Accounting: Configuration: Taxes

Purpose

The purpose of this documentation is to outline the configuration and processes associated with Taxes in Odoo's Accounting application.

Getting Started

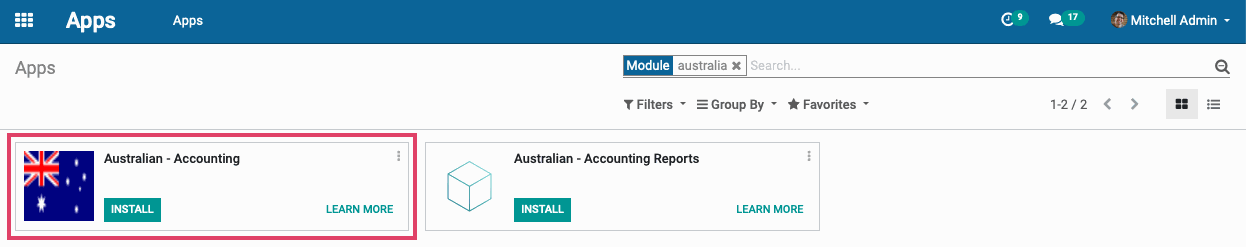

Odoo has localization modules for certain countries that will pre-load your default taxes into the database.

To check and see if your country has a module, navigate to the Apps application.

![]()

Once there, search for your country name to see if there's an available localization module. If there is, it will include a basic chart of accounts and a local tax list.

Click Install on the module.

Processes

To get started, navigate to the Accounting application.

Configuring Taxes

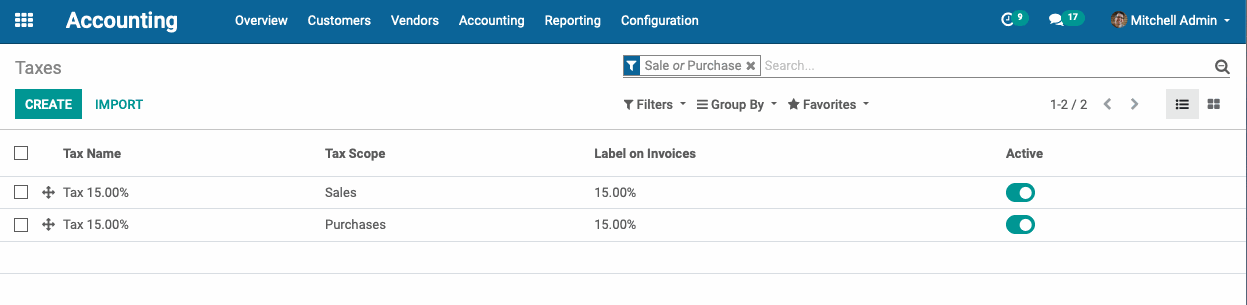

To review your taxes, navigate to Configuration > Taxes. Once there you'll see a list view of all taxes.

Important!

How to Handle Default Taxes

Many are tempted to remove the default sales tax or otherwise modify it to meet a specific use case. We recommend a more flexible approach, which involves using Fiscal Positions to apply the appropriate tax (or no tax, if taxes would not apply to the order).

To use this approach, you'll make some simple changes to the default sales tax:

Change the Tax Name to 'Product Sales Tax'

Change the Amount to 0.0000%

Change the Label on Invoices to 'Sales Tax'

The Product Sales Tax will act as a generic tax will be applied to all sale orders without impacting the amount of tax that gets applied with it. You will then create specific taxes, for each state for example, and map the taxes using Fiscal Positions. For detailed instructions on how this process works, read our Fiscal Positions document.

Click on a tax to view its configuration. We will review the Sales tax as an example. On the Sales tax, click Edit.

You will see the below options:

Tax Name: The name of the tax.

Tax Scope: Where the tax is selectable, on Sales or on Purchases. If 'None' is selected, the tax cannot be used by itself but it can be used in a group.

