USA State Payroll Rates + Resources: State of Nebraska: Filing State Income Taxes, W2s, and 1099s

Purpose

The purpose of this documentation is to outline the processes and requirements associated with Filing State Income Taxes, W-2, and 1099s, as needed, in the state of Nebraska.

State Income Tax Withholding

Beginning January 1, 2020, the Nebraska Form W-4N will be used by employers, in conjunction with the Nebraska Circular EN, to determine the correct income tax withholding when the Federal Form W-4 is completed on or after January 1, 2020. Form W-4N is not required if employees have completed Federal Form W-4 before this date.

When an employee wants additional state income tax to be withheld, he or she should complete a written statement to the employer requesting the amount to be withheld.

Employers are required to keep a copy of a completed Form W-4 form for their employees in their files. The forms serve as verification that state income taxes are being withheld according to the employee’s instructions and needs to be available for inspection if the state requests it.

Federal Form W-4 is generally valid until the employee provides a new version. However, employees who claim exemption from withholding must renew the exemption annually by filing new Form W-4 by February 15th of each year.

State Income Tax Withholding Reporting and Deposits

Reporting

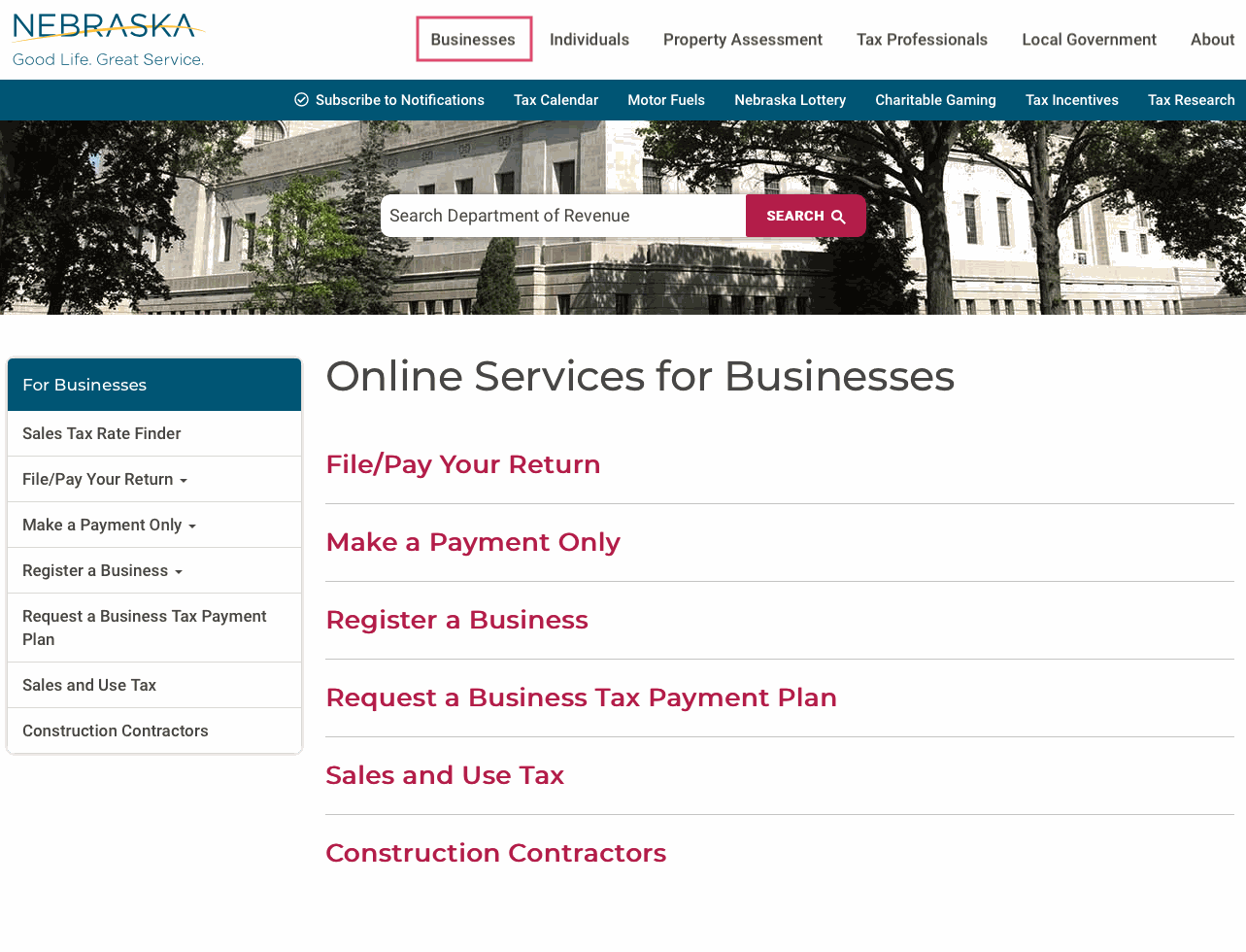

The Nebraska Department of Revenue encourages all taxpayers to file electronically at the Nebraska Department of Revenue website in the Businesses section.

Every employer maintaining an office or transacting business in Nebraska, and making payments to employees, is required to file the Nebraska Income Tax Withholding Return, Form 941N on a quarterly basis unless licensed as an annual filer.

Form 941N is filed whether or not there were payments made during the quarter that were subject to Nebraska income tax withholding.

| Quarter | Months in Quarter | Due Date |

| 1st Quarter | January - March | April 30th |

| 2nd Quarter | April - June | July 31st |

| 3rd Quarter | July - September | October 31st |

| 4th Quarter | October - December | January 31st |

Important!

Employers who have been licensed to file on an annual basis (less than $500 in Nebraska income tax per year) will file a single Form 941N for the entire calendar year. This return is due on or before January 31st of the following year. Quarterly returns will not be sent for the first three quarters of the year.

