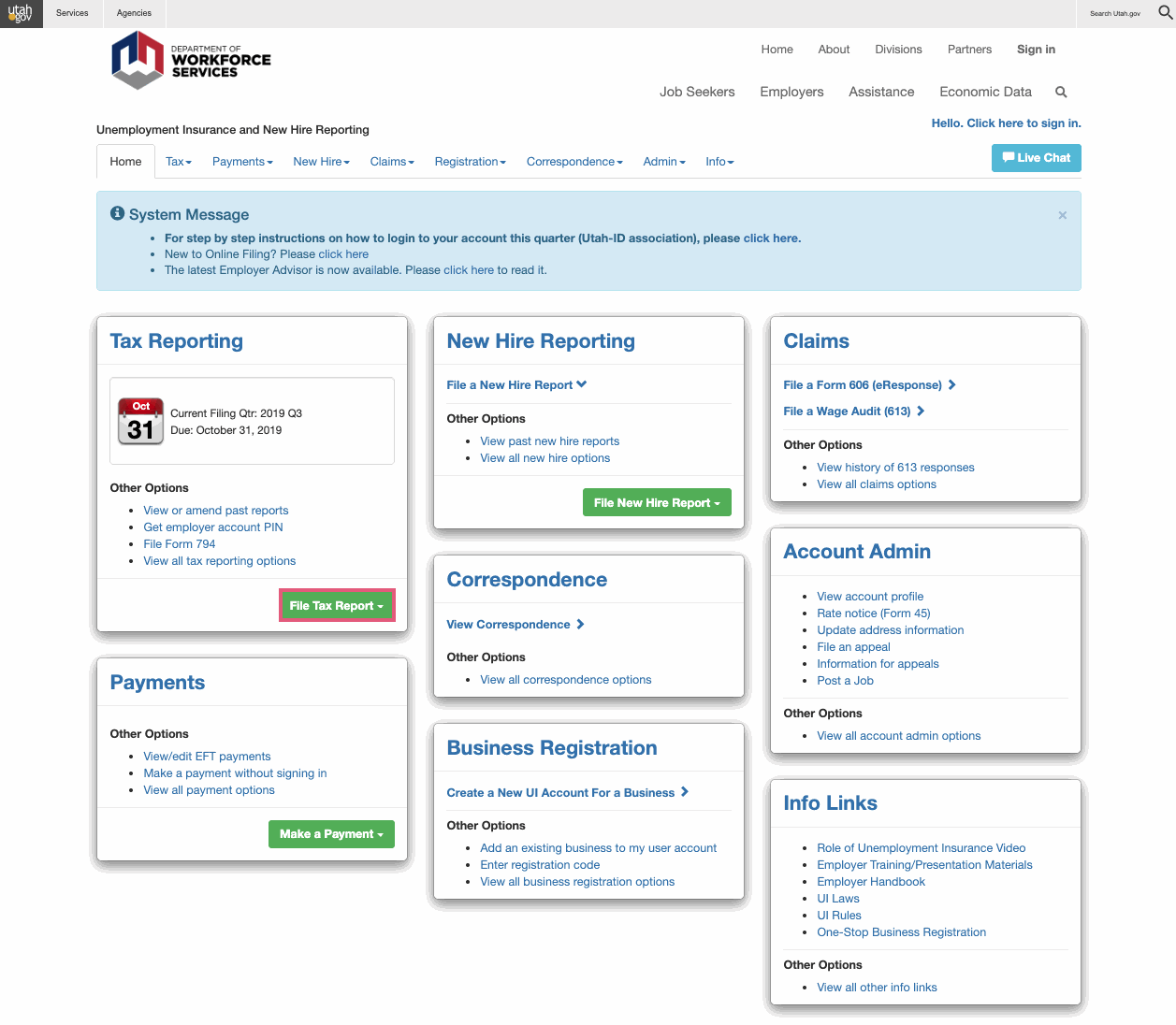

The Utah Department of Workforce Services encourages employers to file their wage data and pay online. Online quarterly reporting is found on the department's Unemployment Insurance and New Hire Reporting page. Once there, click on File Tax Report.

Online filing can be accomplished by manually inputting data or by uploading a file. You can review all options by creating an account with Utahid, logging in, and reviewing this page.

For paper form options and further details, see the Employer Handbook.

| Quarter | Months in Quarter | Due Dates |

| 1st Quarter | January - March | Due April 30th |

| 2nd Quarter | April - June | Due July 31st |

| 3rd Quarter | July - September | Due October 31st |

| 4th Quarter | October - December | Due January 31st |

If the due date is on a weekend or holiday, the next business day becomes the date the quarterly reports and payment must be submitted.

For further details, see the Employer Handbook.