USA State Payroll Rates + Resources: State of New Mexico: Obtaining a TIN + Unemployment Insurance

Purpose

The purpose of this documentation is to outline the processes and requirements associated with becoming a new employer in the state of New Mexico. Specifically, we will be covering how to obtain a Tax Identification Number and Register for Unemployment Insurance.

Good to Know!

Note: Federal Employer requirements (obtaining a federal identification number, withholding of federal income tax, and FICA and filing of all applicable federal returns (FUTA, 940, 941, and 1099-C) will not be covered below - just the state of New Mexico's' requirements. Click here for a basic (not all-inclusive) IRS checklist for Starting a New Business.

Register for Wage Withholding Tax

Good to Know!

If you have already registered with the Taxation and Revenue Department, skip to the next section.

Anyone who engages in business in New Mexico (including an employer who withholds a portion of an employee's wages for payment of federal income tax) must register with the Taxation and Revenue Department (TRD). After registering you will receive a New Mexico CRS tax identification number.

There are two ways to obtain a CRS identification number. You can submit an ACD-31015, Application for Business Tax Identification Number to any local tax office.

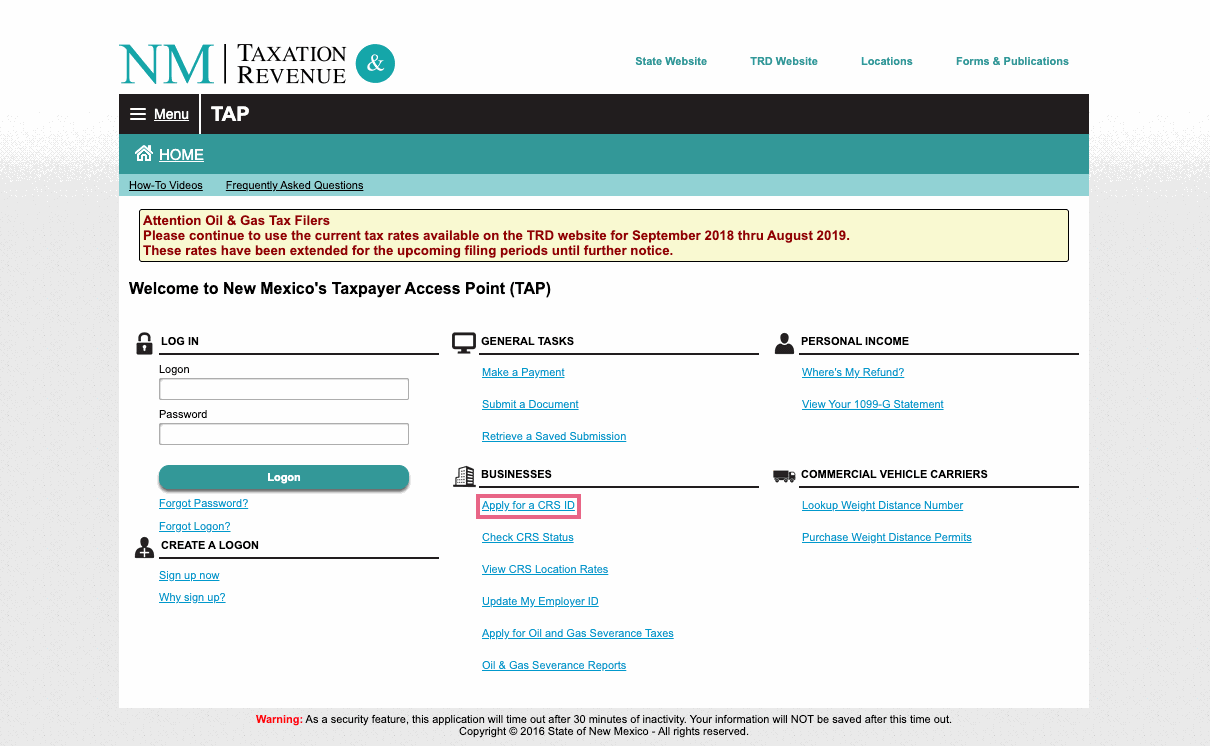

You can also apply for a CRS identification number using the online application at the New Mexico Taxation & Revenue website.

From this site, click the Apply for a CRS ID under the Businesses section.

Good to Know!

Income wholly earned by a Native American member of a New Mexico federally recognized Indian nation, tribe or pueblo on the lands of the nation, tribe or pueblo where he or she is enrolled and lives is exempt from withholding tax.

