USA State Payroll Rates + Resources: State of West Virginia: Unemployment Insurance Reporting & Payments

Purpose

This documentation outlines the processes and requirements associated with submitting unemployment insurance reports and submitting unemployment insurance payments in the state of West Virginia.

Unemployment Insurance Reporting & Payments

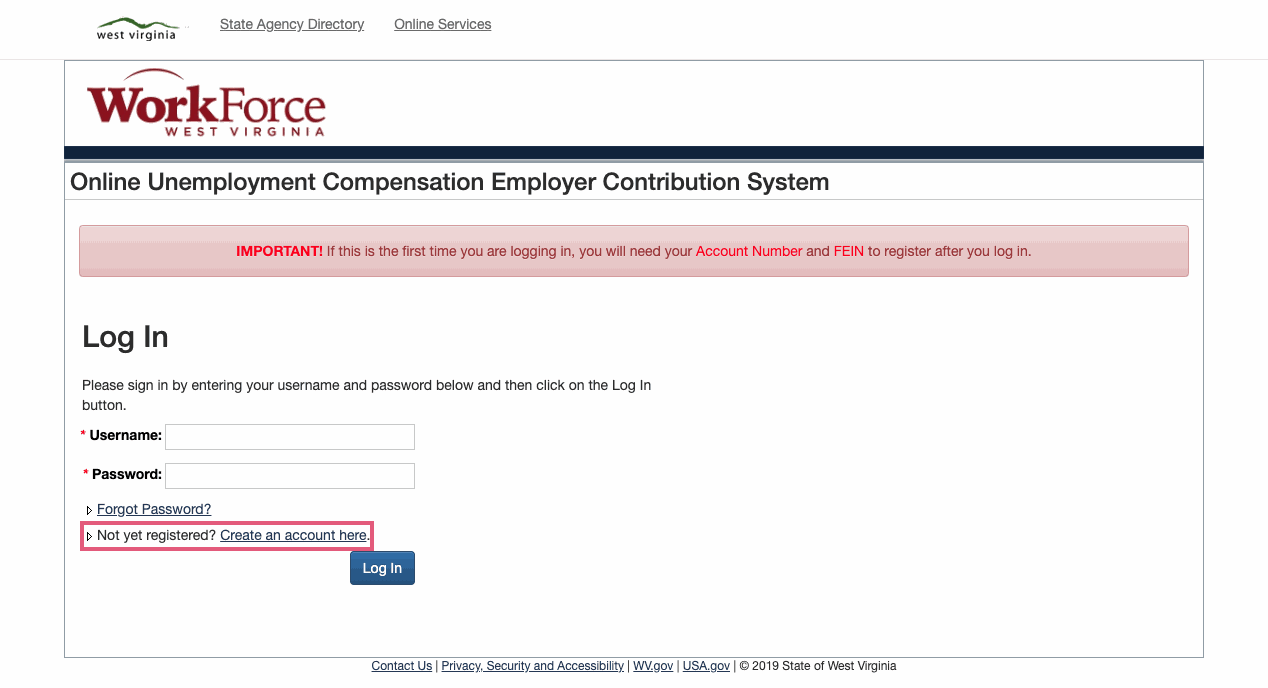

In order to file online, you must first register for an account with the Online Unemployment Compensation Employer Contribution System. Once there, click Create an account here.

If you paid no wages during a given quarter, you still must file contribution and wage reports indicating "No Payroll".

Due dates:| Quarter | Months In Quarter | Due Dates |

| 1st Quarter | January - March | Due April 30th |

| 2nd Quarter | April - June | Due July 31st |

| 3rd Quarter | July - September | Due October 31st |

| 4th Quarter | October - December | Due January 31st |

If the due date is on a weekend or holiday, the next business day becomes the date the quarterly reports and payment must be submitted.

For further details, see the Handbook for Employers.

Good to Know!

The 2020 taxable wage base for West Virginia is $12,000. Most subject employers are required to pay contributions at the rate of 2.7 percent if all taxable wages paid to permanent and temporary employees each quarter, or at a higher or lower rate if such a rate has been assigned.