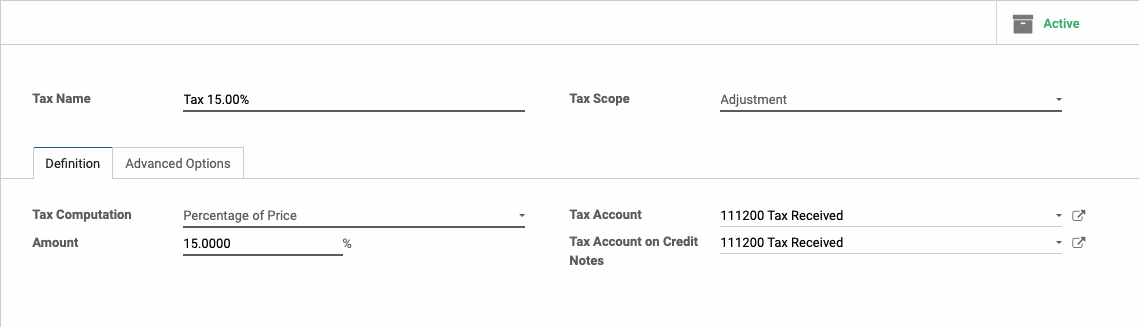

Under the Definition tab, you will see:

Tax Computation: Where you define how you want the tax to be computed.

Group of Taxes: You can select a tax group to calculate the taxes. The use of tax groups is outlined in detail below.

Fixed: Allows you to set a fixed tax rate regardless of the sales price.

Percentage of Price: Allows you to set a percentage of the sales price.

Percentage of Price Tax Included: Allows you to specify an amount of the sales price that you want to be allocated to taxes received, but will display no additional taxes to be paid on documents. For this option, you need to increase the sales price of your items to reflect the tax that will need to be withdrawn.

Amount: The amount of the tax computation. (Example: If you want a 15% tax, you would select 'Percentage of Price' as the Tax Computation and enter 15 for the Amount)

Tax Account: The account that will be used on taxes for invoices. Leave this field empty to use the product's income account.

Tax Account on Credit Notes: The account that will be used for taxes for credit notes. Leave this field empty to use the product's income account.

Good to Know!

If you want to clear all taxes from appearing automatically on Invoices or Vendor Bills, navigate to Configuration > Settings. Under the Taxes section you will see default taxes for both sales and purchases. If you remove both of those or set them to 0.00%, no tax amount will be applied to product sales or purchases automatically.

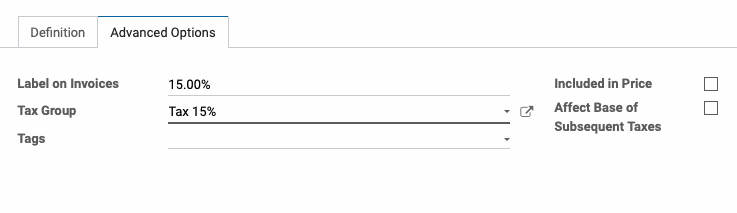

In the Advanced Options tab, you will see:

Label on Invoices: This label will appear on invoices with this tax selected.

Tax Group: Allows you to group taxes on invoices and sale orders. In general, we recommend a simple 'Taxes' group that can be applied to most or all taxes.

Tags: Add tags for reporting purposes, if desired.

Included in Price: Select this if you want to include this tax in the price.

Affect Base of Subsequent Taxes: If set, subsequent taxes will be based on the tax included price.

When ready, hit save.

Good to Know!

