Accounting: Accounting: Journals

Purpose

The purpose of this documentation is to outline the configuration and use of journals in Odoo 13. We will review the different journal types, their unique configuration options, and how to change the entry sequence for your journals.

A Journal is where you record all transactions of the same type, in chronological order. For example, a Sale journal would list all of your customer invoices and refunds that occurred in order of creation thanks to a sequence number.

The entry sequence of a journal determines the way in which your journal entries are numbered.

Good to Know!

Accounting Overview + Journals

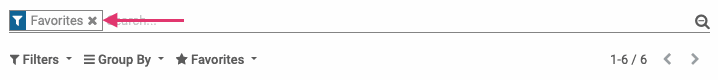

When you open the Accounting app, you'll see all of your favorite Journals shown on the Overview page. This is because the default filter is set to Favorites.

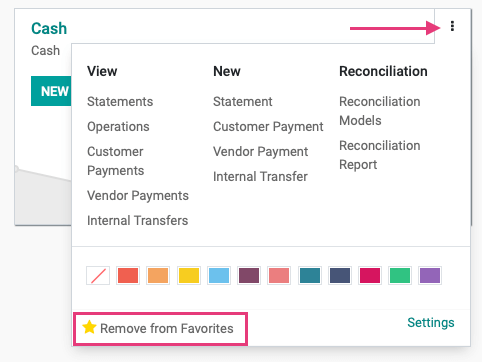

To remove a Journal from this view, click the menu icon and then click Remove from Favorites. When you reload this page, that journal will not display.

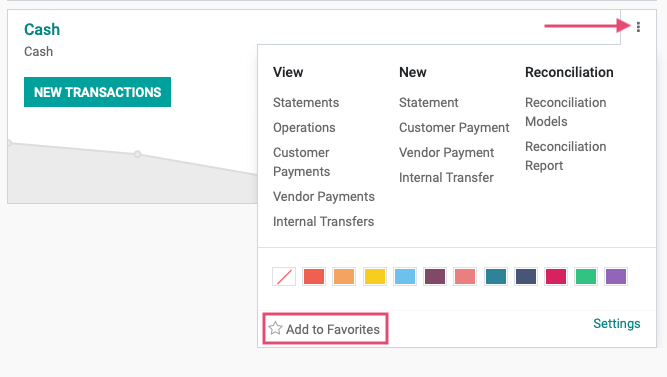

To add a Journal as a favorite to the Overview page, remove the Favorites filter to see all Journals.

From the menu, click Add to Favorites.

Process

To get started, navigate to the Accounting app.

Journal Types

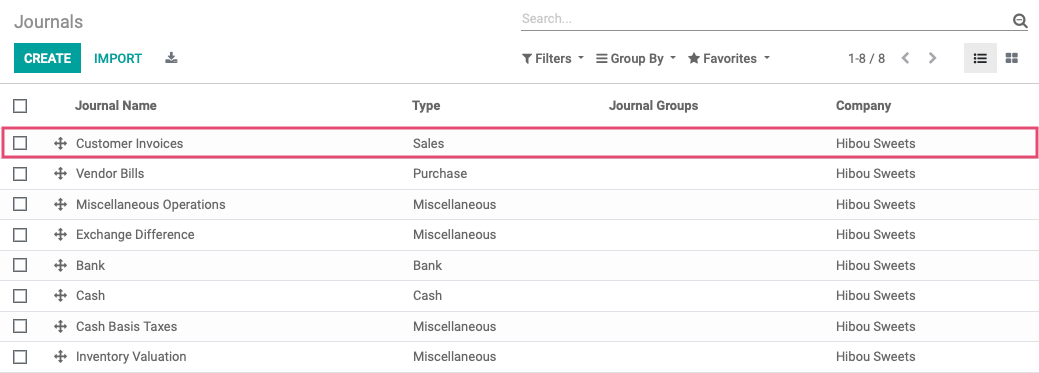

Once there, click on Configuration > Invoicing > journals.

With a new Odoo installation, you'll see pre-configured Journals that are common for most industries. While you likely won't need to modify many outside of Bank journals, you can delete or create journals as needed.

For configuration example purposes, click the pre-defined Customer Invoices journal from the list.

