USA State Payroll Rates + Resources: State of Washington: Unemployment & Workers' Compensation Insurance and Family & Medical Leave Reporting & Payments

Purpose

The purpose of this documentation is to outline the processes and requirements associated with submitting unemployment, workers' compensation insurance, family and medical leave reports, and submitting payments in the state of Washington.

Unemployment & Worker's Compensation Insurance Reporting & Payments

All employers must file a tax-and-wage report every quarter.

Tax reports or tax and wage reports, and unemployment tax payments can be filed and paid through the Department's free and efficient online systems.

For filing tax reports or tax and wage reports online use one of the following services:

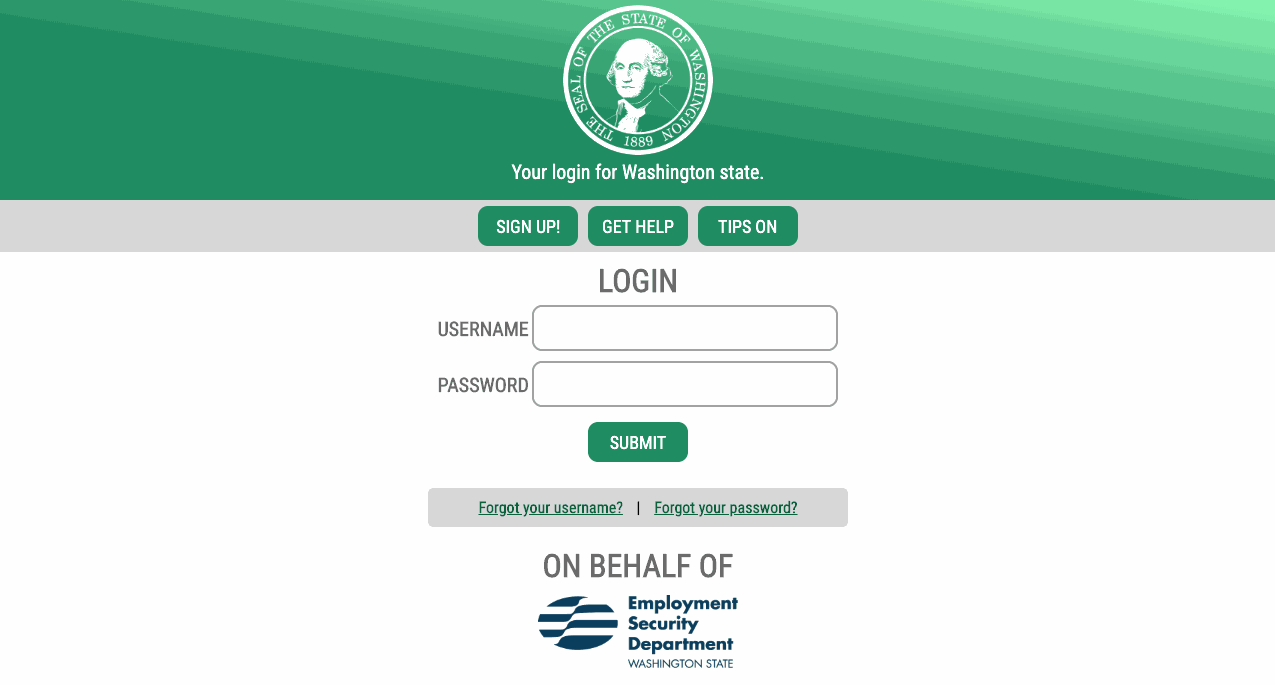

For paying unemployment taxes use EAMS. If you use EAMS, be sure to set up your online account in advance. If you choose ePay, become familiar with it before you need to use it to avoid last-minute set-up or compatibility issues.

For further details about all three systems mentioned above, go to the Employment Security Department's Unemployment taxes web-site.

How to report hours:

Round up to the next whole number. No fraction of hours accepted.

Salaried employees - Report actual hours worked. If hours are not tracked, report 40 hours per week for full-time employees.

Commissioned employees – Report actual hours worked. If hours are not tracked, report 40 hours per week for full-time employees.

Overtime – Report actual hours worked.

Vacation pay – Report the number of hours for leave with pay.

Payment in kind – Report actual hours worked.

Pay in lieu of notice – Report the hours that would have been worked.

Severance pay, bonuses, tips, and gratuities – Report zero (0) hours. Read about reporting zero hours.

| 1st Quarter | January - March | Due April 30th |

| 2nd Quarter | April - June | Due July 31st |

| 3rd Quarter | July - September | Due October 31st |

| 4h Quarter | October - December | Due January 31st |

If the due date is on a weekend or holiday, the next business day becomes the date the quarterly reports and payment must be submitted.

For further details, see the Employer Tax Handbook and Unemployment Taxes page.

Paid Family and Medical Leave (FMLA) Reporting + Payments

Paid Family and Medical Leave is a statewide insurance program.

All employers may either withhold employees' premiums from their paychecks or pay some or all of the premium on their employees’ behalf. The premium for 2020 is 0.4 percent of an employee's gross wages. You can choose to withhold the entire 63.33 percent of the premium from your employee’s paycheck, or you can cover all or part of the premium on your employee’s behalf.

Typically, reporting periods will follow calendar quarters and will be aligned with reporting periods for Unemployment Insurance (UI). However, reporting for Paid Family and Medical Leave is separate from UI and will be completed through the EAMS (SAW) system (see above).

To add a new service to your SAW account, select Add A New Service, then:

Select "I would like to browse a list of services".

Scroll through the list to Employment Security Department and select Paid Family and Medical Leave from the drop-down menu.

When you see the confirmation screen that lets you know the service has been added to your list, click OK, then select Paid Family and Medical Leave from your list of services to access your account.

The amount owed does not appear immediately and may not be available the same day you file your report. Once your report has been processed (it's status in the table on the “Wage Submission History” page will say, “Processed”), your updated balance will be displayed on the “Payments” page which you can access by selecting “Payments” from the menu bar on the employer homepage.

For further details, see the Employer Toolkit and Washington's Paid Family & Medical Leave website.

Good to Know!

If you have no payroll, no Paid Family and Medical Leave Report is due.