USA State Payroll Rates + Resources: State of Oregon: Obtaining a TIN + Unemployment Insurance

Purpose

The purpose of this documentation is to outline the processes and requirements associated with becoming a new employer in the state of Oregon. Specifically, we will be covering how to obtain a Tax Identification Number and Register for Unemployment Insurance.

Important!

It is not within the scope of this documentation to discuss local taxes (e.g. transit taxes).

Good to Know!

Note: Federal Employer requirements (obtaining a federal identification number, withholding of federal income tax, and FICA and filing of all applicable federal returns (FUTA, 940, 941, and 1099-C) will not be covered below - just the state of Oregon's requirements. Click here for a basic (not all-inclusive) IRS checklist for Starting a New Business.

Important!

As Oregon Employer taxes are complex and muti-faceted, make sure to consult the Oregon Employer's Handbook as our documentation is a general overview.

Register for Payroll Taxes (Income Tax Withholding, Unemployment Insurance & Worker's Compensation Insurance)

All employers with paid employees working in Oregon must register for a Business Identification Number (BIN) to report and pay Oregon payroll taxes (including unemployment insurance taxes).

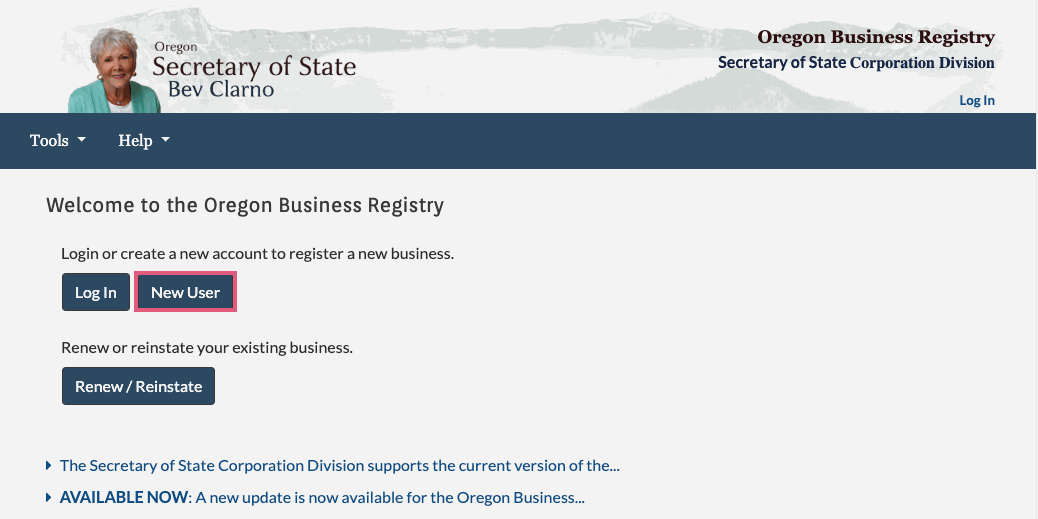

Register online for a BIN using the Oregon Business Registry. Click on New User.

Within three weeks, the Department of Revenue will assign your business a Business Identification Number (BIN). The BIN is the employer’s account number used for all payroll taxes that are a part of the Oregon Combined Payroll Tax Reporting System.

The Employment Department will send you information on options to file your quarterly payroll reports. The Oregon payroll taxes include withholding administered by the Department of Revenue, unemployment insurance taxes administered by the Employment Department, and the Workers’ Benefit Fund assessment administered by the Department of Consumer and Business Services.