USA State Payroll Rates + Resources: State of South Dakota: Obtaining a TIN + Unemployment Insurance

Purpose

This documentation outlines the processes and requirements associated with becoming a new employer in the state of South Dakota. Specifically, we will cover how to register for Unemployment Insurance.

Good to Know!

Federal Employer requirements (obtaining a federal identification number, withholding of federal income tax, FIC, and filing of all applicable federal returns (FUTA, 940, 941, and 1099-C) will not be discussed below - just the state of South Dakota's requirements. Click here for a basic (not all-inclusive) IRS checklist for Starting a New Business.

Register for Unemployment Tax Account

South Dakota require all newly established businesses to register with the Unemployment Insurance Tax Unit.

Successors to a business already subject to the unemployment insurance laws must register within 30 days of the change.

If there is a change in the ownership structure of your business (i.e. individual ownership changing to a corporation or LLC), you must register within 30 days of the change.

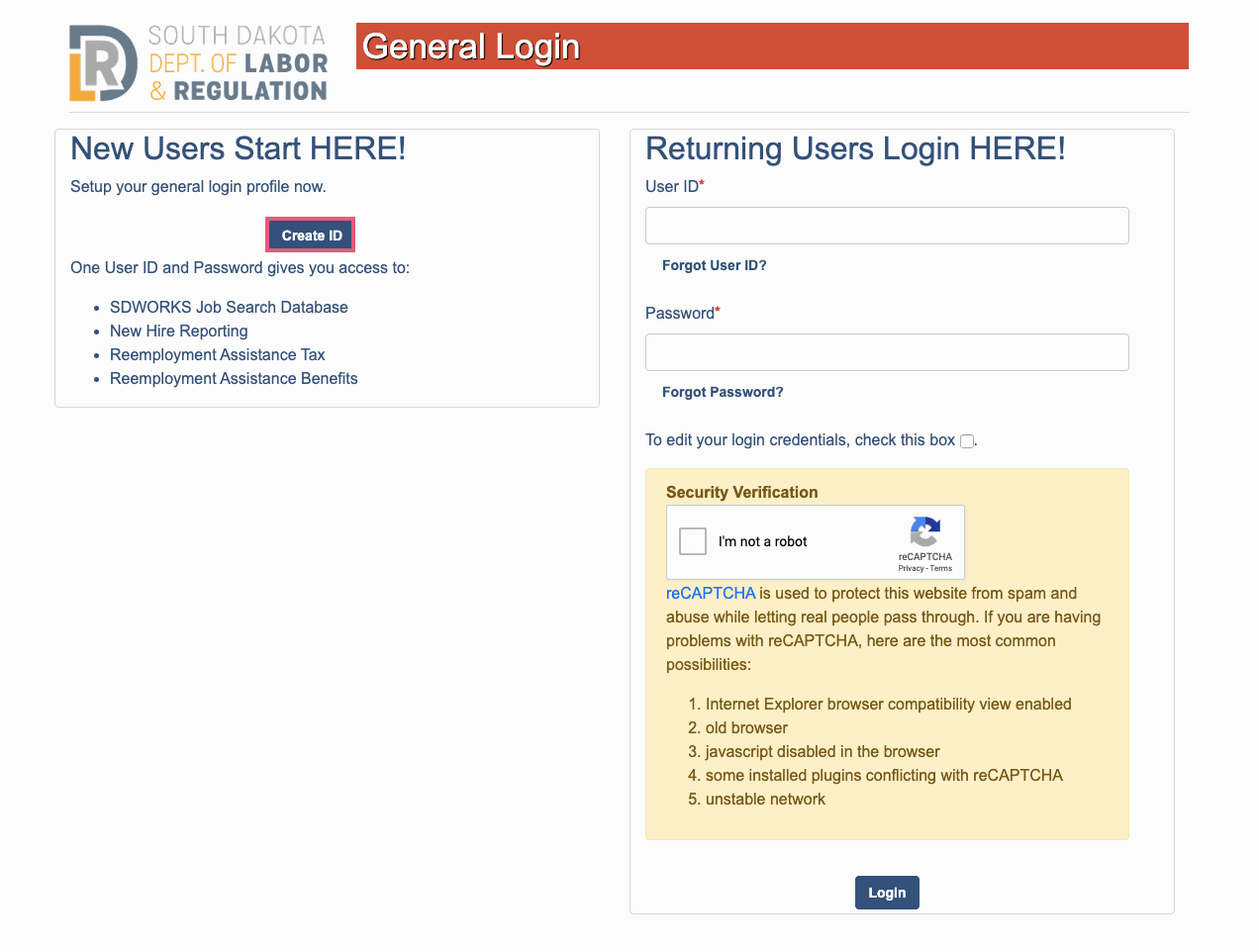

To register your business, visit the South Dakota Department of Labor & Regulation new user page. Once there, click on Create ID.

You also have the option to complete a printable Form 1 and send it to:

South Dakota Department of Labor and Regulation

Reemployment Assistance

P.O. Box 4730

Aberdeen, SD 57402-4730

Fax: 605.626.3347

After completing the registration, you'll have access to:

One User ID and Password gives you access to:

SDWORKS Job Search Database

New Hire Reporting

Reemployment Assistance Tax

Reemployment Assistance Benefits