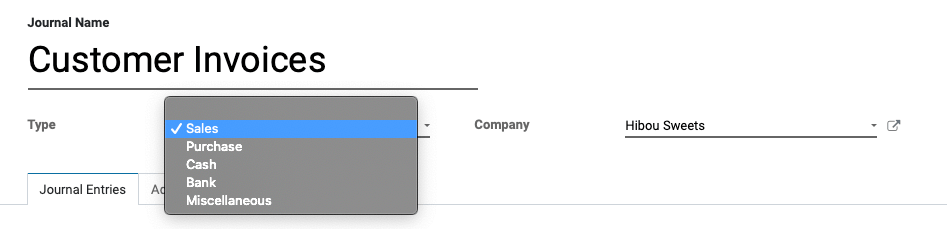

Click Edit to display all of the different options available. The general information is as shown:

Journal Name: The name of the journal. Our example is "Customer Invoices".

Type: There are five journal types in Odoo.

Sale: Post recorded customer invoices.

Purchase: Post received vendor bills.

Cash: Where you keep track of petty cash and daily cash transactions, as well as received customer payments.

Bank: Post your bank statements and track customer payments, vendor payments, and all other transactions recorded by your associated bank account.

Miscellaneous: Post miscellaneous entries, like payroll or all of your corrections. This journal is used for anything that doesn't fit into the above journal types. Miscellaneous Journals do not have any advanced settings.

Company: This is the name of your company.

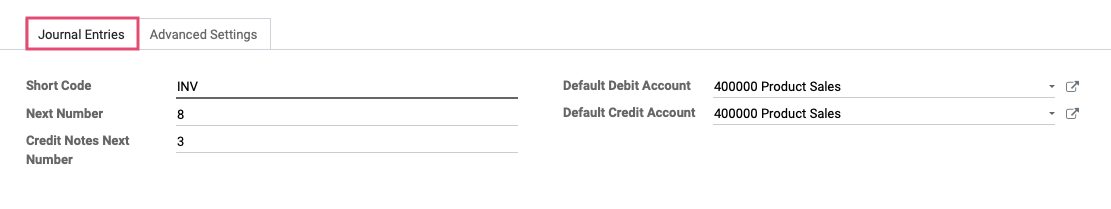

Under the Journal Entries tab for all journal types, you will see the fields shown.

Short Code: A journal's Short Code is used to easily identify a journal and track the journal entries and journal items that are posted to it. Journal short codes are heavily used throughout Odoo. This journal's short code is INV.

Next Number: This indicates the next sequence number that will be used for the next invoice.

Credit Notes Next Number: This field only displays on Sales and Purchase accounts, and indicates the next sequence number that will be used for subsequent credit notes.

Default Debit Account: Is only mandatory for bank journals. Whatever account is selected here will be the default account that will be listed on the debit side of your journal entries.

Default Credit Account: Is only mandatory for bank journals. Whatever account is selected here will be the default account that will be listed on the credit side of your journal entries.

Configuring Sale Journals

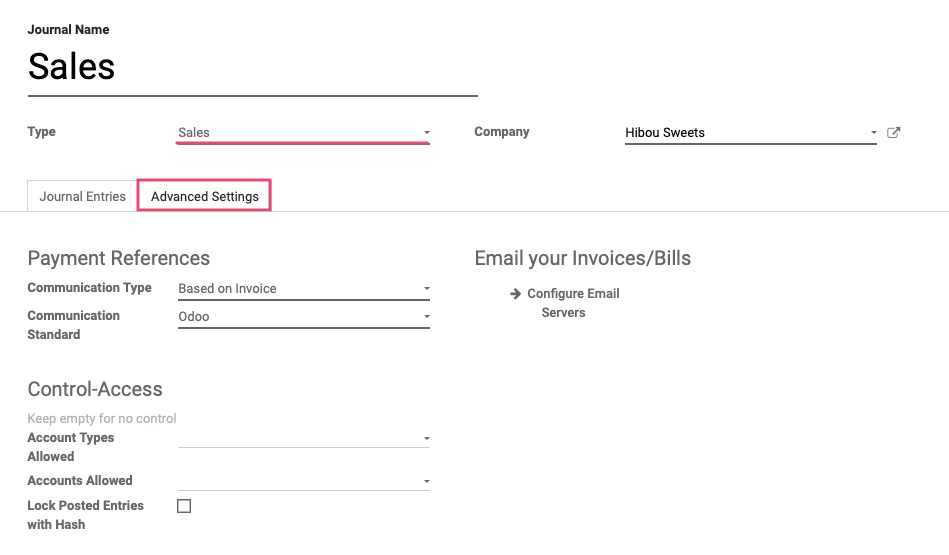

The following configuration is for Sale journals and is found under the Advanced Settings tab.

