Accounting: Accounting: Management: Cash Roundings

Purpose

This document covers the definition and configuration of Cash Roundings in the Accounting application in Odoo 14. Cash rounding can be necessary when the lowest denomination of currency (or smallest coin), is higher than the minimum unit of account. For example, in some countries, when a payment is made in cash, it is required that companies round up or down the total amount on an invoice to the nearest five cents.

Process

To get started, navigate to the Accounting app.

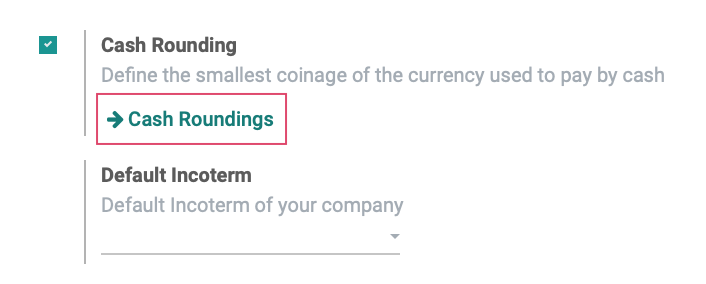

You will find the option to use Cash Rounding under CONFIGURATION > SETTINGS. Then, scroll down to the section labeled Customer Invoices, click the box to enable the use of Cash Rounding, then Save. Once this finishes saving, click on Cash Roundings.

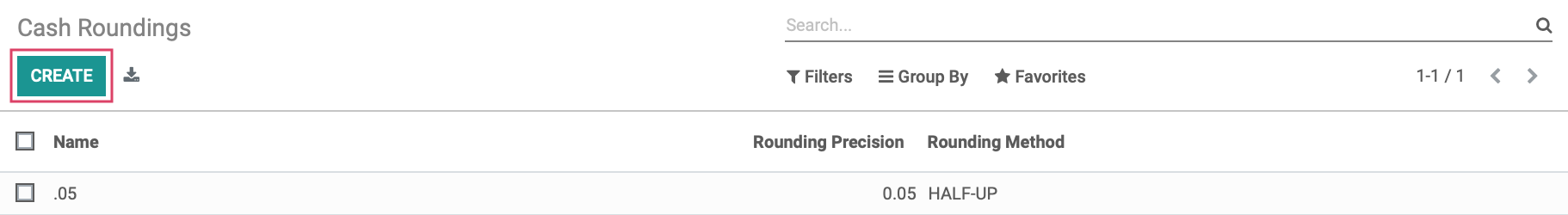

Once enabled, Cash Roundings can also be created or configured under CONFIGURATION > Management >CASH ROUNDINGS.

Both of these methods will bring you to an overview of any existing Cash Roundings, as well as allowing you to CREATE a new one.

Odoo supports two rounding strategies:

Add a rounding line: This requires you to set a profit and loss account

Modify tax amount: This will only require you to select a rounding method.