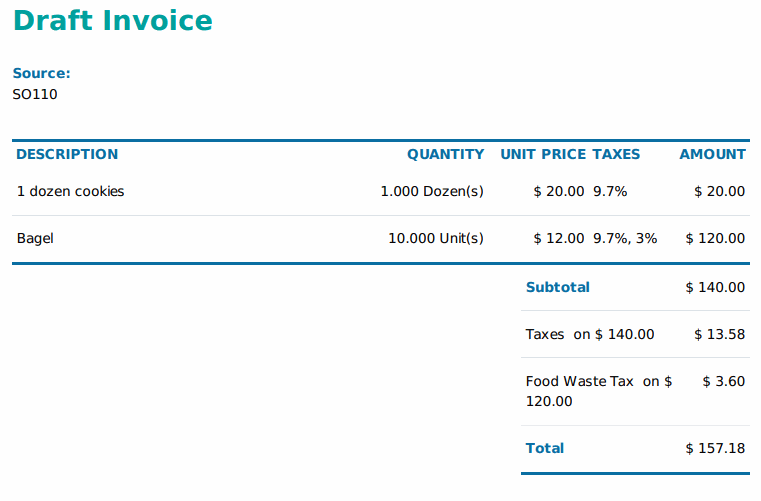

Understanding Tax Groups

Tax Groups can greatly improve the readability of taxes on invoice and sale order PDFs!

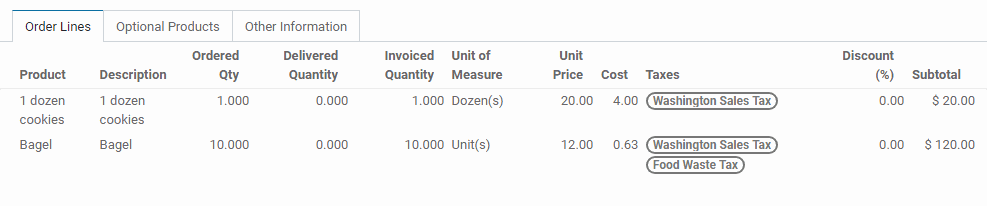

Take, for example, a customer purchasing some bagels and a dozen cookies. There are two associated taxes:

Sales Tax 9.7%

Food Waste Tax 3%

The first is in the Taxes tax group and the latter is in its own tax group dedicated to display Food Waste taxes as a separate tax item to customers on the invoice.

When taxes are in a tax group, the total for the tax group and its name will be totaled and listed below the subtotal on the invoice's PDF.

If you only have general sales and purchasing taxes, we recommend using the generic 'Taxes' group, to keep things simple.

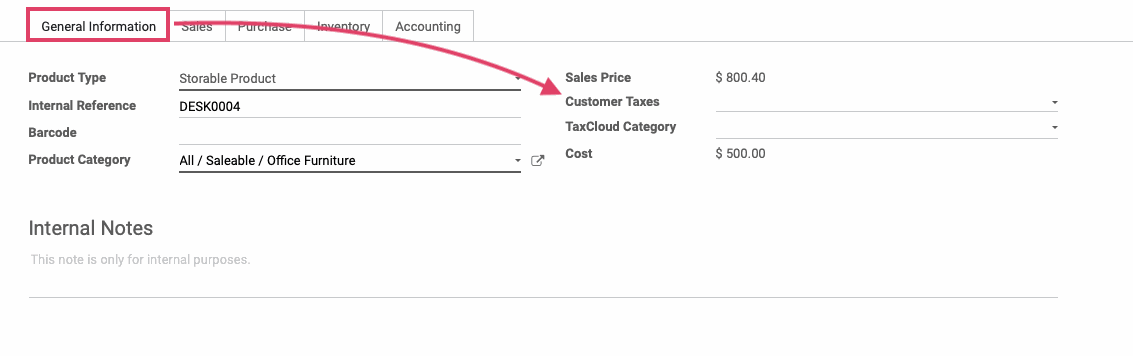

Select the product that you would like to set a default tax on. Click Edit on the product details page.

Under the General Information tab, you will see Customer Taxes. This is where you can select the taxes that apply to this product when it is sold to your customers.

Select all of the taxes that apply.