For Sales journals, you have the below configuration:

Payment References

Communication Type: Set the communication that will appear on customer invoices, once validated, to help the customer refer to that particular invoice when making the payment.

Communication Standard: Choose different models for each type of reference. The default is the Odoo reference.

Control Access: Leave these fields empty for no control.

Account Types Allowed: Select the account types allowed for this journal.

Accounts Allowed: Select the accounts allowed for this journal.

Lock Posted Entries with Hash: Enable this to lock accounting entries or invoices once posted. This means they cannot be further modified.

Email your Invoices/Bills: If you configure an email alias for your Purchase journal, you can email yourself vendor bills to a unique email alias and they will automatically generate a Vendor Bill entry for the journal. We will cover the email server configuration in a separate document.

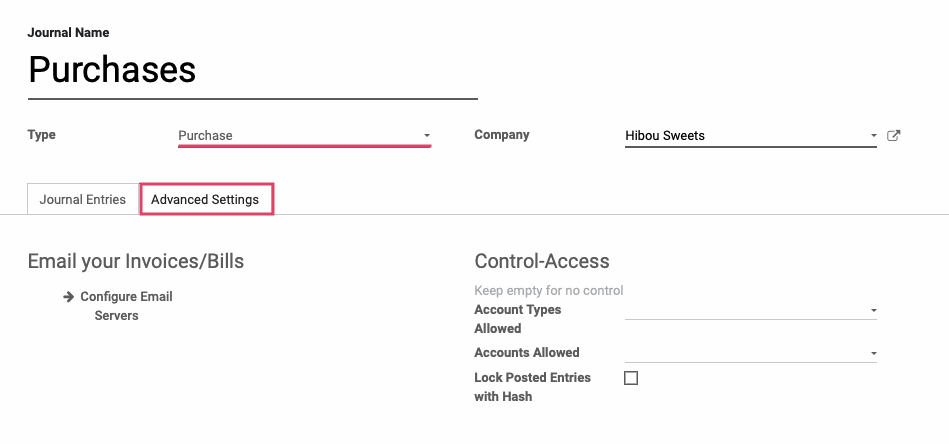

Configuring Purchase Journals

The following configuration is for Purchase journals and is found under the Advanced Settings tab.

Email Your Invoices/Bills: If you configure an email alias for your Purchase journal, you can email yourself vendor bills to a unique email alias and they will automatically generate a Vendor Bill entry for the journal. We will cover email server configuration in a separate document.

Control Access: Leave these fields empty for no control.

Account Types Allowed: Select the account types allowed for this journal.

Accounts Allowed: Select the accounts allowed for this journal.

Lock Posted Entries with Hash: Enable this to lock accounting entries or invoices once posted. This means they cannot be further modified.

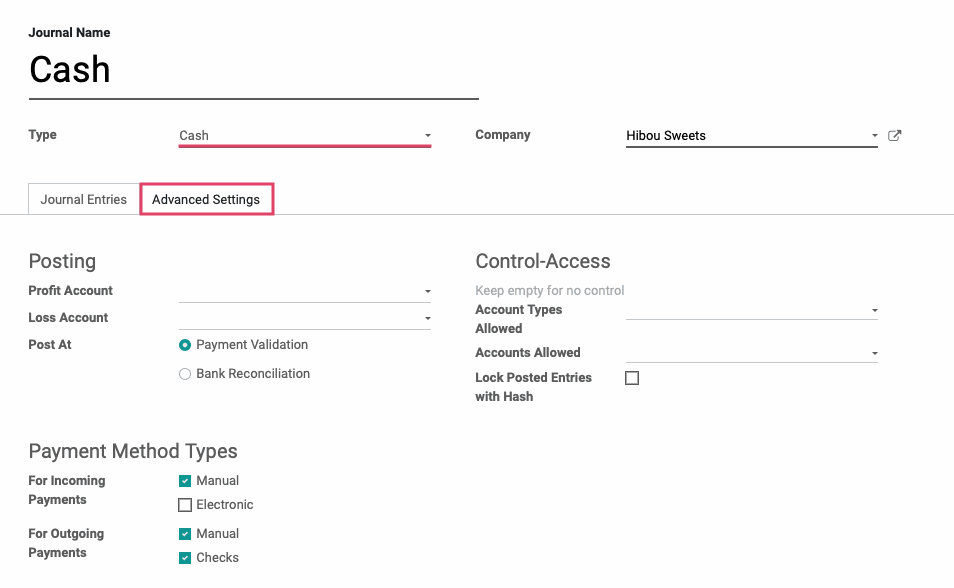

Configuring Cash Journals

The following configuration is for Cash journals and is found under the Advanced Settings tab.