Deposits

The Nebraska Department of Revenue encourages all taxpayers to pay electronically at the Nebraska Department of Revenue website in the For Businesses section.

The amount of taxes withheld determines the frequency of deposits.

| Deposit Schedule | Withholding Amount | Due |

| Monthly | More than $500 in first month of the quarter: A monthly deposit is then required to be made for the second month of the quarter, whether or not the amount of income tax withheld for the second month is more than $500 OR More than $500 is withheld in the second month of the quarter. | 15th day of the following month. |

| Quarterly | $500 or less for month 1 or 2 of the quarter | The last day of the month following the end of the calendar quarter. |

| Annually | Less than $500 for the year | January 31st of the following year. |

Most taxpayers who are required to make monthly withholding deposits have been mandated to submit their payments via electronic funds transfer.

All employers who made income tax withholding payments of more than $5,000 in any prior year are required to e-pay.

The Form 501N is a transmittal document used for making withholding deposits by check in the first two months of a quarter and is not required when making deposits electronically.

W-2 and 1099 Forms

A Nebraska Reconciliation of Income Tax Withheld, Form W-3N, is mailed at year-end to each licensed employer including annual filers.

The Form W-3N is due on or before January 31st of the following year. It is filed separately from Form 941N and may be e-filed.

Nebraska copies of the following forms (for each employee or payee receiving wages or having income tax withheld) are due the January 31st after the close of the tax year:

Wage and Tax Statements Federal Forms W-2;

Distributions from Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., Federal Forms 1099-R;

Miscellaneous Income, Federal Forms 1099-MISC.

An employer who is filing more than 50 Forms W-2, 1099-R, and/or 1099‑MISC with Nebraska income tax withholding amounts for a tax year must file the forms electronically.

For more details, see Circular EN or Income Tax Withholding FAQ's.

Good to Know!

The Nebraska Department of Revenue is not issuing a new Nebraska Circular EN for 2020. Continue using the 2017 Nebraska Circular EN. Any changes since 2017 will be specifically called out above.