Accounting: Configuration: Chart of Accounts

Purpose

The purpose of this documentation is to outline the processes associated with a Chart of Accounts.

A Chart of Accounts is a listing of all accounts used in the general ledger of an organization. The Chart of Accounts should be tailored to reflect the actual operations of a company and an organization has the freedom to add or remove accounts, as needed, to better suit its needs.

Processes

To get started, navigate to the Accounting application.

Configuring the Chart of Accounts

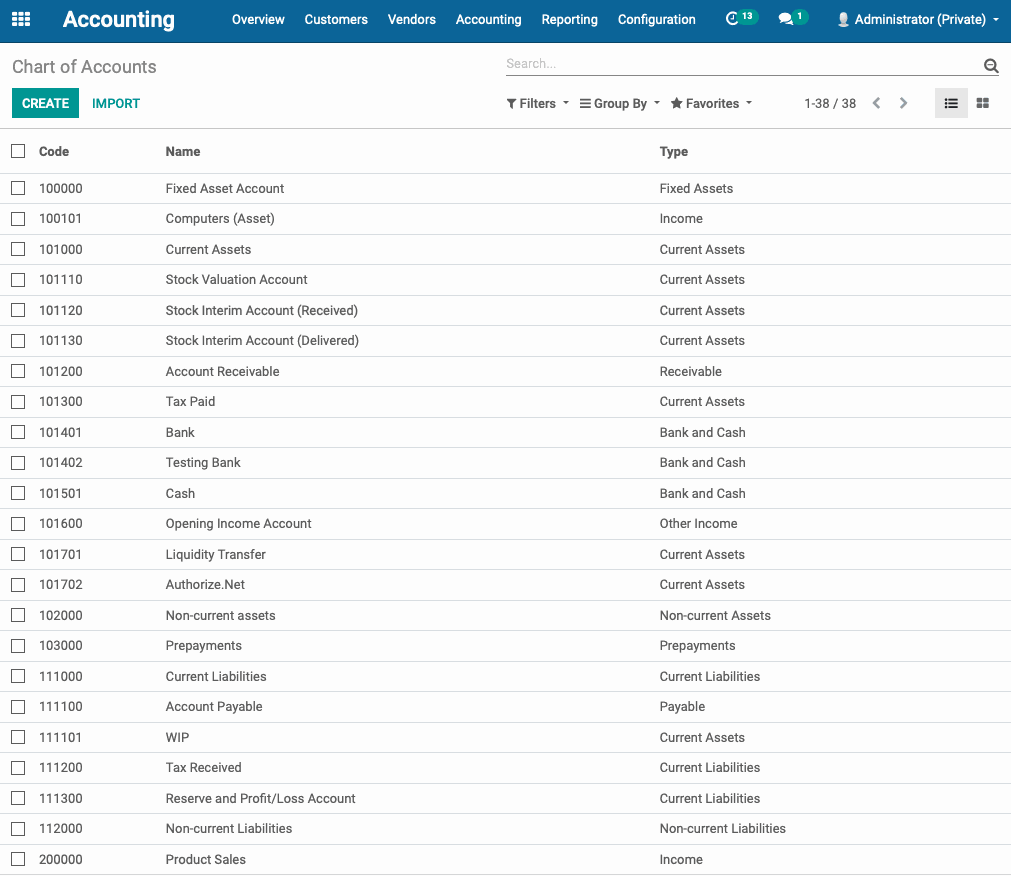

Once there, click on Configuration and then Chart of Accounts.

You will see a list view of all accounts. From here you can modify, import, remove, and create accounts as needed.