Posting

Profit Account: When the end balance of a cash register or drawer is higher than what the system computes, this account can be used to log the difference.

Loss Account: When the end balance of a cash register or drawer is lower than what the system computes, this account can be used to log the difference.

Post At: Indicate at which point you'd like the posting to take place.

Payment Validation: Post when the payment is validated.

Bank Reconciliation: Post when the transaction is reconciled with the bank.

Control Access: Leave these fields empty for no control.

Account Types Allowed: Select the account types allowed for this journal.

Accounts Allowed: Select the accounts allowed for this journal.

Lock Posted Entries with Hash: Enable this to lock accounting entries or invoices once posted. This means they cannot be further modified.

Payment Method Types

For Incoming Payments

Manual: Should be selected if you get paid by cash, check, or any other method outside of Odoo.

Electronic: Should be selected if you get paid automatically through a payment acquirer when a customer is buying or subscribing online (using payment tokens).

For Outgoing Payments

Manual: Should be selected to pay bills by cash or any other method outside of Odoo.

Checks: Should be selected to pay a bill by check and print it through Odoo.

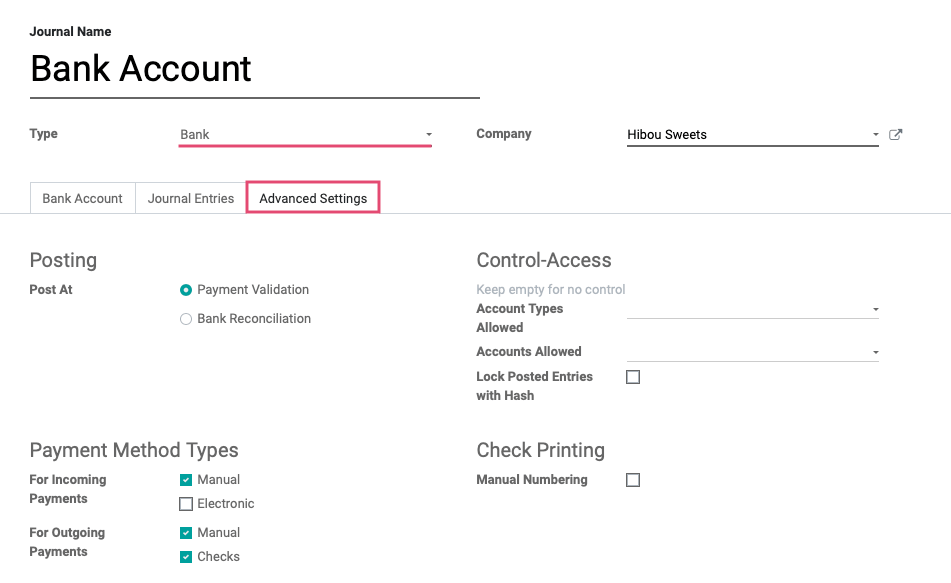

Configuring Bank Journals

The following configuration is for Bank journals and is found under the Advanced Settings tab.

Posting

Post At: Indicate at which point you'd like the posting to take place.

Payment Validation: Post when the payment is validated.

Bank Reconciliation: Post when the transaction is reconciled with the bank.

Control Access: Leave these fields empty for no control.

Account Types Allowed: Select the account types allowed for this journal.

Accounts Allowed: Select the accounts allowed for this journal.

Lock Posted Entries with Hash: Enable this to lock accounting entries or invoices once posted. This means they cannot be further modified.

Payment Method Types

For Incoming Payments

Manual: Should be selected if you get paid by cash, check, or any other method outside of Odoo.

Electronic: Should be selected if you get paid automatically through a payment acquirer when a customer is buying or subscribing online (using payment tokens).

For Outgoing Payments

Manual: Should be selected to pay bills by cash or any other method outside of Odoo.

