USA State Payroll Rates + Resources: State of Illinois: Obtaining a TIN + Unemployment Insurance

Purpose

The purpose of this documentation is to outline the processes and requirements associated with becoming a new employer in the state of Illinois. Specifically, we will be covering how to obtain a Tax Identification Number and Register for Unemployment Insurance.

Good to Know!

Note: Federal Employer requirements (obtaining a federal identification number, withholding of federal income tax, and FICA and filing of all applicable federal returns (FUTA, 940, 941, and 1099-C) will not be covered below - just the state of Illinois' requirements. Click here for a basic (not all-inclusive) IRS checklist for Starting a New Business.

Obtaining a New Tax Account Number

Good to Know!

If you already have a state of Illinois New Tax Account Number, skip to the next section.

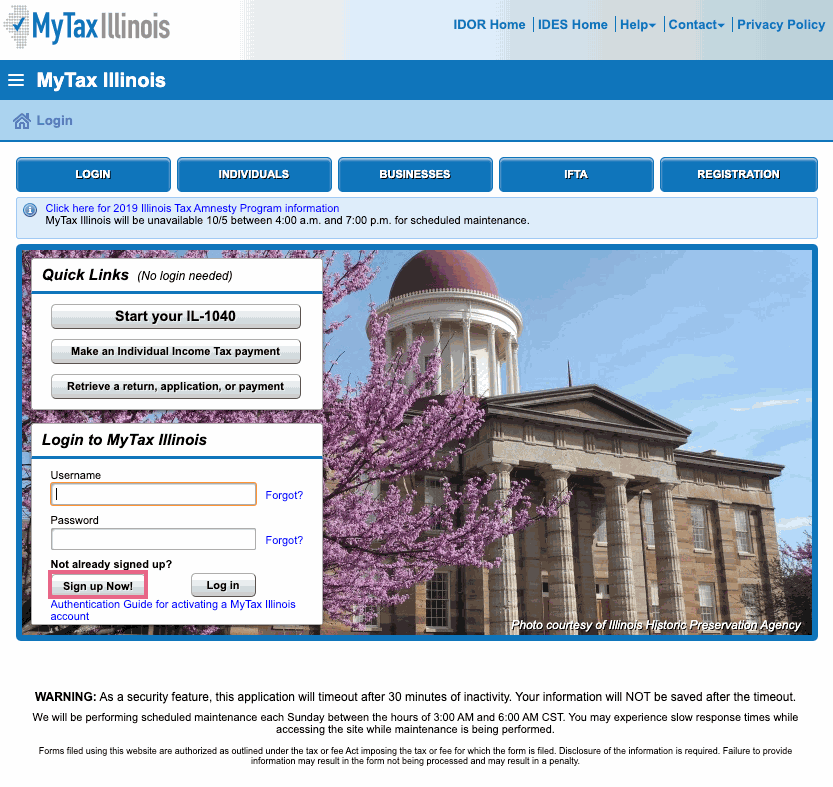

Any entity that has employees within Illinois is required to register for one or more tax specific identification numbers. Online registration is available through the Illinois Department of Revenue at MyTax Illinois.

Click on the Sign Up Now! button and fill out the online application. This method has the fastest processing time.

To apply online, you’ll need your federal employer ID number (EIN), if applicable; business name or if applicable; Certificate of Assumed Name, business owner's Social Security Number, contact phone number and email address, the North American Industry Classification Code (NAICS), and business begin date.

You may also print and complete Form REG-1 Illinois Business Registration Application or visit a regional office near you and register in person.

Registering for Unemployment Insurance

The fastest way to register for IL Unemployment Insurance is online at MyTax Illinois. You may do this at the same time you register for your Illinois Business Tax number.

You can also register for IL Unemployment Insurance by filling out the REG-UI-1 Report to Determine Liability Under the Illinois Unemployment Insurance Act form.