USA State Payroll Rates + Resources: State of Kentucky: Filing State Income Taxes, W-2s, and 1099s

Purpose

The purpose of this documentation is to outline the processes and requirements associated with filing state income taxes as well as how to file W-2s and 1099s, if needed, in the state of Kentucky.

State Income Tax Withholding

As all Kentucky wage earners are taxed at a flat 5% tax rate with an allowance for the standard deduction, Form K-4 is only required to document that an employee has requested an exemption from withholding OR to document that an employee has requested additional withholding in excess of the amounts calculated using the formula or tables.

If neither of the above situations applies, then an employer is not required to maintain Form K-4. Upon receipt of this form, properly completed, you are authorized to discontinue withholding for an employee who qualifies for one of the four exemptions.

Retain a copy of all K-4’s received from employees.

State Income Tax Withholding Reporting and Deposits

Employers report and pay Kentucky withholding tax annually, quarterly, monthly or twice monthly.

| Frequency | Annual Withholding Threshold | Due |

| Annual (form K-3) | Less than $400 | January 31st |

| Quarterly (form K-1) | $400 - $1,999 | Last day of the month following the end of the quarter |

| Monthly (form K-1) | $2,000 - $49,999 | 15th of the month subsequent to the end of the month |

| Twice-monthly (form K-1) | $50,000 or more | From Jan 1 - Jan 31: Due Feb 10 From 1st - 15th: Due 25th of the same month From 16th - EOM: Due 10th of the following month From Dec 1 - Dec 15: Due 26th of Dec From Dec 16 - Dec 31: Due Jan 31 |

Employers who accumulate $100,000 or more tax during any reporting period must remit payment within one banking day.

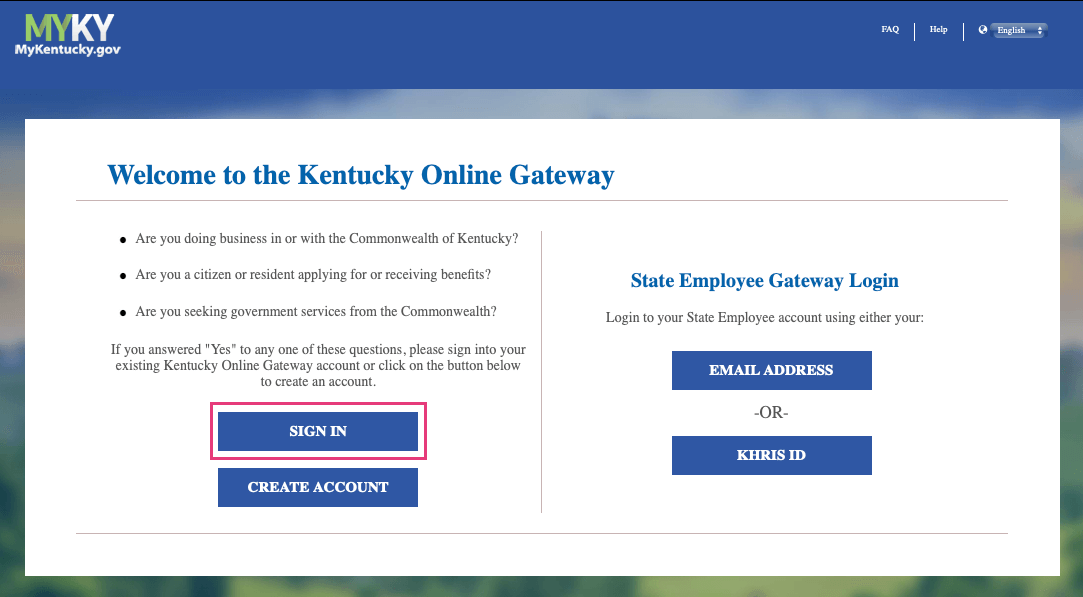

Employers can file electronically on the Withholding Return and Payment System (WRAPS) after clicking SIGN IN.

Employers not filing electronically will be mailed Form K-1 at the end of each reporting period. These preprinted forms contain important processing information and cannot be furnished as a blank form.

Regardless of the reporting and payment frequency, returns issued to employers must be filed even though no Kentucky income tax was withheld during that period.

If the due date falls on a Saturday, Sunday or legal holiday, use the next regular business day.

W-2 and 1099 Forms

The withholding statement information (Forms W-2 and 1099 Series) must be reported to the Kentucky Department of Revenue (DOR) on or before January 31st (no extensions). Form K-5 is used to report withholding statement information from Forms W-2, W-2G, and 1099 and is completed online with two filing methods to choose from.

Employers and payers that issue less than 26 Kentucky withholding statements that are not reported in an electronic file must file printed Form K-5.

Annual Reconciliation (Form W-3)

For all filing frequencies, a Form W-3 is due by January 31st of the following year.

For further details, see the Withholding Kentucky Income Tax Instructions for Employers.

Good to Know!

Do not mail paper copies of the withholding statements (W-2, 1099, etc) to the DOR. Paper copies of Forms W-2, W-2G, and 1099 Series received by DOR will not be processed and will not be considered filed. Retain the paper forms for your records and only provide copies upon request.