USA State Payroll Rates + Resources: State of Vermont: Unemployment Insurance Reporting & Payments

Purpose

The purpose of this documentation is to outline the processes and requirements associated with reporting and paying unemployment insurance in the state of Vermont.

Unemployment Insurance Reporting & Payments

All Vermont employers who have to pay Unemployment Insurance (UI) on their employees MUST file a quarterly wage and contribution report. Vermont has a mandatory electronic filing requirement for all employers.

Employers reporting 0 to 250 employees:

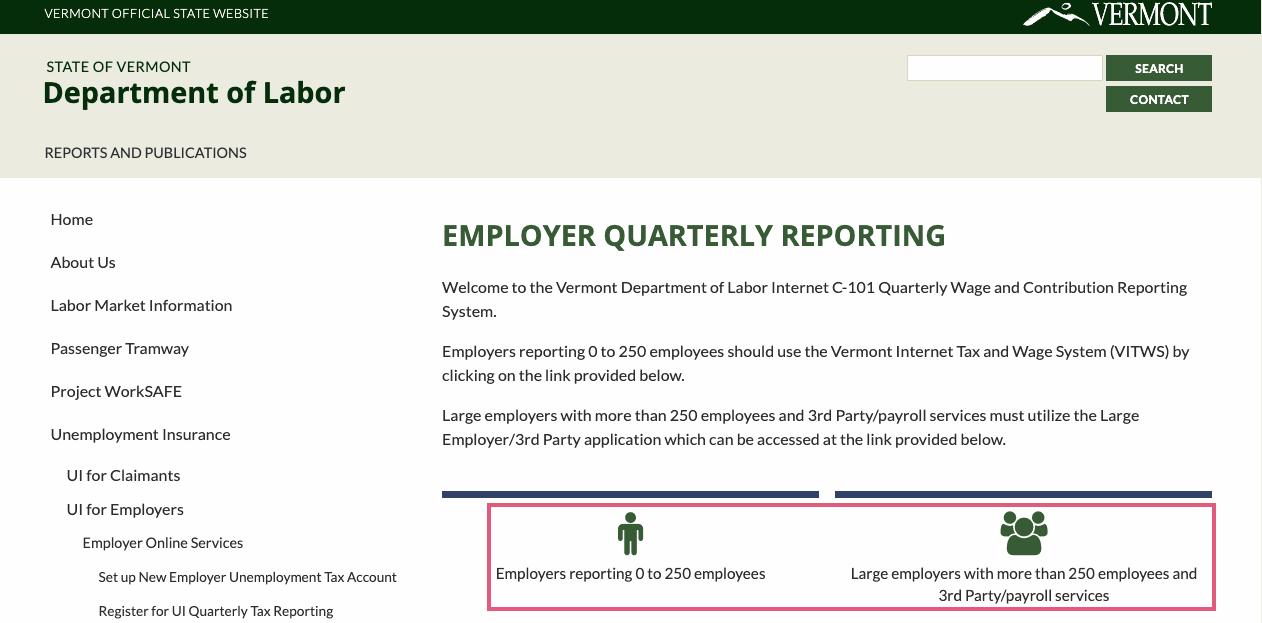

The electronic Vermont Internet Tax and Wage System (VITWS) can be accessed on the Employer Quarterly Reporting website by selecting Employers reporting 0 to 250 employees.

New employers will be mailed a temporary password. When the temporary password is received, log onto the Vermont Internet Tax and Wage System (VITWS) to create your own custom password for quarterly filing. Please retain your newly established password for safekeeping, as this will be your permanent password for all future filings. If you need to reset your password, you can click on the “Forgot Password” link or you can call the Employer Service Unit at (802) 828-4344.

Employers reporting more than 250 employees:

Must utilize the Large Employer Reporting System by selecting Large employers with more than 250 employees and 3rd Party/payroll service on the Employer Quarterly Reporting website.

Quarterly wage reports are due quarterly on the following schedule:

| Quarter | Months In Quarter | Due Date |

| 1st Quarter | January - March | April 30th |

| 2nd Quarter | April - June | July 31st |

| 3rd Quarter | July - September | October 31st |

| 4th Quarter | October - December | January 31st |

If the report due date falls on a weekend, the due date will be the next business day.

For further details, see the Employer Information Manual.

Good to Know!

One of the commonly misunderstood sections of the quarterly report is calculating “excess” wages. “Excess” wages mean the amount paid to each employee after his or her year-to-date earnings have exceeded the maximum calendar year taxable wage limit as shown in the report.

For questions or help with "excess" wage calculations, contact Employer Services staff (802) 828-4344.

Good to Know!

The Vermont 2020 taxable wage base is $16,100 and the new employer rate for most employers is 1.00% but can vary by industry.