The income earned from active-duty military service is also exempt from withholding requirements.

Register for Unemployment Insurance

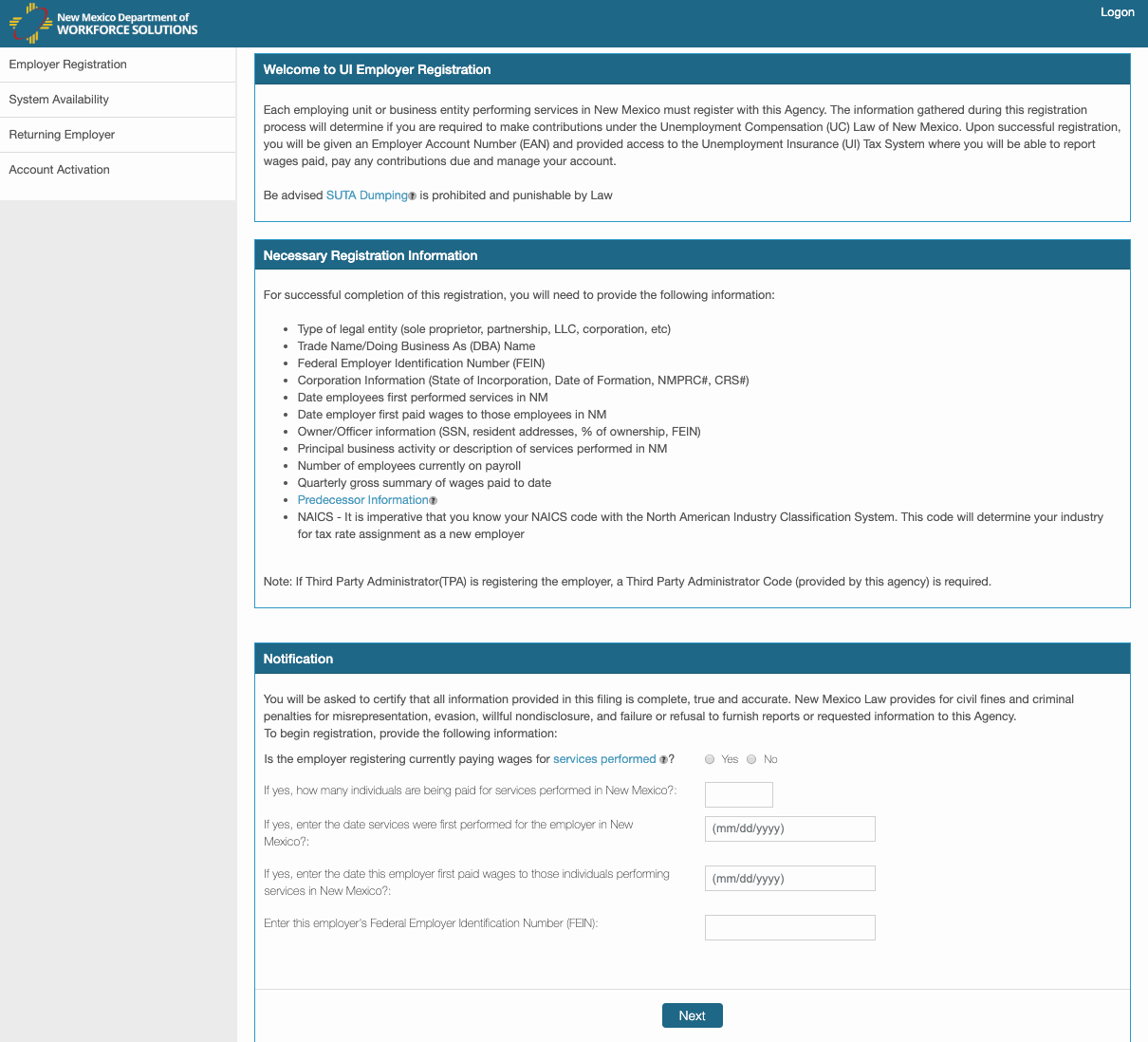

Each employing unit or business entity performing services in New Mexico must register with the New Mexico Department of Workforce Solutions.

The information gathered during this registration process will determine if you are required to make contributions under the Unemployment Compensation (UC) Law of New Mexico.

Upon successful registration, you will be given an Employer Account Number (EAN) and provided access to the Unemployment Insurance (UI) Tax System where you will be able to report wages paid, pay any contributions due, and manage your account.