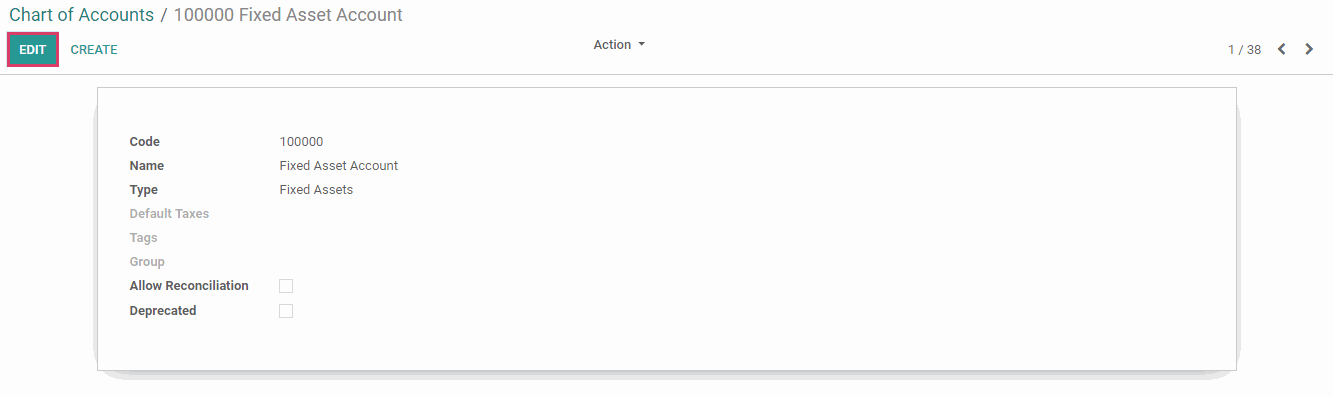

Deleting an Account

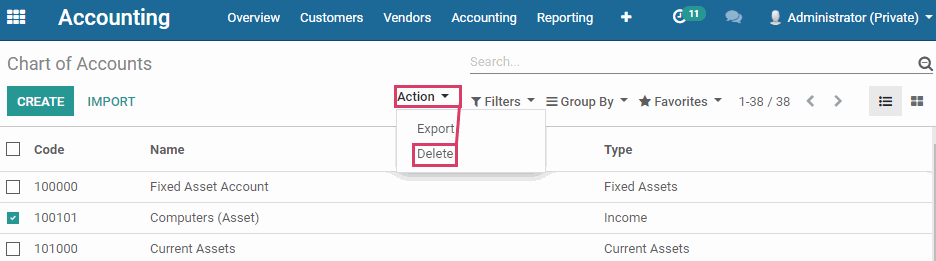

To delete an account, select the checkbox next to the account's Code. Then, click the Action drop-down menu and select 'Delete'.

Important!

In a production environment with existing data, you should not delete an account. Instead, follow the instructions above in the 'Editing an Existing Account' section and select the 'Deprecated' checkbox.

Deprecated accounts will still show up in your list view of accounts unless you filter them out.

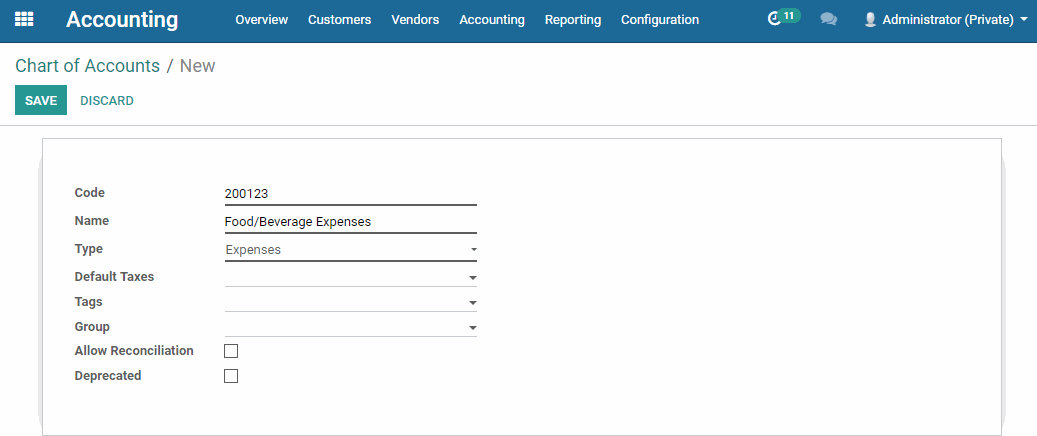

Creating a New Account

From the list view of accounts, hit the Create button.

