USA State Payroll Rates + Resources: State of Connecticut: Obtaining a TIN + Unemployment Insurance

Purpose

The purpose of this documentation is to outline the processes and requirements associated with becoming a new employer in the state of Connecticut. Specifically, we will be covering how to obtain a Tax Identification Number and Register for Unemployment Insurance.

Good to Know!

Note: Federal Employer requirements (obtaining a federal identification number, withholding of federal income tax, and FICA and filing of all applicable federal returns (FUTA, 940, 941, and 1099-C) will not be covered below - just the state of Connecticut's requirements. Click here for a basic (not all-inclusive) IRS checklist for Starting a New Business.

Obtaining a Tax Registration Number

Good to Know!

If you already have a state of Connecticut Tax Registration Number, skip to the next section.

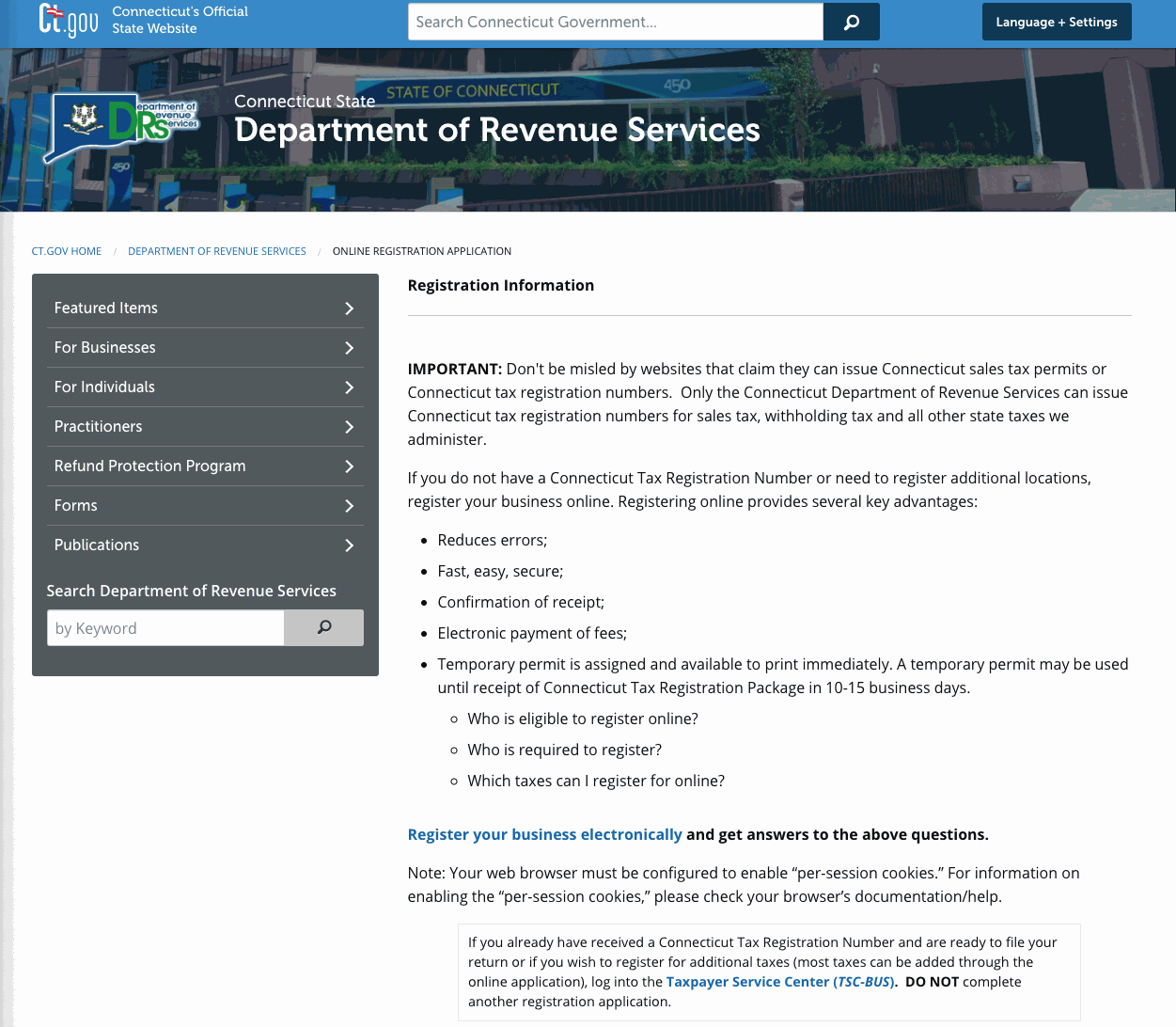

You are required to register with the Department of Revenue Services (DRS) before you may conduct business in Connecticut (including having employees who work in Connecticut, withhold Connecticut income tax, etc.).

