USA State Payroll Rates + Resources: State of Rhode Island: Unemployment Insurance Reporting & Payments

Purpose

This documentation outlines the processes and requirements associated with submitting unemployment insurance reports and submitting unemployment insurance payments in the state of Rhode Island.

Unemployment Insurance and Temporary Disability Reporting & Payments

The 2021 Quarterly Tax and Wage Reports, Form TX-17 will be mailed to each employer in advance of the due date.

Employers must enter employment and wage data and calculate the amount of taxes due in the Tax Report Section. Employers must also enter the social security number, name, the number of hours for which the employee received pay during the quarter, and total wages paid to each employee during the quarter in the Wage Report Section or use a computer listing in a format that matches the Department’s format.

Employers with 200 or more employees on their payroll are required by law to submit their wage data electronically. Employers may also file their Quarterly Tax and Wage information online at the department's web site.

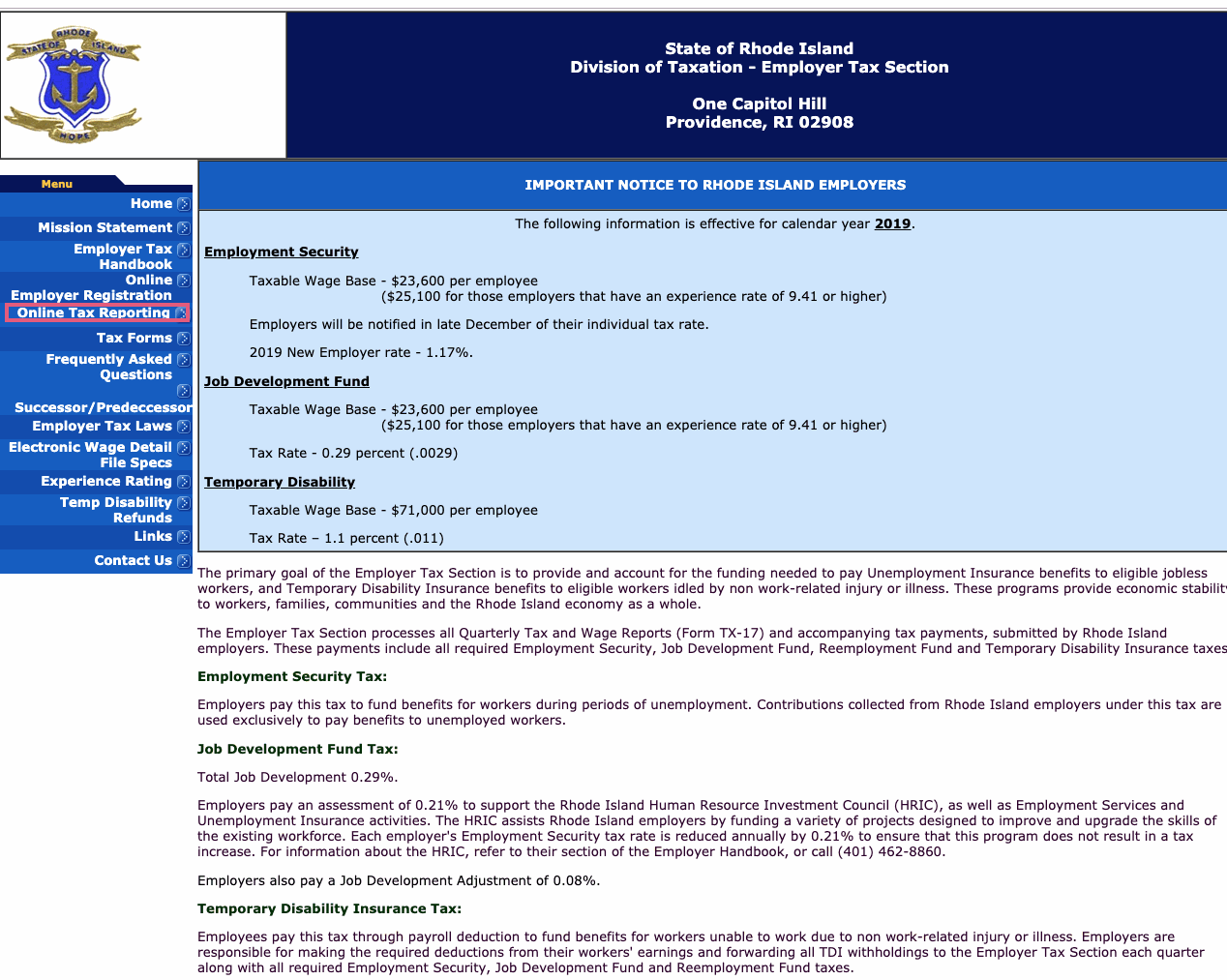

On this page, click on Online Tax Reporting.

Reporting must be completed and filed by all Rhode Island employers, including those with no wages and those who are not required to fill in the Quarterly Tax Section of the form.

Due dates:

| Quarter | Months in Quarter | Due Date |

| 1st Quarter | January - March | April 30th |

| 2nd Quarter | April - June | July 31st |

| 3rd Quarter | July - September | October 31st |

| 4th Quarter | October - December | January 31st |

If the due date is on a weekend or holiday, the next business day becomes the date the quarterly reports and payment must be submitted.

Unemployment Insurance includes Employment Security and Job Development Fund. Temporary Disability is separate, but it is managed by the same Department (State of Rhode Island Division of Taxation - Employer Tax Section). For differences in each one, see below:

For further details, see the Employer Handbook and the UI and TDI Quick Reference guide.Good to Know!

2021 SUTA rates and wage base limits for Rhoda Island are as follows:

| Program | Taxable Wage Base | New Employer Rate | Who pays? |

| Employment Security | $24,600 | 1.16% | Employers |

| Job Development Fund | $24,600 | 0.21% | Employer |

| Temporary Disability | $74,000 | 1.3% | Employees through payroll deductions |