USA State Payroll Rates + Resources: State of Oregon: New Hire Reporting

Purpose

The purpose of this documentation is to outline the processes and requirements associated with reporting new hires in the state of Oregon.

New Hire Reporting

In Oregon, you are required to report new hires to the Oregon Department of Justice Division of Child Support.

Oregon law requires employers to report within 20 days all new hires and re-hires, including temporary staff, to the Division of Child Support of the Oregon Department of Justice. Employers must report the first day of work for each new hire. A "new hire" is any employee who is required to fill out a W-4 form, or any returning employee who has been absent for more than 60 days. The following information will need to be furnished:

Employer:

FEIN

State Identification Number

Name and DBA, where applicable

Contact Information for the business and the payroll contact

Status of health insurance availability

Employee:

Full, legal name

Contact details

Date of Birth

Social Security Number

First work date

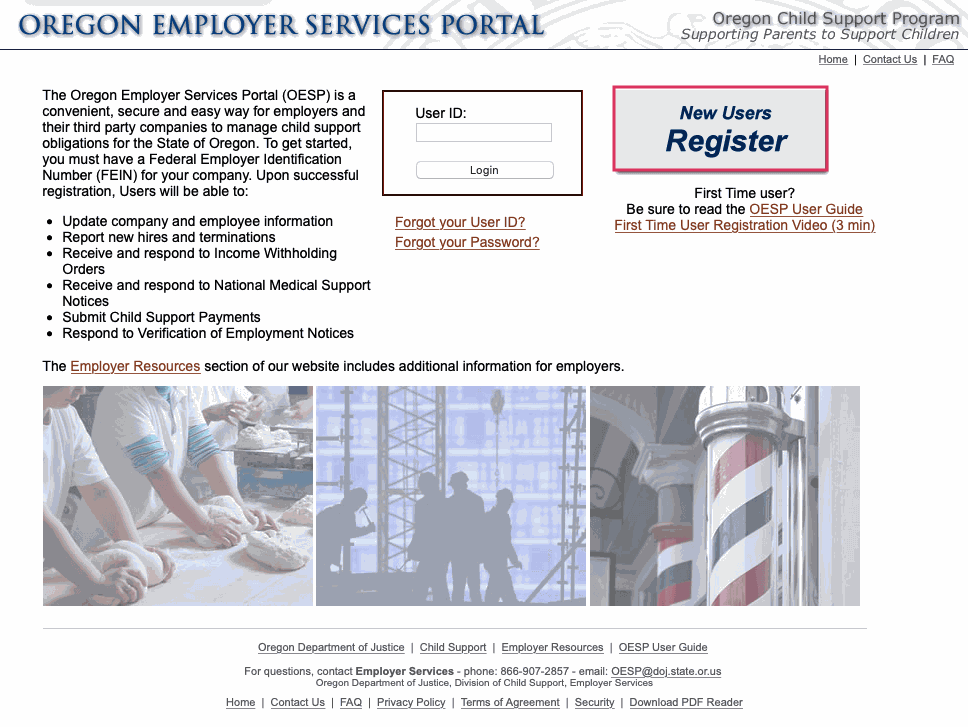

You can report new hires in several ways. The fastest way is through the Oregon Employer Services Portal. Once there, click New User Register.

You also have the option to fill out the Oregon New Hire Reporting Form and mail or fax it to:

Employer Services

Division of Child Support

Oregon Department of Justice

4600 25th Ave. NE, Ste. 180

Salem, OR 97301

Fax: 1-877 877 7415

For more information, please refer to the Frequently Asked Questions document or the Report New Hires page of the Oregon Department of Justice Child Support website. You can also contact Employer Services at (866) 907-2857 or by email at [email protected].