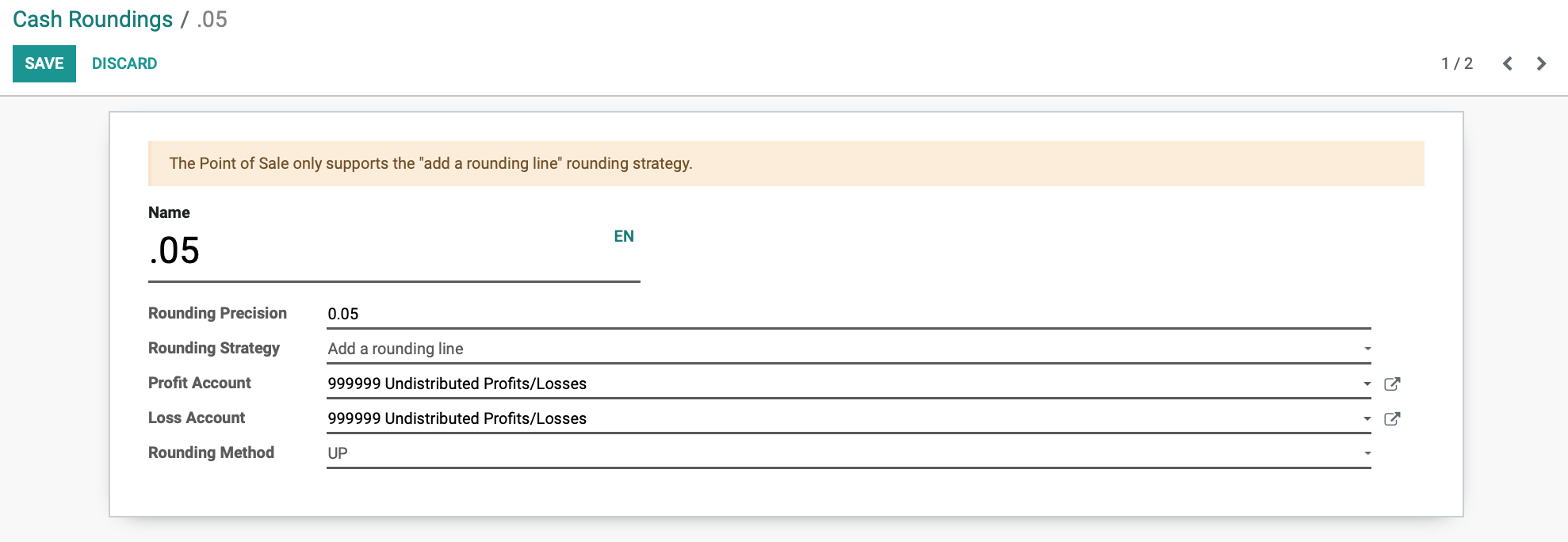

Add a Rounding Line

Name: Give your rounding method a name.

Rounding Precision: Enter a non-zero amount to denote the smallest acceptable coinage.

Rounding Strategy: Select to "Add a rounding line".

Profit Account: Select an account to record profits from the rounding method.

Loss Account: Select an account to record losses from the rounding method.

Rounding Method: Select UP to round up, DOWN to round down, and HALF-UP.

UP: Will round up to the next increment using the set rounding precision. If precision is set to .05, and a total ends in .02, rounding up will adjust the total to .05, resulting in a profit of 3 cents.

DOWN: Will round down to the next decrement using the set rounding precision. If precision is set to .05 and a total ends in .02, rounding will adjust the total to .00, resulting in a loss of 2 cents.

HALF-UP: This will always round the total up based on the next increment set as the rounding precision. If precision is set to .50, and a total ends in .75, rounding will adjust the total to 1.00.

Click SAVE when ready.