Checks: Should be selected to pay a bill by check and print it through Odoo.

Check Printing: Check this option if your preprinted checks aren't numbered.

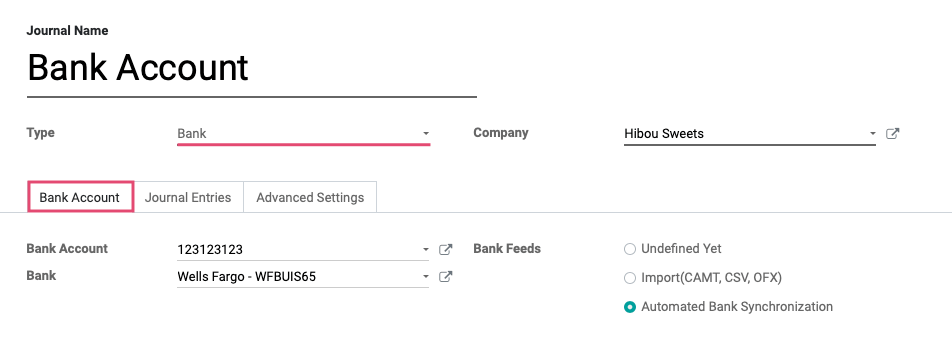

Bank journals also have a Bank Account tab. This is where you will link your associated bank account to this journal and configure how you want your bank statements to synchronize with Odoo.

On this tab, you will have the below options. We will go over each one.

Bank Account: Select your desired bank account from the drop-down menu.

Bank: Select your desired bank from the drop-down menu.

Good to Know!

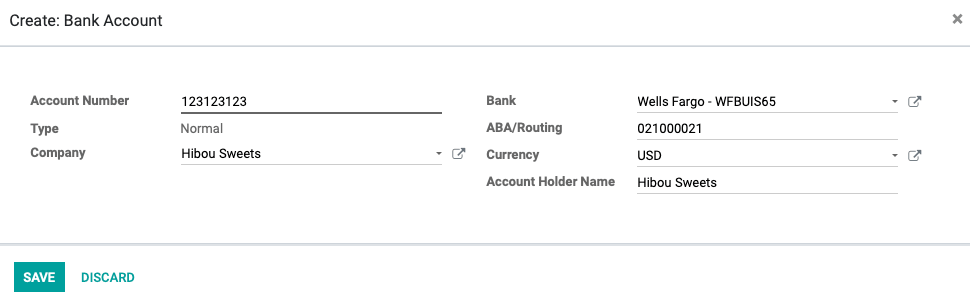

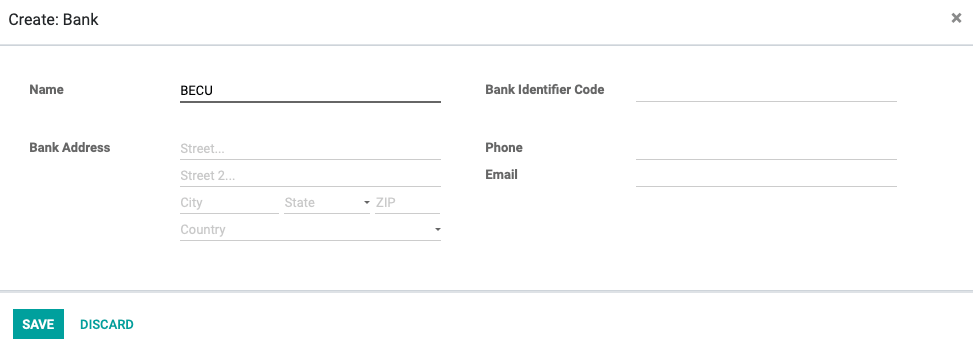

If you have not added your bank account yet, you can select CREATE AND EDIT from the Bank drop-down and fill in the details on the pop-up window as shown below. Note: This is mostly informational, but these fields may come in handy when doing exports.

Bank Feeds: This is how you define the way in which you will import your Bank Statements for reconciliation.

Undefined Yet: If this is selected, it means you will be entering your bank statement lines manually.

Import (CSV, OFX): If this is selected, then you will need to import your bank statements once issued from your bank in the necessary format.

Automated Bank Synchronization: If this option is selected, you will have the ability to link your bank account to Odoo and schedule synchronizations at various time intervals to create your bank statements.