The following fields are required when creating an account:

Name: The name of the account, which indicates what types of transactions are classified under this account.

Code: A unique number that helps in identification of the account type and may also be coded with further information.

Type: The type of account, which is detailed below in the 'Choosing an Account Type' section.

When finished, hit the Save button.

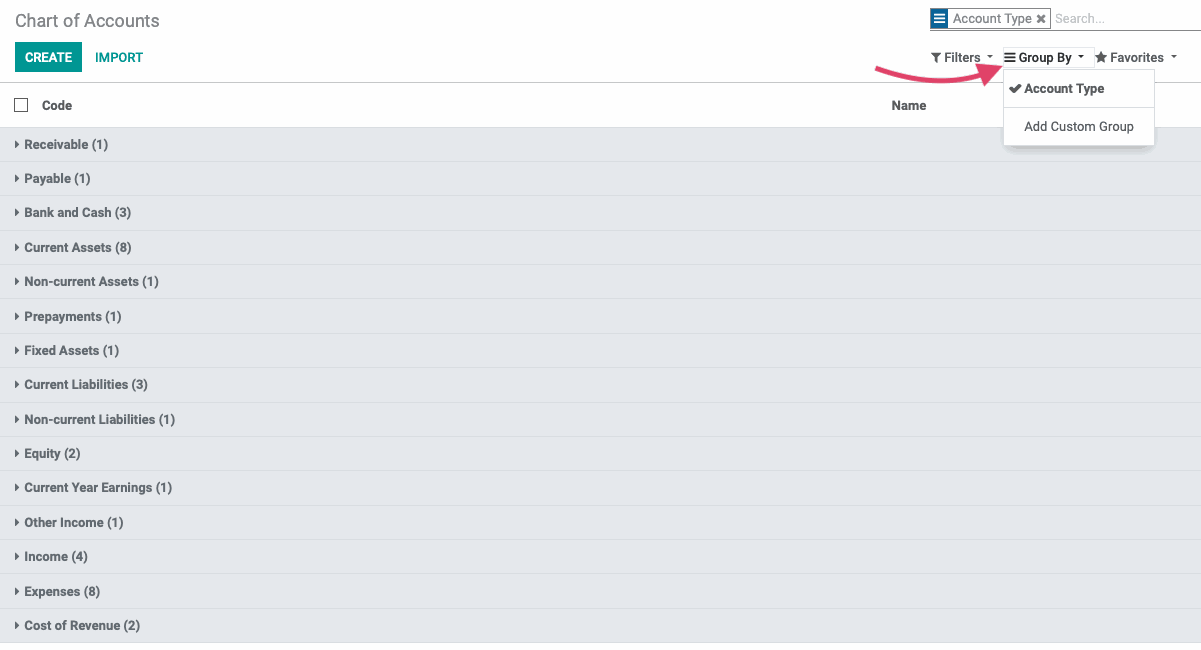

Choosing an Account Type

Choosing the correct Account Type is extremely important as they affect your overall reporting.

Receivable: Record funds owed to you (Example: For products or services delivered)

Payable: Record funds you owe (Example: Bills from suppliers)

- Bank and Cash: Record bank and cash transfer transactions

- Credit Card: A bank account that is considered to be a liability

- Current Assets: All Assets that can be reasonably expected to be converted into cash within one year

- Non-current Assets: Long-term investments where the full value will not be realized within the accounting year

- Prepayments: A liability account that stores partial payments from customers that still owe money

- Fixed Asset: Record assets and property that cannot be easily converted into cash (These will not be used up, consumed, or sold within the current accounting year)

- Current Liabilities: Financial obligations that are payable within one year

- Non-current Liabilities: Financial obligations that will not become due within the accounting year

- Equity: Record capital gains and losses (To measure the net worth of your business)

- Current Year Earnings: Record net income or loss for your company within the current year (The difference between all revenues and expenses on an income statement)

- Other Income: Record income that does not come from your company's main business (Example: Interest)

- Income: Record revenue your business earns

- Depreciation: A expense that comes from a Fixed Asset account

- Expense: Record outflow of funds to pay for goods and services your business uses