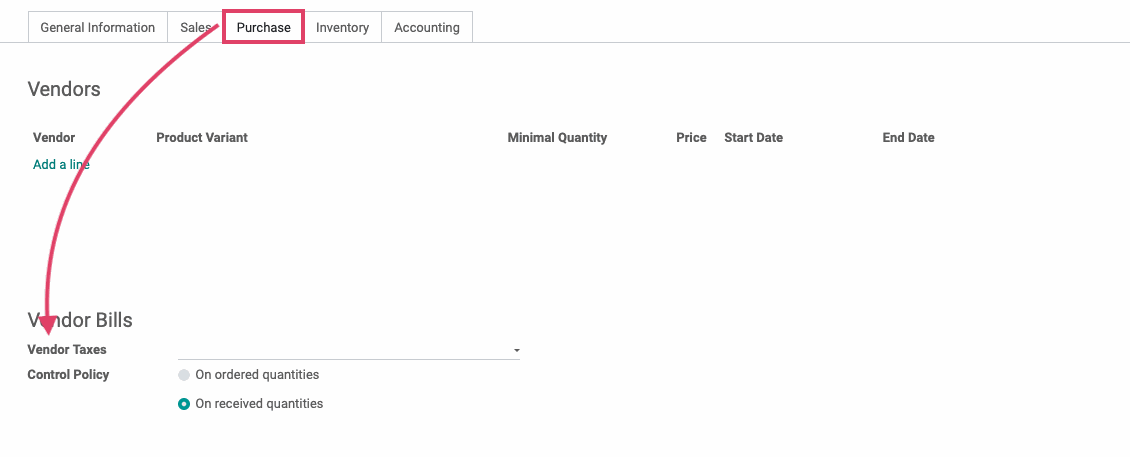

Under the Purchase tab, click on the Vendor Taxes drop down and select the default tax for this product. This is the tax that will be applied when this product is purchased.

When ready, click Save.

Remember!

We recommend assigning the default Sales Tax we setup earlier as the Customer Tax across products. You'll then use Fiscal Positions to map each customer to the correct tax at the time of sale. For instructions on using fiscal positions, read our Fiscal Positions document.

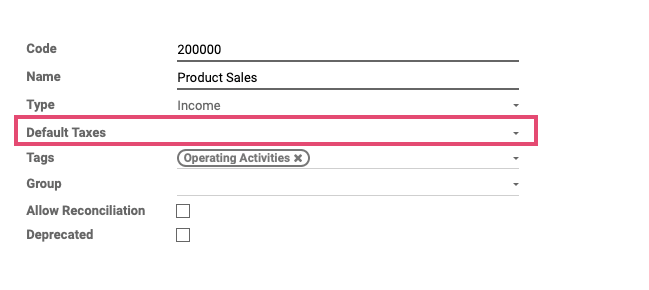

Setting Default Taxes on an Account

When default taxes are set on an account, this default tax will be applied each time the account is selected. With this setting, regardless of whether or not a product is selected, the default tax will always be present in the taxes column on a sale order or invoice.

In the Accounting app, click configuration > Chart of Accounts. Select the account you would like to set a default tax on and hit the edit button.

Click the drop down menu next to the Default Taxes field and select the default tax you'd like to apply to this account. Note that you can apply both tax scopes: sales and purchases.

When ready, hit save.

