Accounting: Accounting: Journal Entries

Purpose

The purpose of this documentation is to outline the processes associated with Journal Entries in Odoo.

A Journal Entry, also referred to as an accounting entry, is a formal record that documents a transaction in a Journal. In Odoo, journal entries are made by utilizing the double entry bookkeeping system.

Double Entry Bookkeeping Systems require you to make both a debit line and credit line for each entry. In addition, the credit side and the debit side of all entries, must be equal to each other.

In Odoo, these credit and debit lines that make up Journal Entries are called Journal Items.

Processes

To get started, navigate to the Accounting application.

Creating a Journal Entry

In Odoo, there are numerous operations that can lead to the creation of a journal entry, such as customer invoices, payments, vendor bills, bank statements, stock moves, and payslips. However, sometimes it is necessary to create custom journal entries, like when setting up your initial account balances.

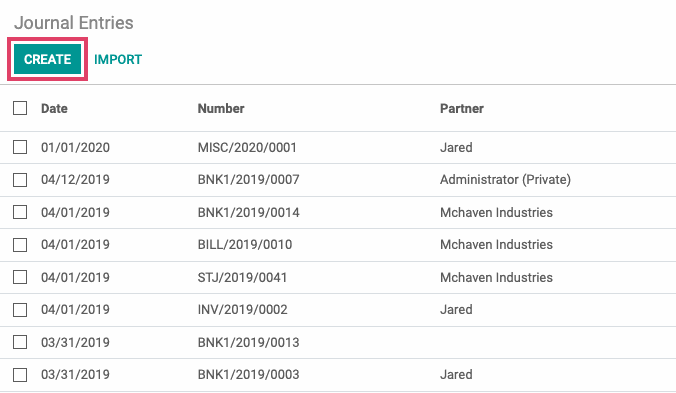

To get to your Journal Entries, click Accounting > Journal Entries. You will see a list view of all journal entries.

Hit the Create button to make a new entry.

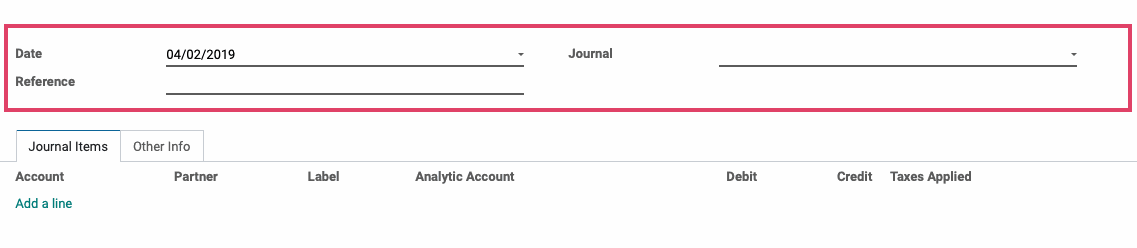

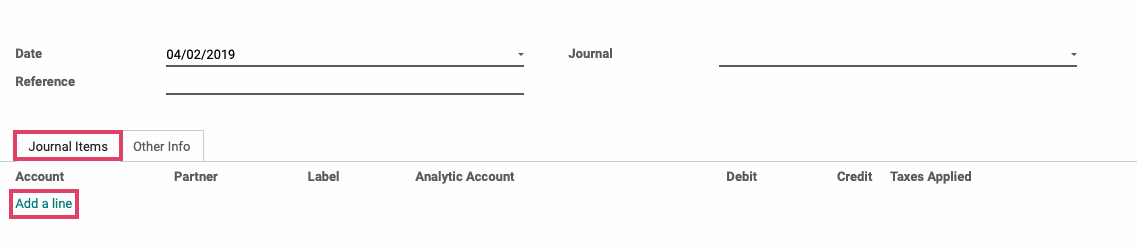

On the following page, you will be prompted to fill in the following fields:

Date: This is the date that you want the entry to be shown as being done on. It is automatically set to the current date; but it can be changed, if needed.

Journal: Select the journal you'd like to add this entry to. All journal entries require a journal to be selected.

Reference: Enter a description of the journal entry's purpose; this will appear on the journal entry itself.