- Cost of Revenue: Record total cost incurred to obtain a sale and the cost of the goods or services sold (Example: The cost of materials or cost of production labor)

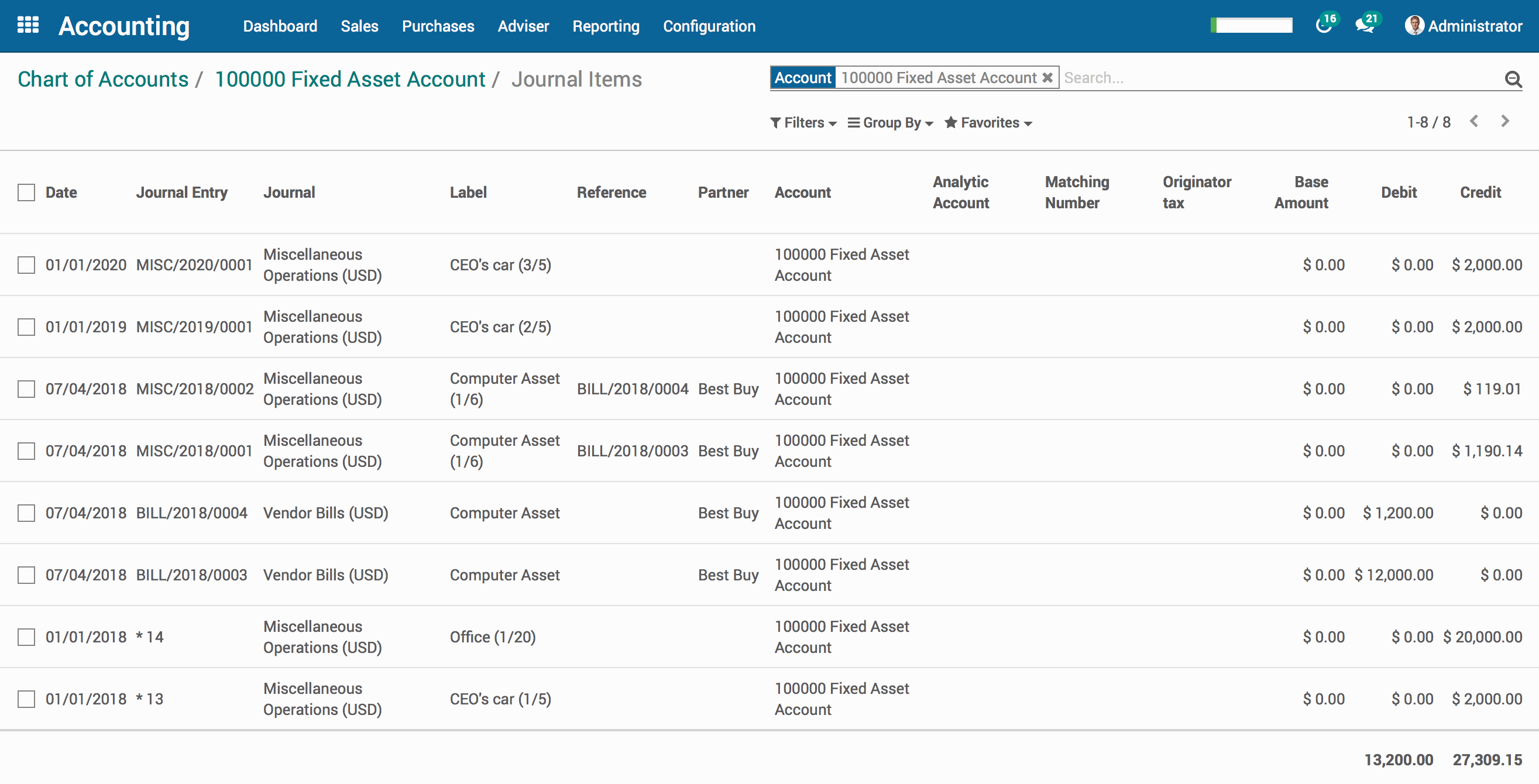

Unreconciled Entries and Journal Items

From the Action menu on an account, in addition to deleting and duplicating, you can also choose to view reconciled entries and journal items for a specified account.