USA State Payroll Rates + Resources: State of Utah: Filing State Income Taxes, W-2s, and 1099s

Purpose

This documentation outlines the processes and requirements associated with filing state income taxes as well as how to file W-2s and 1099s, if needed, in the state of Utah.

State Income Tax Withholding

Utah does not have a state equivalent to the federal form W-4. Withholding allowances are the same number as the employee claims on his or her federal form W‑4. You'll find the value of the Utah allowance in the Withholding Tax Guide.

Employers must keep a copy of their employees' completed W-4 forms in their files. The forms serve as verification that state income taxes are being withheld according to the employees' instructions and needs to be available for inspection if the state requests it.

Federal form W-4 is valid until the employee provides a new one. However, employees who claim exemption from withholding must renew the exemption annually by filing a new W-4 by February 15th each year.

State Income Tax Withholding Reporting and Deposits

As the employer, you must file returns electronically and pay all amounts withheld to the Tax Commission by the due dates. You must file a return for each filing period, even if you don’t withhold taxes during a period.

| Deposit Schedule | Reporting Schedule | Withholding Amount | Deposit Due | Reporting Due |

| Monthly | Quarterly | $1,000 or more per month. | Last day of the month following the end of the month | Last day of the month following the end of the quarter |

| Quarterly | Quarterly | Less than $1,000 per month | Last day of the month following the end of the quarter | Last day of the month following the end of the quarter |

Anything with a due date that falls on a Saturday, Sunday, or legal holiday is due the next business day.

If you have no withholding for the entire year, you must still file an annual reconciliation by January 31 of the following year. Failure to do so may result in penalties.

You may file your withholding electronically through:

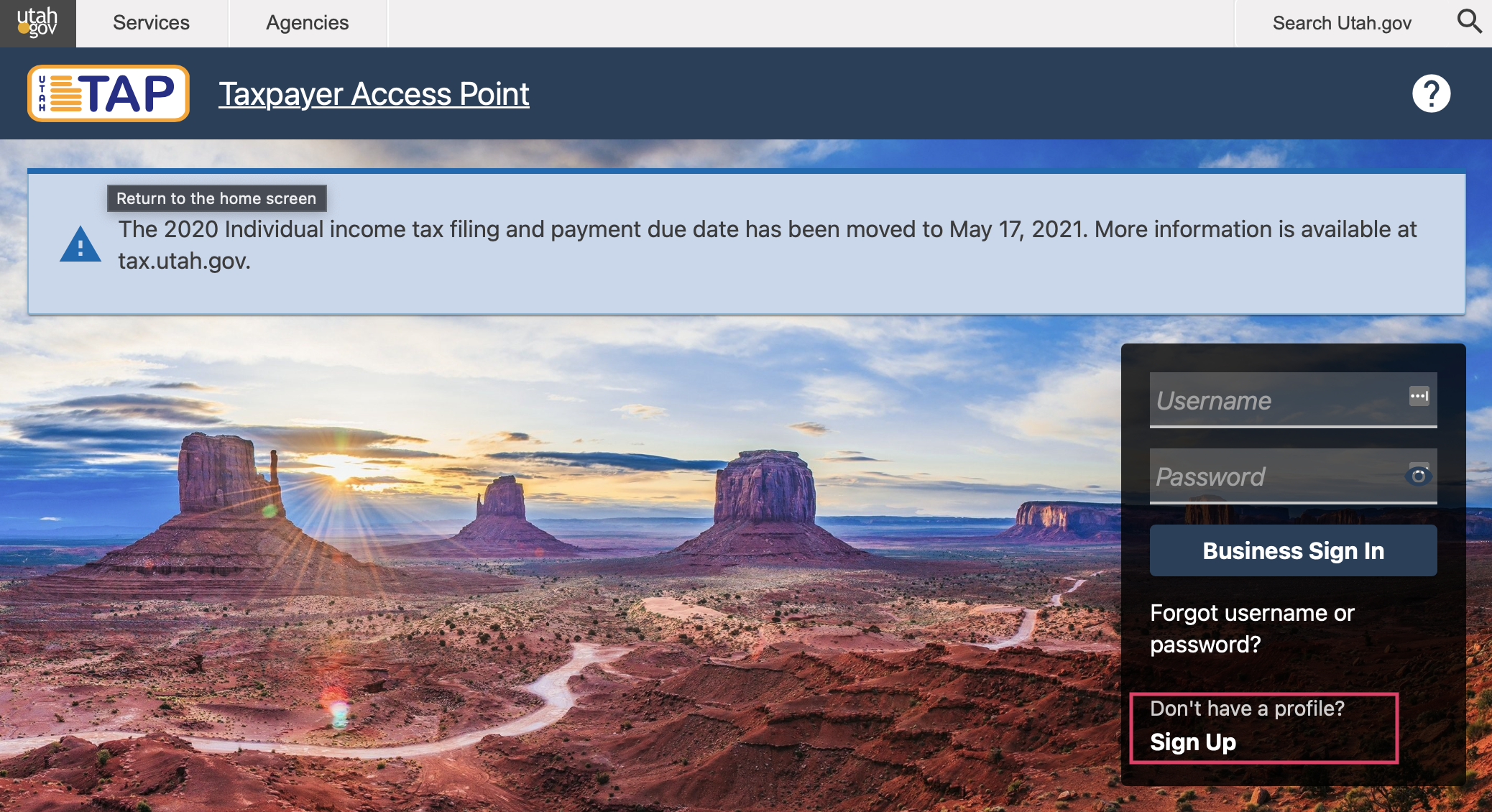

Taxpayer Access Point (TAP) – Manually enter return information, use the Excel template and import it, or upload fixed-length files at tap.utah.gov. For first time visitor to TAP, will need to click on Sign Up.

Withholding Web Service – For filers who submit large volumes of returns and forms. Your IT developers must create the necessary interface. See Withholding Web Service Developer’s Handbook.

Remit online via TAP, or mail your payment with payment coupon TC-941PC to:

Utah State Tax Commission

210 N 1950 W

SLC, UT 84134-0100

Good to Know!

Utah does not follow the federal withholding payment periods. Utah only requires that payments be made monthly, quarterly, or annually. The IRS semiweekly deposit and $100,000 next day deposit rules do not apply to Utah withholding taxes.

W-2 and 1099 Forms

Employers must file all W-2s, 1099s, and Annual Reconciliations (TC-941E) electronically by January 31 of the following year at the Taxpayer Access Point (TAP).

For further details see Employer Withholding and Withholding Tax Guide.