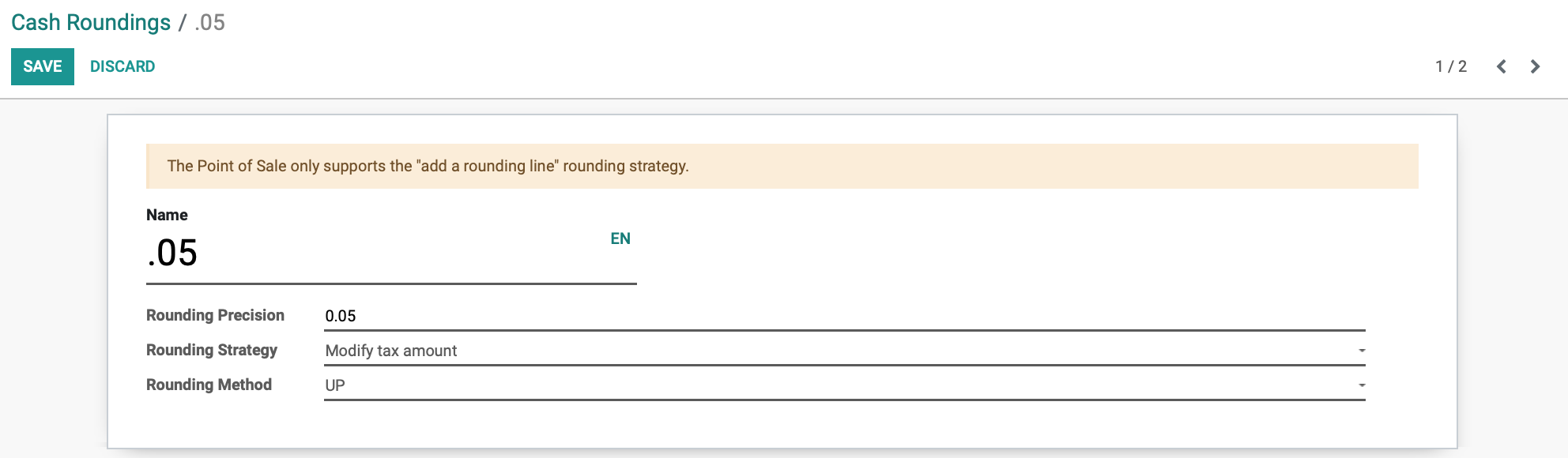

Modify Tax Amount

Name: Give your rounding method a name.

Rounding Precision: Enter a non-zero amount to denote the smallest acceptable coinage.

Rounding Strategy: Select "Modify tax amount". This will use the set rounding method to add or subtract to the tax amount.

Rounding Method:

UP: Will round up to the next increment using the set rounding precision. If precision is set to .05, and a total ends in .02, rounding up will adjust the total to .05.

DOWN: Will round down to the next decrement using the set rounding precision. If precision is set to .05 and a total ends in .02, rounding will adjust the total to .00.

HALF-UP: This will always round the total up based on the next increment set as the rounding precision. If precision is set to .50, and a total ends in .75, rounding will adjust the total to 1.00.

Click SAVE when ready.

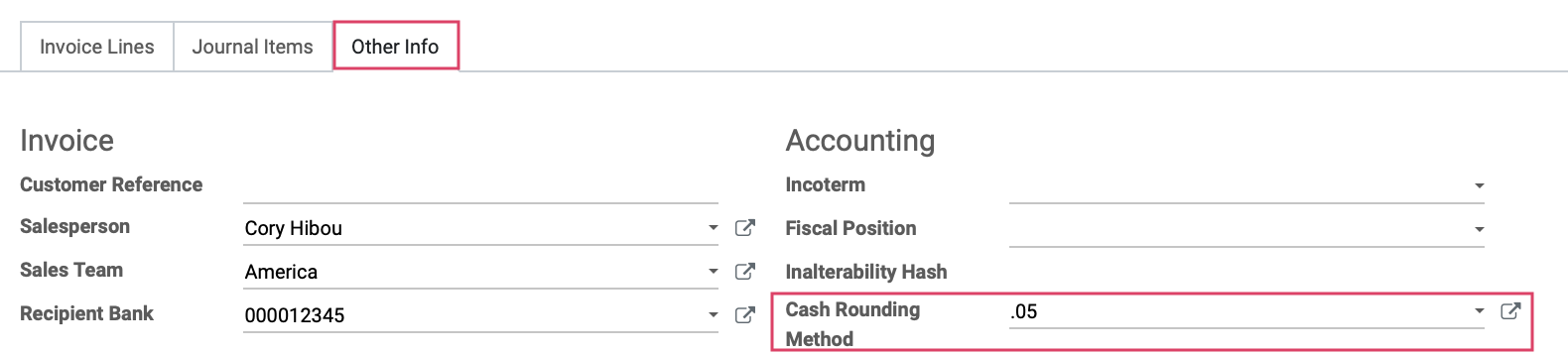

Once you have your Cash Rounding method created, you can add it to a draft invoice on the OTHER INFO tab.