In the Journal Items tab you will add Journal Item lines. You will always need at least two lines, one for a debit amount and one for a credit amount.

Click the Add a line button to add a journal item line.

You will be prompted to fill in the following information:

Account: Select the account from which you will be making the debit/credit from the drop down menu. This is required for all Journal Items.

Partner: Select any associated partners for this Journal Line, if applicable.

Label: Input a description of the debit/credit line for internal reference.

Analytic Account: Choose a relevant Analytic Account, if desired.

Analytic Tags: Choose a relevant Analytic Tag, if desired.

Credit: The value of the credit.

Debit: The value of the debit.

Continue adding as many journal items as needed.

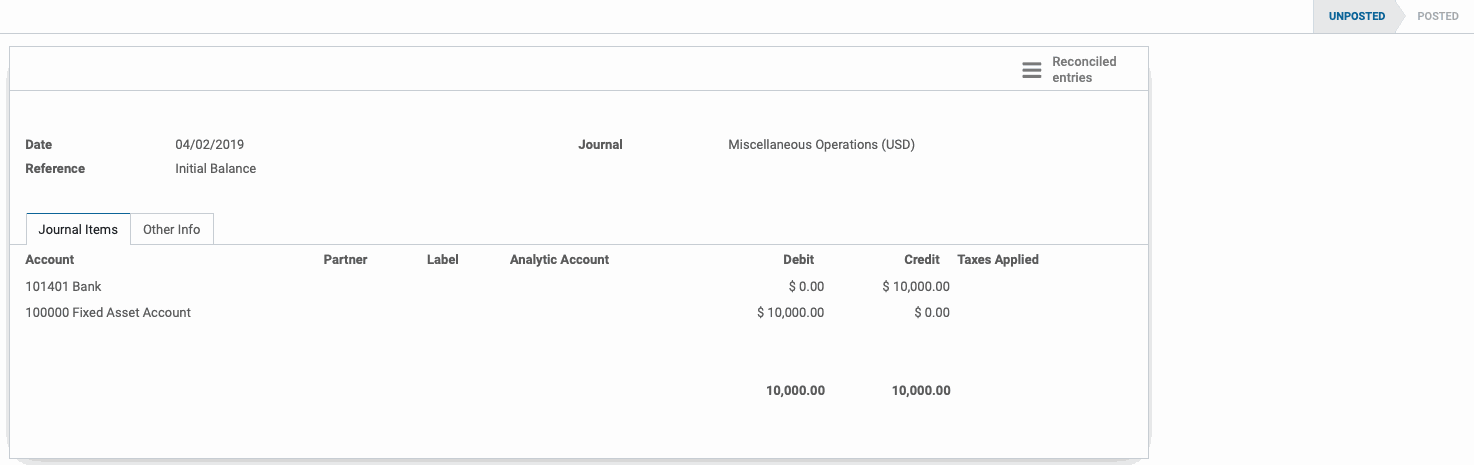

When finished, make sure that the totals of the Debit and Credit amounts are equal. When ready, hit the Save button.

You will notice that the entry has not yet been posted, and is in the Unposted state. This adds another step of validation before actually posting the entry to your journal and gives you time to ensure that everything has been entered correctly.

When ready to save this entry to your journal, hit the Post button.

