USA State Payroll Rates + Resources: State of Texas: Obtaining a TIN + Unemployment Insurance

Purpose

The purpose of this documentation is to outline the processes and requirements associated with becoming a new employer in the state of Texas. Specifically, we will be covering how to obtain a Tax Identification Number and Register for Unemployment Insurance.

Good to Know!

Federal Employer requirements (obtaining federal identification number, withholding of federal income tax, FICA, and filing of all applicable federal returns (FUTA, 940, 941, and 1099-C) will not be covered below - just Texas' requirements. Click here for a basic (not all inclusive) IRS checklist for Starting a New Business.

Register for Unemployment Tax

Good to Know!

If you have already registered for unemployment tax, skip to the next section.

Liability for the tax is determined by several different criteria. Once wages are paid, employers should register with the Texas Workforce Commission (TWC) within 10 days of becoming liable for Texas unemployment tax. For more information, see Determine Whether You Need to Establish an Unemployment Tax Account.

An employing unit that is or becomes an employer in a calendar year is subject to unemployment insurance coverage during that entire calendar year

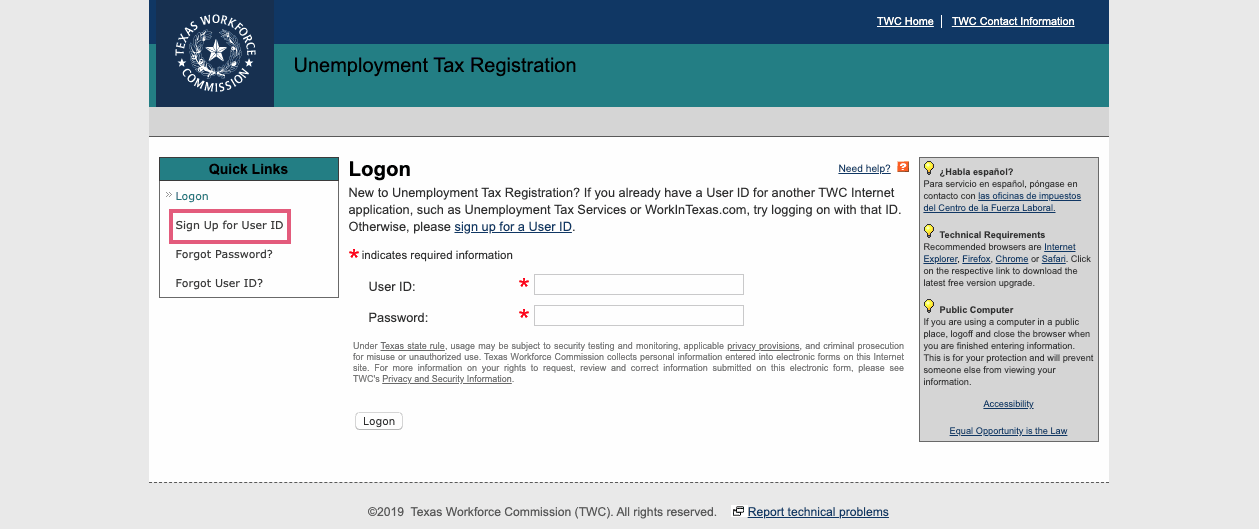

Liable employers must register with TWC (Texas Workforce Commission) to create a tax account and in each calendar quarter, report wages paid to employees and pay taxes due. Click on "Sign Up for User ID".