USA State Payroll Rates + Resources: State of Massachusetts: New Hire Reporting

Purpose

The purpose of this documentation is to outline the processes and requirements associated with doing your new hire reporting in the state of Massachusetts.

New Hire Reporting

Employers must report newly hired employees and independent contractors within 14 days of the employee's first day of work.

You will need the following information:

Your company's FEIN, legal name, and payroll address.

The new hire's full name, mailing address, and work status.

The new hire's SSN and name, as shown on their Social Security card.

The new hire's first day of employment.

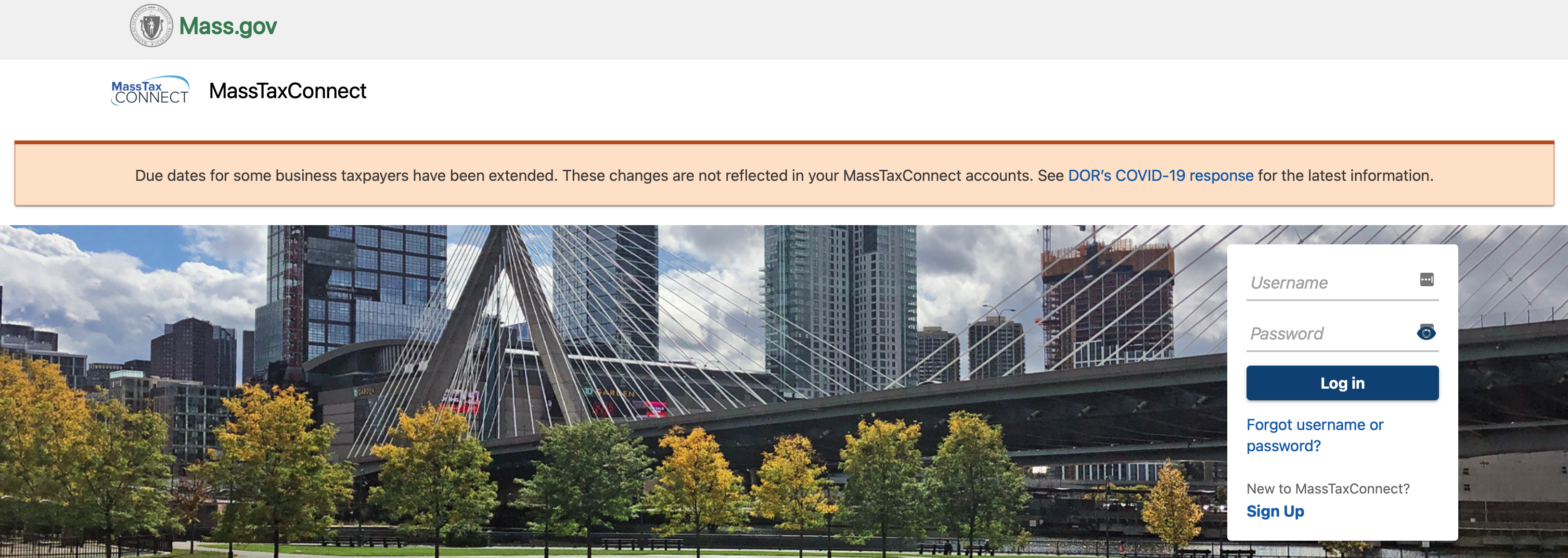

To submit online, go to MassTaxConnect. If you don't already have a login, create one by clicking Sign Up

You can also submit the New Hire Reporting Form:

Massachusetts Department of RevenueP.O. Box 55141

Boston, MA 02205

FAX: (617) 376-3262

For more information, visit the Report New Hires section on the Mass.gov website.