Taxes in Action

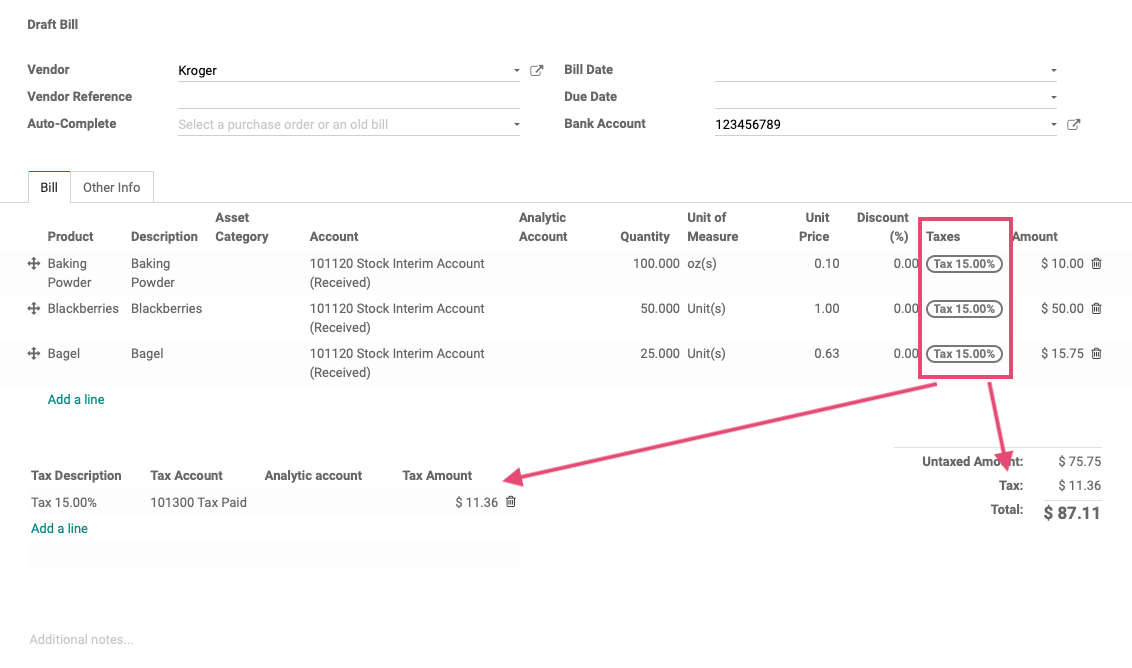

To see how taxes are used, let's create a Vendor Bill. Navigate to Vendors > Bills. Hit the Create button.

Select a vendor from the drop down menu and then click Add an item and select a product. Give the product a unit price and in the Taxes column click the drop down and select your tax.

Once a tax has been selected, a taxes line will be added to the line items on the bottom right with the total that displays the amount in tax. Additionally, there is a new table on the bottom left that displays a table of the tax and its computation.

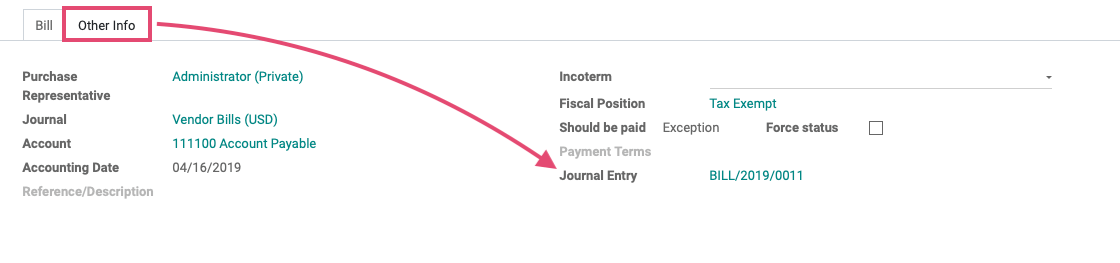

Click the Validate button. Once validated, click on the Other Info tab so we can take a look at the Journal Entry that has been created.

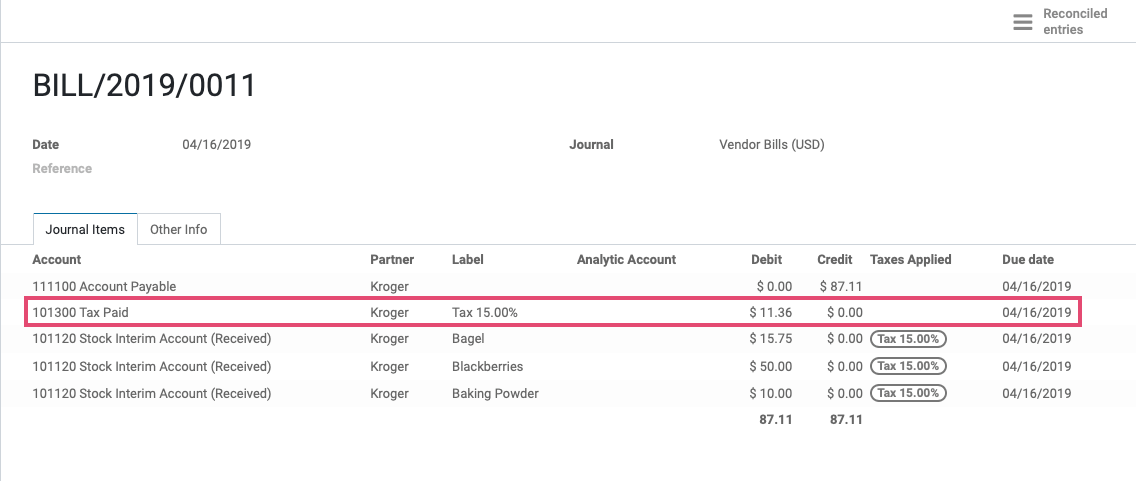

You will see we have a specific line for the taxes. In the account column is the account that is defined in your tax's definition.