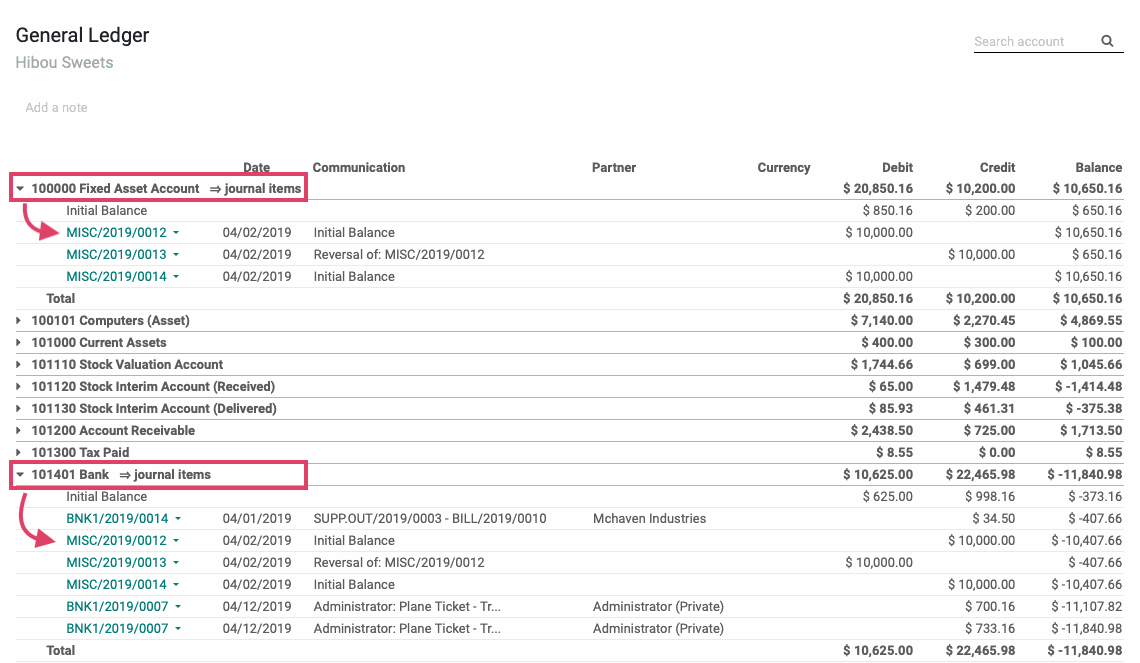

Once your Journal Entry has been posted, if you look at a report such as the General Ledger, you will see the journal items from the posted journal entry.

