USA State Payroll Rates + Resources: State of Rhode Island: New Hire Reporting

Purpose

The purpose of this documentation is to outline the processes and requirements associated with reporting new hires in the state of Rhode Island.

New Hire Reporting

In Rhode Island, you are required to report new hires to the Rhode Island New Hire Reporting Directory.

Rhode Island Law requires employers to report all new hires or rehires within 14 days of employment to the Rhode Island New Hire Reporting Directory. If you are reporting electronically or magnetically, you must report by two monthly transmissions (if necessary) not less than 12 or more than 16 days apart.

Re-hires or Re-called employees: Employers must report all re-hires, or employees who return to work after being laid off, furloughed, separated, granted a leave without pay, or terminated from employment for at least 60 consecutive days.

You'll need the following information for each new hire:

Employee's Full Name

Employee's Address

Employee's Social Security Number

Employee's State of Hire (only if reporting as a Multistate employer)

Employee's Date of Hire

Employer's Name (use corporate name)

Employer's Address (provide address where Income Withholding Orders should be sent)

Employer's Federal Employer Identification Number (FEIN). if you have more than one FEIN, make certain you use the same FEIN you use to report your quarterly wage information when reporting new hires.

The following information is optional for you to provide:

Employee's Date of Birth

Employee's State of Hire

Does Employee have medical insurance?

Date Medical Insurance Started

Employer's Phone Number

Employer's Contact Name

Employer Email Address

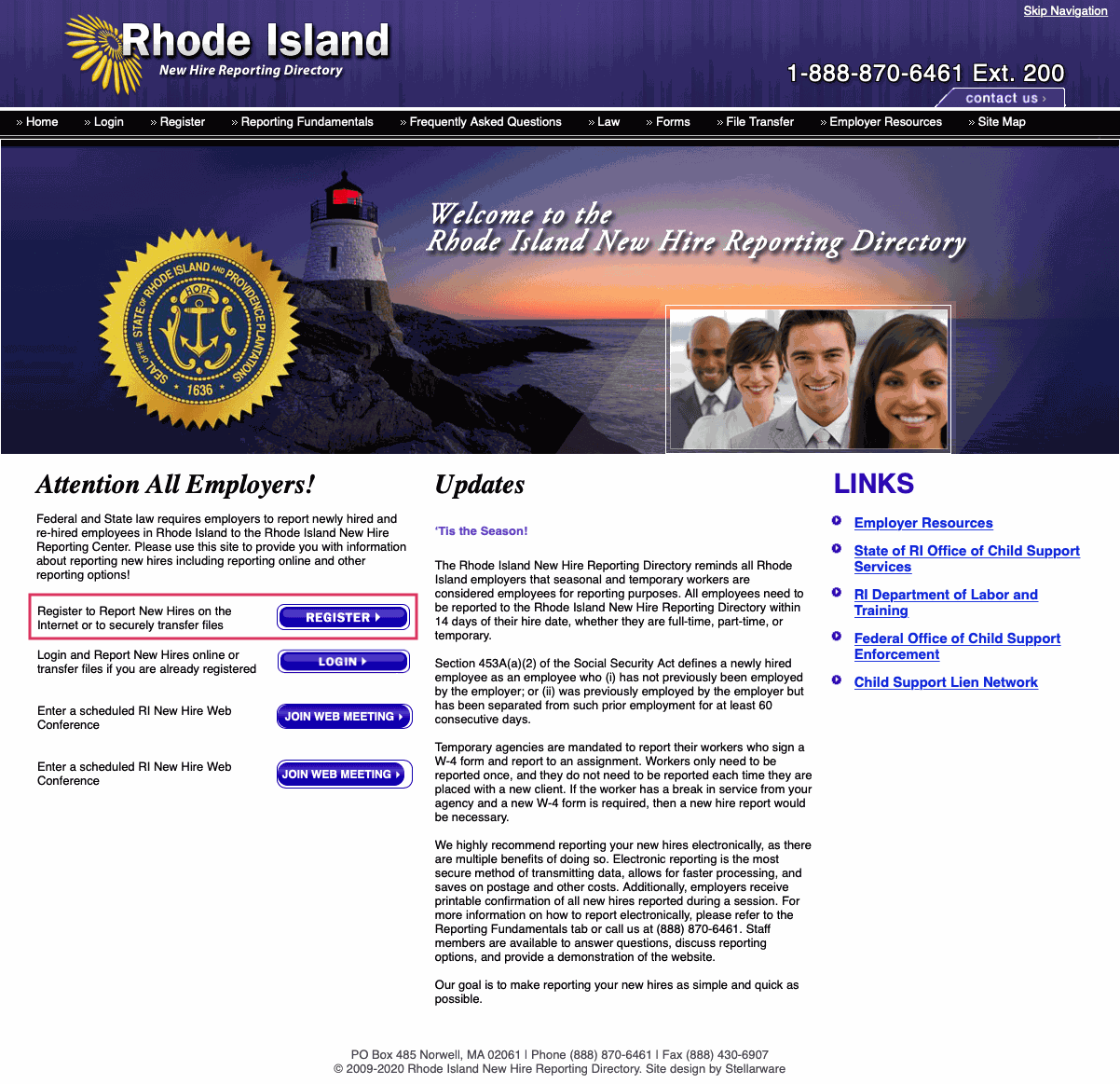

You can report new hires in several ways. The fastest is via the Rhode Island New Hire Reporting Directory. Once there, click register.

You also have the option to create your own Electronic New Hire Reports. You can submit them via one of the accepted File Transfer Options.

You can also submit the Rhode Island New Hire Reporting Form, a printed list containing all the required information on the New Hire Reporting Form, or a W-4 form. You can mail or fax the forms to:

Rhode Island New Hire Reporting Directory

P.O. Box 485

Norwell, MA 02061

Fax: (888) 430 6907

For more information, please refer to the Reporting Fundamentals page or the Frequently Asked Questions page of the Rhode Island New Hire Reporting Directory, or contact the Directory at (888) 870 6461.