Tax Reporting

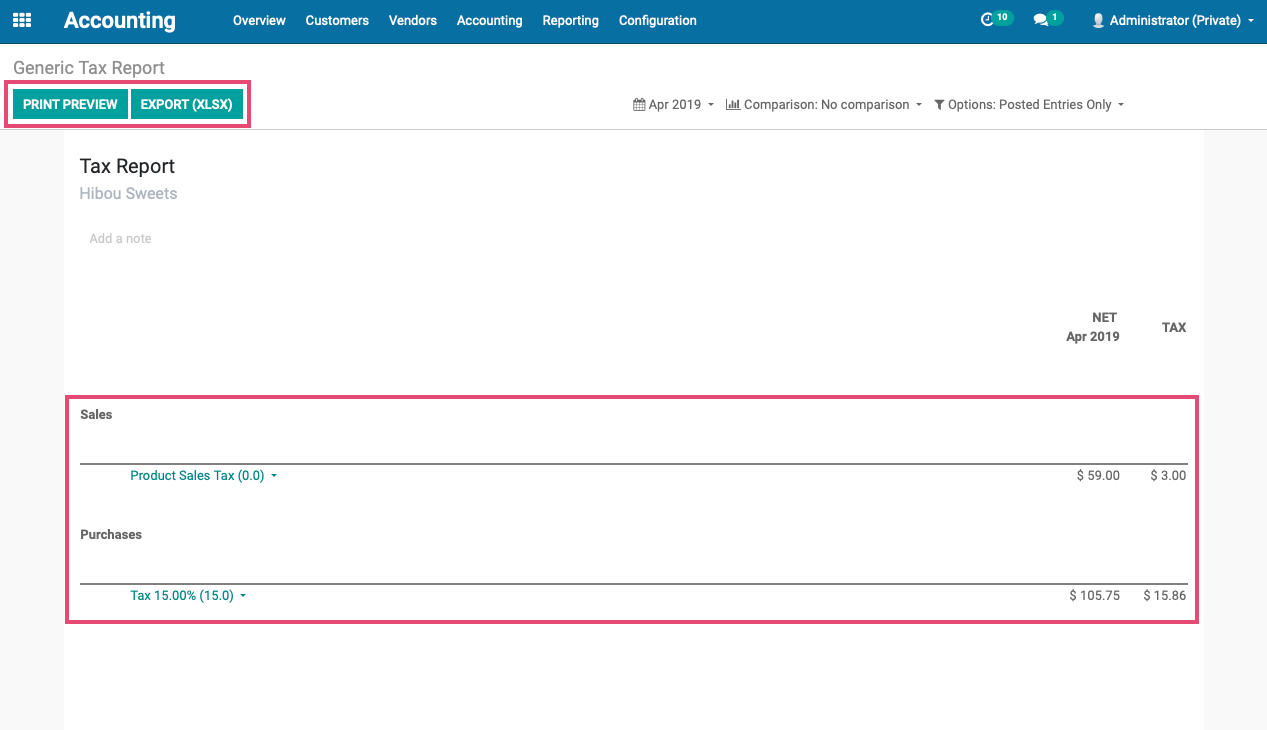

To view your Tax Report, navigate to Reporting > Tax Report. Here you will see your Sale and Purchase taxes, with a columns on the right for the Net amount and the Tax amount.

To print your Tax Report hit the Print Preview button to download a printer-friendly PDF. To export a file of the report, hit the EXPORT (XLSX) button.

To Audit or Annotate a tax, click the tax to bring up a drop down menu.