Reversing a Journal Entry

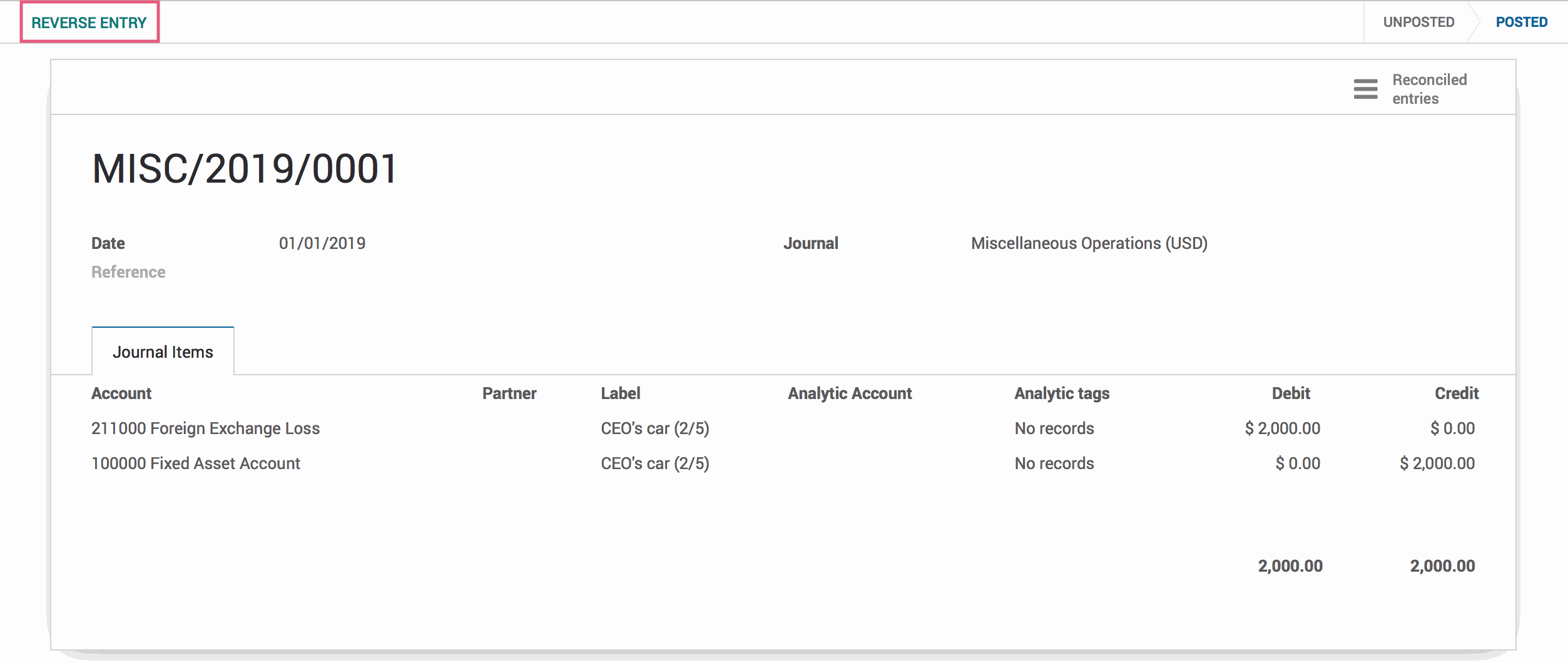

Navigate to the journal entry you wish to reverse. Once you're on the journal entry, click Reverse Entry.

A Reverse Moves modal will appear and you will give you the option to fill in the below:

Reversal Date: Select the date that you want the entry to show as being reversed. It will be set to the current date by default, but can be changed.

Use Specific Journal: If you would like to use a specific journal to record the reversal that is different from the Journal this entry was originally posted to, you can select an alternate journal from this dropdown. If this field is left blank, it will use the Journal the entry was originally posted to.

When ready, hit the REVERSE MOVES button.

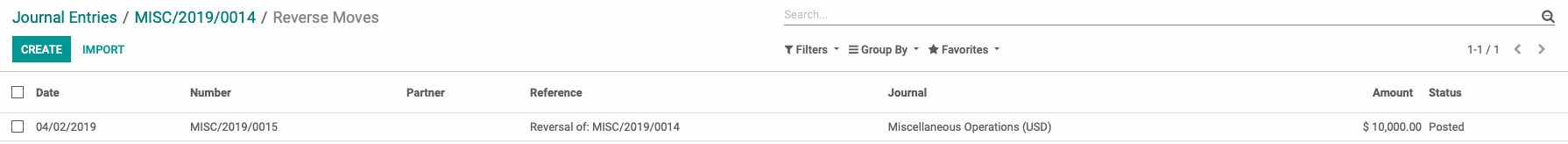

Once reversed, you will see a list view of the reversed moves.

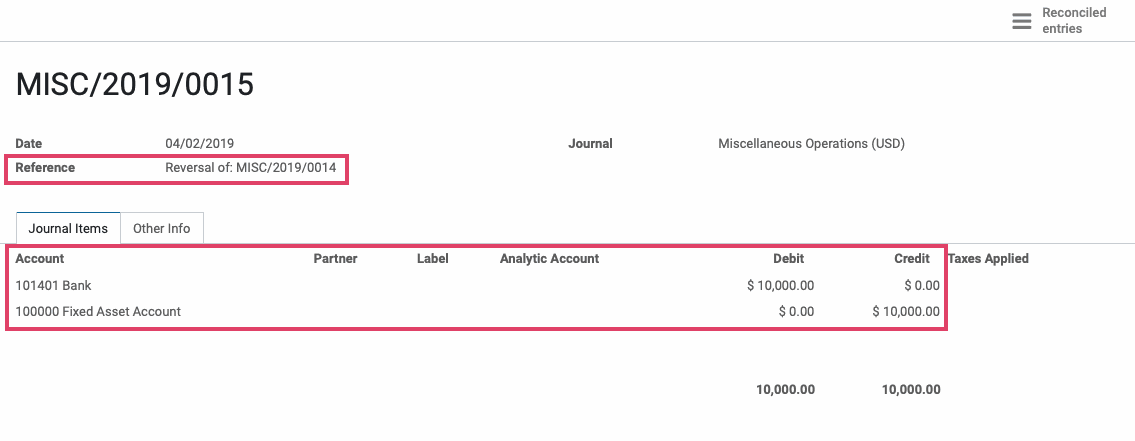

If you click on the reversal journal entry we just created, you can view the entry details.

You will notice that the Journal Items are the same as the original journal entry with the exception that the debit and credit amounts are swapped. The Reference will also indicate that this journal entry is a reversal of the original.