USA State Payroll Rates + Resources: State of Tennessee: Unemployment Insurance Reporting & Payments

Purpose

This documentation outlines the processes and requirements associated with submitting unemployment insurance reports and submitting unemployment insurance payments in the state of Tennessee.

Unemployment Insurance Reporting & Payments

Employers may submit the Wage and Premium Report, and any premiums due, to the Department of Labor & Workforce Development quarterly. They are due within one month after the end of each calendar quarter.

Due dates:

| 1st Quarter | January - March | Due April 30th |

| 2nd Quarter | April - June | Due July 31st |

| 3rd Quarter | July - September | Due October 31st |

| 4th Quarter | October - December | Due January 31st |

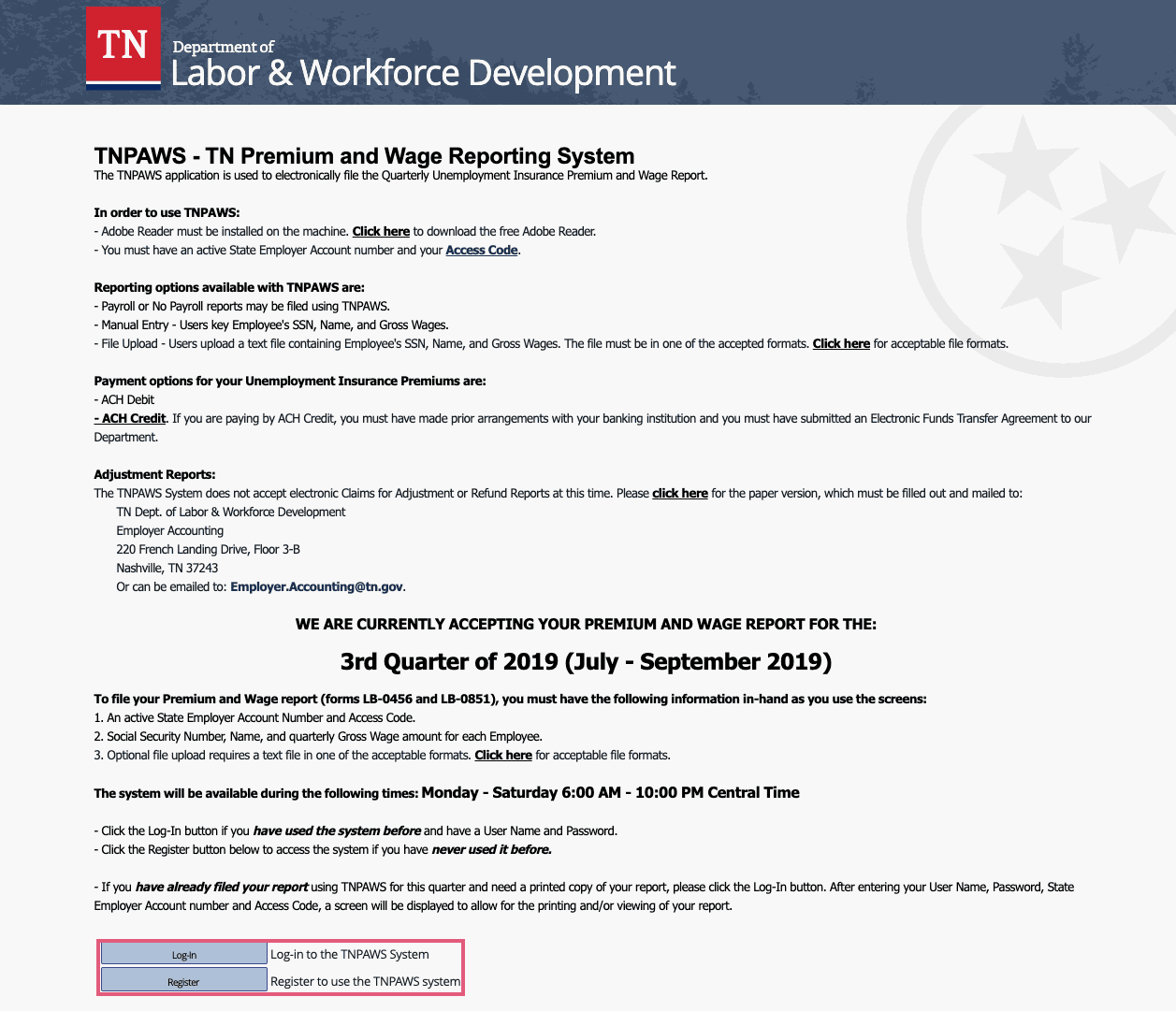

Tennessee Employment Security law requires employers to file their quarterly Wage and Premium Report electronically via Tennessee Premium and Wage Reporting System (TNPAWS).

If you are a new user to the site, click Register on the bottom of this page and create your account.

For further information, see the Handbook for Employers.