If your business has a valid Connecticut tax registration number from the Connecticut Department of Revenue Services, you may add withholding tax to the existing registration by logging into the Taxpayer Service Center (TSC-BUS), using your existing CT Tax Registration number and selecting "Register for Additional Tax Types" on the left toolbar.

If your business does not have a Connecticut tax registration number from the Connecticut Department of Revenue Services, you must complete a Form REG-1 and submit the Business Taxes Registration Application.

All employers of one or more persons (full or part-time) in the state of Connecticut must register by filing an Employer Status Report.

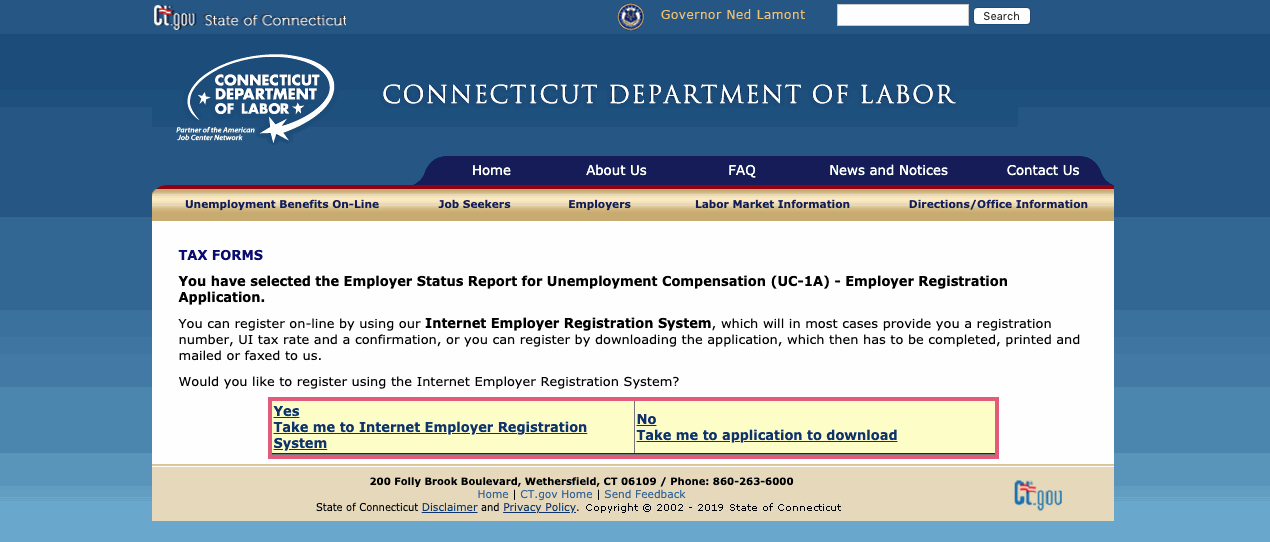

Employers can register their business on-line or by downloading the application, which will then need to be completed, printed and mailed or faxed to the department. For either option, please visit http://www.ctdol.state.ct.us/uitax/leadUc1a.htm