USA State Payroll Rates + Resources: State of New Jersey: Obtaining a TIN + Unemployment Insurance

Purpose

This documentation outlines the processes and requirements associated with becoming a new employer in the state of New Jersey. Specifically, we will cover how to get a Tax Identification Number and Register for Unemployment Insurance.

Good to Know!

Federal Employer requirements (obtaining a federal identification number, withholding of federal income tax, FICA, and filing of all applicable federal returns (FUTA, 940, 941, and 1099-C) will not be covered below - just the state of New Jersey's requirements. Click here for a basic (not all-inclusive) IRS checklist for Starting a New Business.

Tax Identification Number

In the state of New Jersey, your federal employer identification number (FEIN) serves as your tax identification number (TIN) and you must get it from the IRS.

Register for Unemployment Tax Account Number

If you are doing business in New Jersey, you must register for tax purposes by completing Form NJ-REG (page 17). You may complete this form on paper and mail it to:

Client Registration

PO Box 252

Trenton NJ 08646-0252

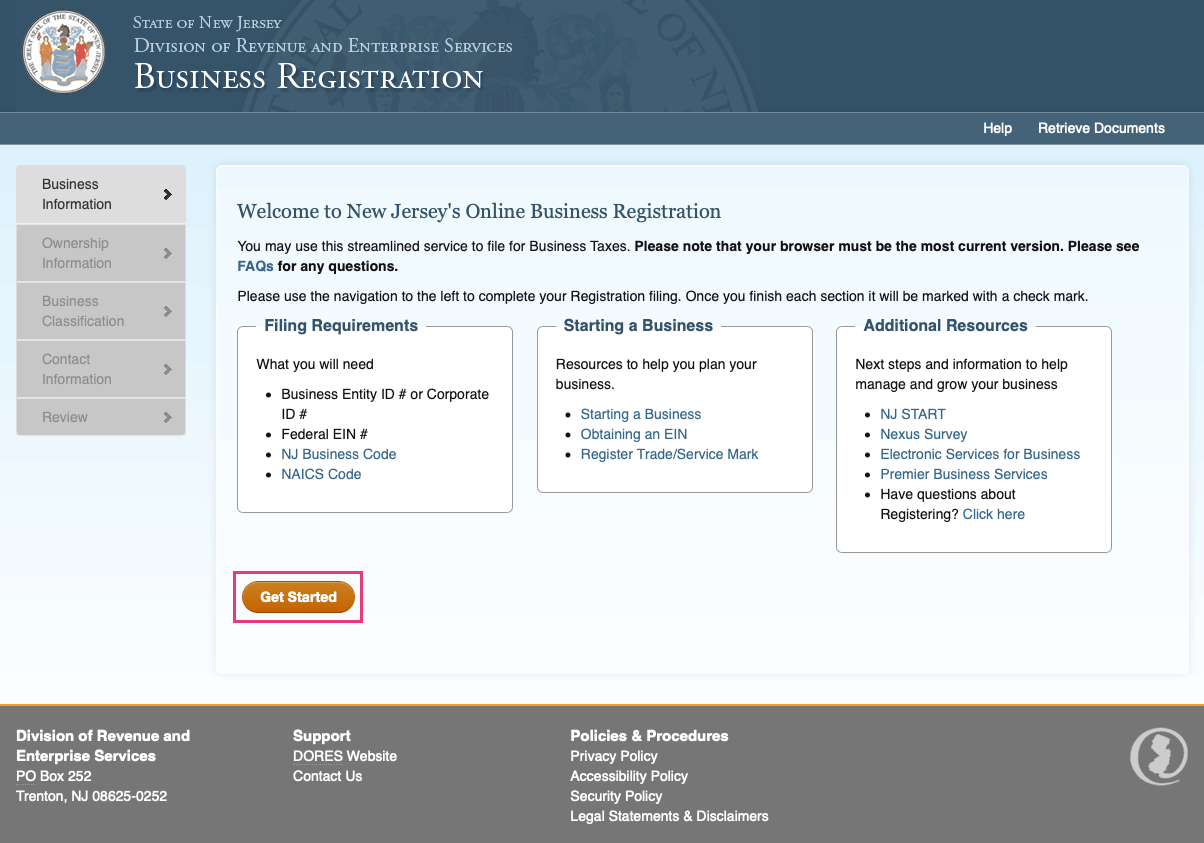

Or, you can complete it online via the New Jersey Division of Revenue and Enterprise Services. From this site, click the Get Started button.

Once you have registered, your business will receive forms, returns, instructions, certificates, and other information required for on-going compliance with New Jersey State taxes. Many of the filings for the business can be completed online.